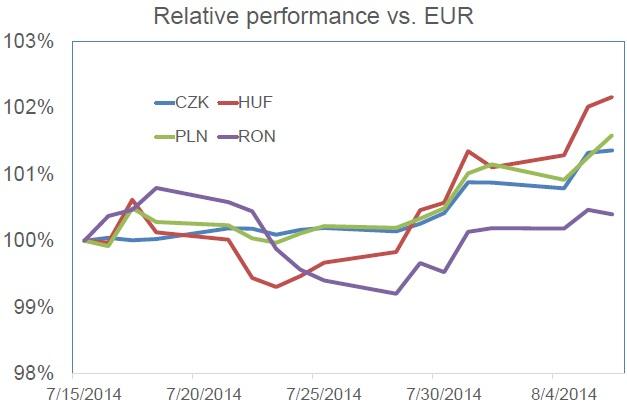

Chart of the day:

CEE FX: Since Ukrainian-Russian tensions intensified once again, CEE currencies depreciated. Deprecation in Hungary can be explained by most recent policies pursued by the government such as Mortgage FX relief program while in Poland & Czech Republic, country specific reasons for the depreciation is less evident. Interestingly enough, the RON has managed to outperform other CEE currencies including safe heaven Czech Koruna. This however, could be attributed to the “manage” approach pursued by the Romanian National Bank in keeping the currency stable.

Analysts’ Views:

RS rates: At today's MPC meeting, we expect the NBS to remain on hold and keep the key rate at 8.50% amid increased FX volatility, growing fiscal uncertainties and elevated turbulence on international markets (geopolitical risks). Looking ahead, the comfortable inflation outlook provides room for additional easing up to YE, but we do not expect any changes before late- September, when we should see more details on the fiscal front (budget revision, IMF report and presentation of consolidation program). For now, we maintain our YE rate forecast at 8%.

HU Macro: Industrial output rose by 11.3 % y/y in June, while the m/m index also increased by 1.8%. The CSO also revised the May yearly figure upwards (from 9.6% to 10.1%). The significant growth can be explained by favorable weather (food industry), and manufacturing (especially the automotive sector). The investments at the beginning of the year also had a positive impact on production. Although we expect that the growth in the industry will slow down in 2H14, we see upside risks to our current 7% year-average forecast. Market forecasts are unaffected by the release.

CZ Macro: After an unexpectedly weak reading in May, industrial production coming in at 8.1% y/y in June confirmed the fairly good shape of the Czech industrial sector. Although the growth of industrial output will probably slow down during 2H14 as a result of the worsening outlook for the German manufacturing, the persistently strong inflow of new foreign orders (19.1% y/y in June) provides hope that industry will remain one of the main drivers of GDP growth. As June's industrial reading was in line with expectations, we keep our forecast for 10Y yields at 1.67% at end-2014.

Traders’ comments: Following disappointing GDP data from Italy the risk off moment was reinstated with German 10 yields trading down to 1.09% and German 2 year yield dropping below 0 this morning, first time since May 2013. Today, ECB meeting will remain the focus of the day.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.