Good morning from Hamburg and welcome to our latest Daily FX Report. Asian shares rose on Thursday, shrugging off weak U.S. data overnight that raised concerns ahead of Friday's key employment figures, as investors covered positions ahead of the Easter holidays. Most U.S. markets will be closed on Friday, with some European markets closed Friday through Monday and reopening on Tuesday. MSCI's broadest index of Asia-Pacific shares outside Japan was up about 0.5 percent, ignoring modest overnight losses on Wall Street. Australian shares rose on growing expectations that the Reserve Bank of Australia will announce its second rate cut of 2015 when it meets on Tuesday. Japan's Nikkei stock average was up 1.3 percent, after skidding to a three-week low in the previous session.

However, we wish you a successful trading day!

Market Review – Fundamental Perspective

The dollar nursed modest losses on Thursday, having suffered a setback on fresh signs that the U.S. economy slowed significantly in the first quarter which could delay the Federal Reserve's decision to begin hiking interest rates.The dollar fell as far as 119.42 yen overnight, from levels above 120.00. It last fetched 119.57, down 0.2 percent on the day. In contrast to the United States, figures out of Europe were much more encouraging with manufacturing activity across the euro zone accelerating and adding to signs the bloc's economy is recovering. The euro climbed to $1.0800, from one-week lows of $1.0713. It last stood flat at $1.0764. Wariness over Greece's debt negotiations with lenders prevented the euro from making more gains. Among commodity currencies the Canadian dollar benefited from a jump in oil prices. But persistent weak iron ore prices kept its Australian counterpart under pressure, while a further fall in dairy prices weighed on the New Zealand dollar. The CAD last stood at C$1.2610 per USD, continuing to recover from this week's low of C$1.2784 per USD after oil jumped as much as 5 percent on Wednesday. The Australian dollar was down 0.3 percent at $0.7579, languishing near a six-year trough of $0.7561 as prices of iron ore, Australia's single biggest export earner, hit fresh lows. In commodities markets, Brent crude settled up 3.6 percent to $57.10 a barrel. U.S. crude rose 5.2 percent to $50.09. Government data showed U.S. crude inventories rose 4.8 million barrels in latest week. Fears of a bigger increase had been stoked a day earlier, when the American Petroleum Institute said stockpiles rose as much as 5.2 million barrels.

Daily Technical Analysis

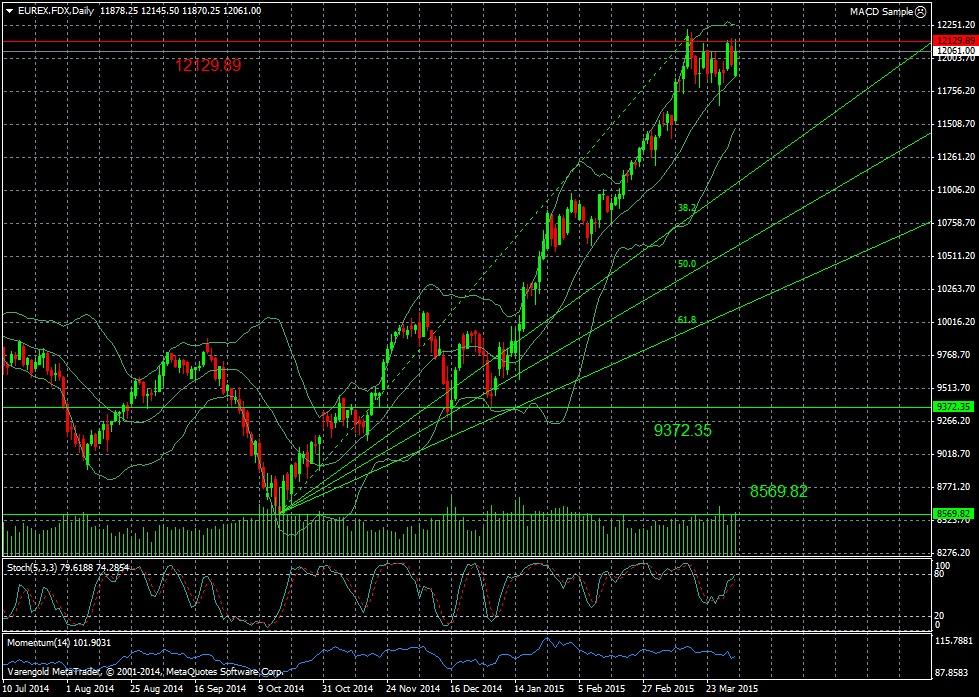

EUREX.FDX (Daily)

Since April the German Index appreciated and even was able to break through the 10,000 points mark. Then we saw a downward movement and the DAX lost more than 1,500 points. In the last trading sessions the bulls took control over the Index and pushed it back first cleary over the 10,000 mark. The DAX has once again reached its alltime high and it remains to be seen whether the index has developed enough momentum in order to continue rising. According to the indicators there is still some room for more gains.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.