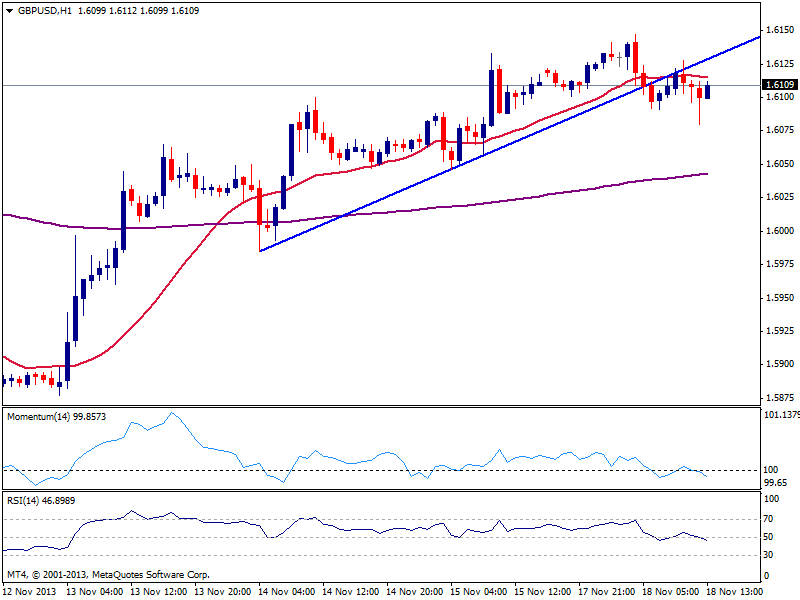

GBP/USD Current price: 1.6109

View Live Chart for the GBP/USD

After surging to a daily high of 1.6147, the GBP/USD broke below a short term ascendant trend line, but held above 1.6080 and quickly recovered the 1.6100 mark. A more hawkish than usual FED’s Dudley triggered a kneejerk down to 1.6080, albeit very short lived. Ahead of Asian opening, the pair presents a very shy bearish tone in the hourly chart, as per price capped below 20 SMA and indicators heading lower below their midlines. In the 4 hours chart price bounced pretty nice from a still bullish 20 SMA, while indicators lost the bearish slope and turned flat in positive territory, denying for now, chances of a stronger slide. The upside however is still limited, as price needs to accelerate and stabilize above 1.6120 to show a bit more of an upward tone, while a break below mentioned support should expose the pair to a test of 1.6000/20 price zone.

Support levels: 1.6080 1.6050 1.6020

Resistance levels: 1.6120 1.6150 1.6190

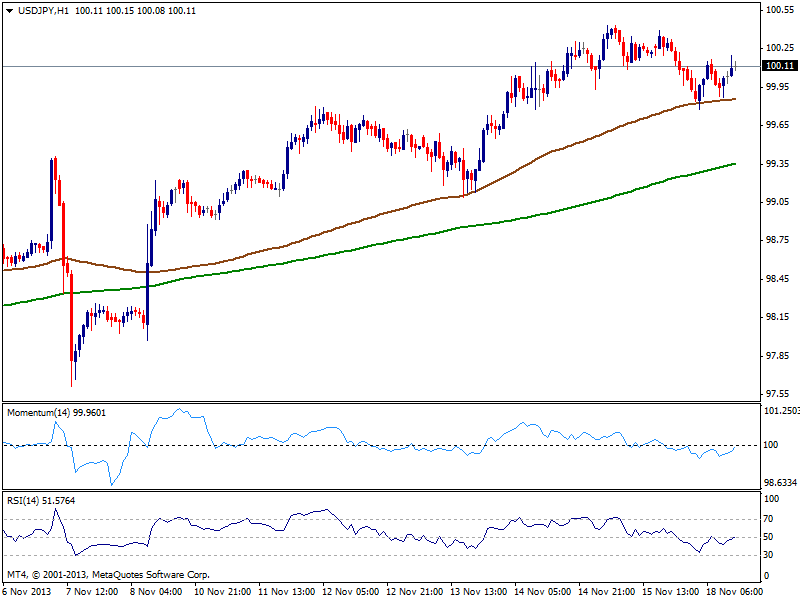

USD/JPY Current price: 100.11

View Live Chart for the USD/JPY

Not a good day for USD/JPY that barely managed to hold the 100.00 area. The pair has been mostly under pressure, although the hourly chart shows price found support in its 100 SMA currently around 99.80. In the mentioned time frame, indicators head higher approaching their midlines still in negative territory, while the 4 hours chart present a slightly negative tone. Taking a look at the daily chart and considering the past 5 months, gains above 100.00 had produced lower highs and remained short lived, and this time seems not much different: price needs to take 100.70 area, September highs, to actually confirm a bullish continuation while losses below 99.70 may see a slide down to 99.20 price zone.

Support levels: 99.70 99.40 99.10

Resistance levels: 100.35 100.70 101.10

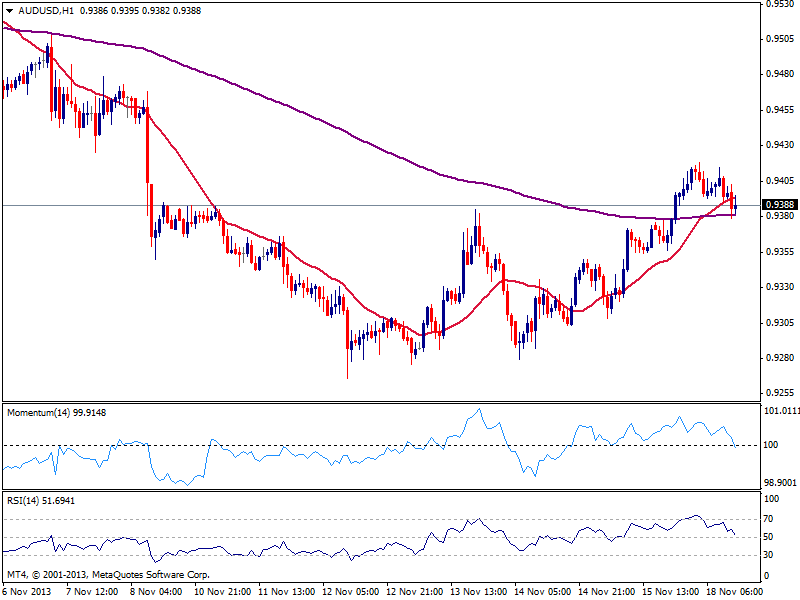

AUD/USD Current price: 0.9388

View Live Chart for the AUD/USD

The AUD/USD reached 0.9420 before easing some also presenting a quite disappointing behavior compared to other currency pairs. Gold may have weighted also in the pair, as metals had remained under strong selling pressure since ever the week started. As for technical readings, the hourly chart shows price right below its 20 SMA as indicators enter negative territory, while the 4 hours chart shows price faltered a few pips below 200 EMA as momentum continues to head north above its midline. Support around 0.9340/50 will now be key as if buyers surge on approaches to it, will likely keep the upward momentum alive. A break below it however, may see the pair retesting the 0.9260 lows in the upcoming sessions.

Support levels: 0.9385 0.9340 0.9300

Resistance levels: 0.9420 0.9470 0.9510

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.