Forex News and Events

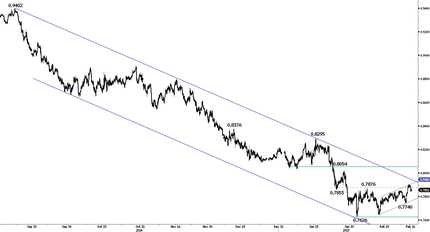

The influence of accommodating monetary policy continues to dominate financial markets. Today the evidence is clearly witness in Australian. Accommodating policy drives currency lower while pushing equity markets higher (regardless if central bankers call it a currency war, competitive devaluation or QE policy). Overnight the AUDUSD sold-off to 0.7840 slowing its recent bullish advanced. The stock market was slightly softer, as S&P/ASX reached a seven years high at 5955.50. The key driver was the collapse of Australia’s private capital expenditure. CAPEX for Q4 2014 declined -2.2%Y against expected -1.6%Y fall. This is the critical first read of capital expenditures for 2015-2016 since its sets the tone for the rest of the year. The estimates came in at AUD109.8 billion against the market consensus for AUD119 billion. A sizeable deceleration in spending expectation. As expected the biggest hit was the mining sector yet there were cuts in non-mining sectors recovery, dimming forward outlook, and suggesting broad-based economic weakness. The rates market were quick to react sending expectations for a RBA OCR cut to 52% from 38%. Given the FOMC slightly dovish turn, the RBA now has more room to cut without any geopolitical backlash (accusations of targeting FX). We now expect the RBA to cut 25bp at next week’s rate decision meeting as signs of slowing growth has increased. As a results we anticipate further weakness in AUD. AUDUSD recent recovery nearing 0.7942 downtrend provide opportunity to reload short positions (see Daily Technical Report). That said, with China expected to accommodate further with RRR cuts, rate cuts and financial reforms in the medium term these will be bullish development for Australia growth outlook.

USD and global yields are shifting lower based on the view that Fed Chair Yellen’s testimony indicates a more dovish Fed. We suspect that Yellen is more likely taking a balanced approach to limit USD strength and slow yields uptrend. The Fed wants to tighten monetary conditions when they believe the time is correct, and not have tighter policy forced on the US by the market. After recent US data disappointments, robust new home sales at 481k was a positive result. With labor market data coming in particularly strong , it’s only a matter of time before we start to see wage prices improve (next week payroll will be watched). Given this base scenario we expected the Fed will be ready to changed its guidance at April 29th rate decisions meeting. Today’s inflation read will be critical test of our view. A significant erosion in core CPI might make use reconsider our call for Aprils removal of “patient” from the Feds conversation. Despite short term liquidations of overbought USD long, we remains constructive on the USD based on policy divergance.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.