Daily Forecast - 22 January 2015

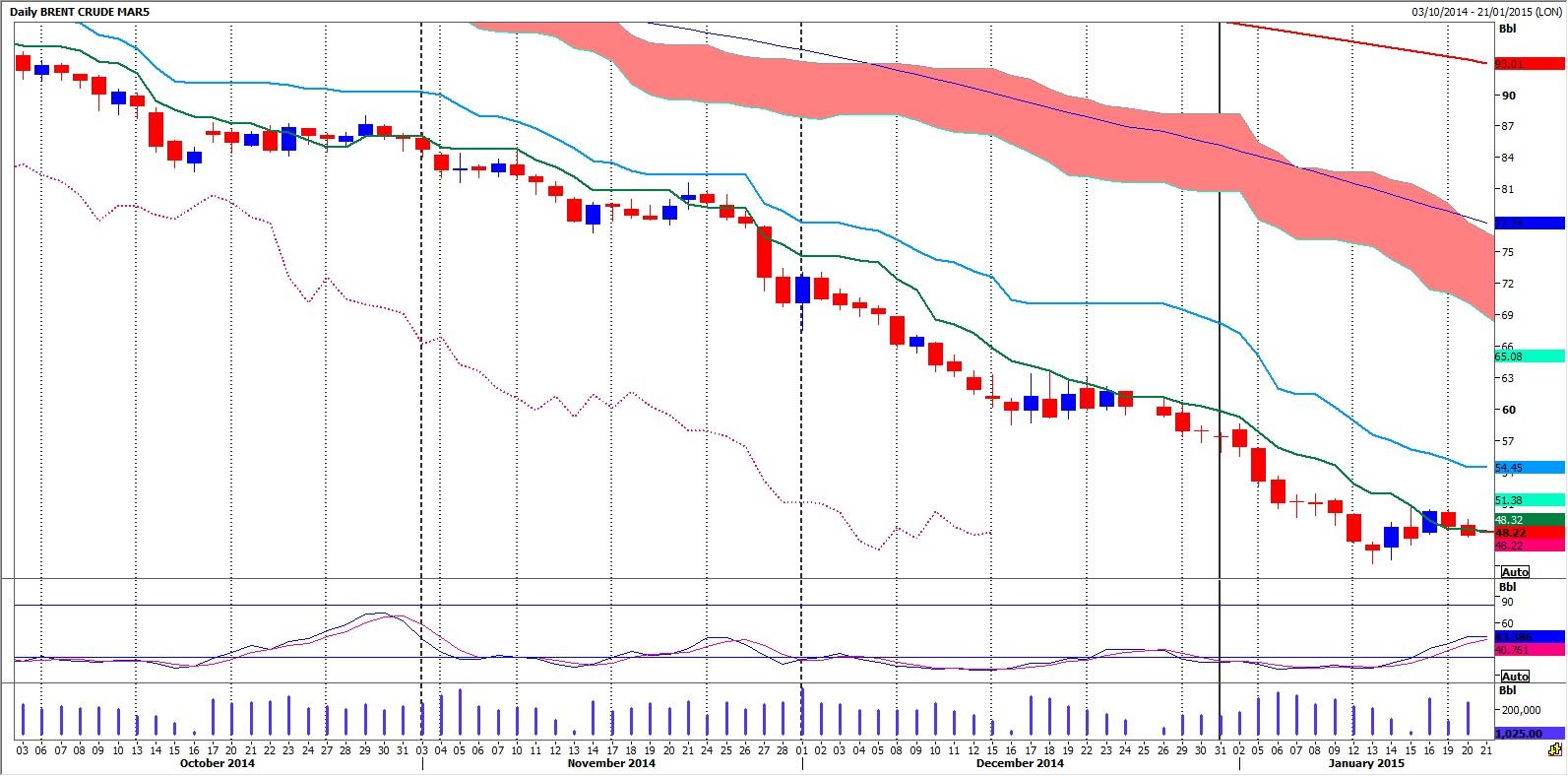

Brent Crude February contract

Brent Crude February same levels apply for today with immediate resistance at 4950/60. A break higher today targets resistance at 5060/5080. We should struggle here, but be aware that another break higher could target 5135/45. If we continue higher this week, look for a good selling opportunity at 5220/5230.

Failure to hold above 4855/65 re- targets 4800/4790. If we continue lower today look for a test of good support at 4730/4725. Try longs with stops below 4700. On a break lower however look for the next downside target and support at 4640/4630. Any longs here need a stop below 4590. Be ready to go with a break lower targeting 4560 then last week's low at 4520.

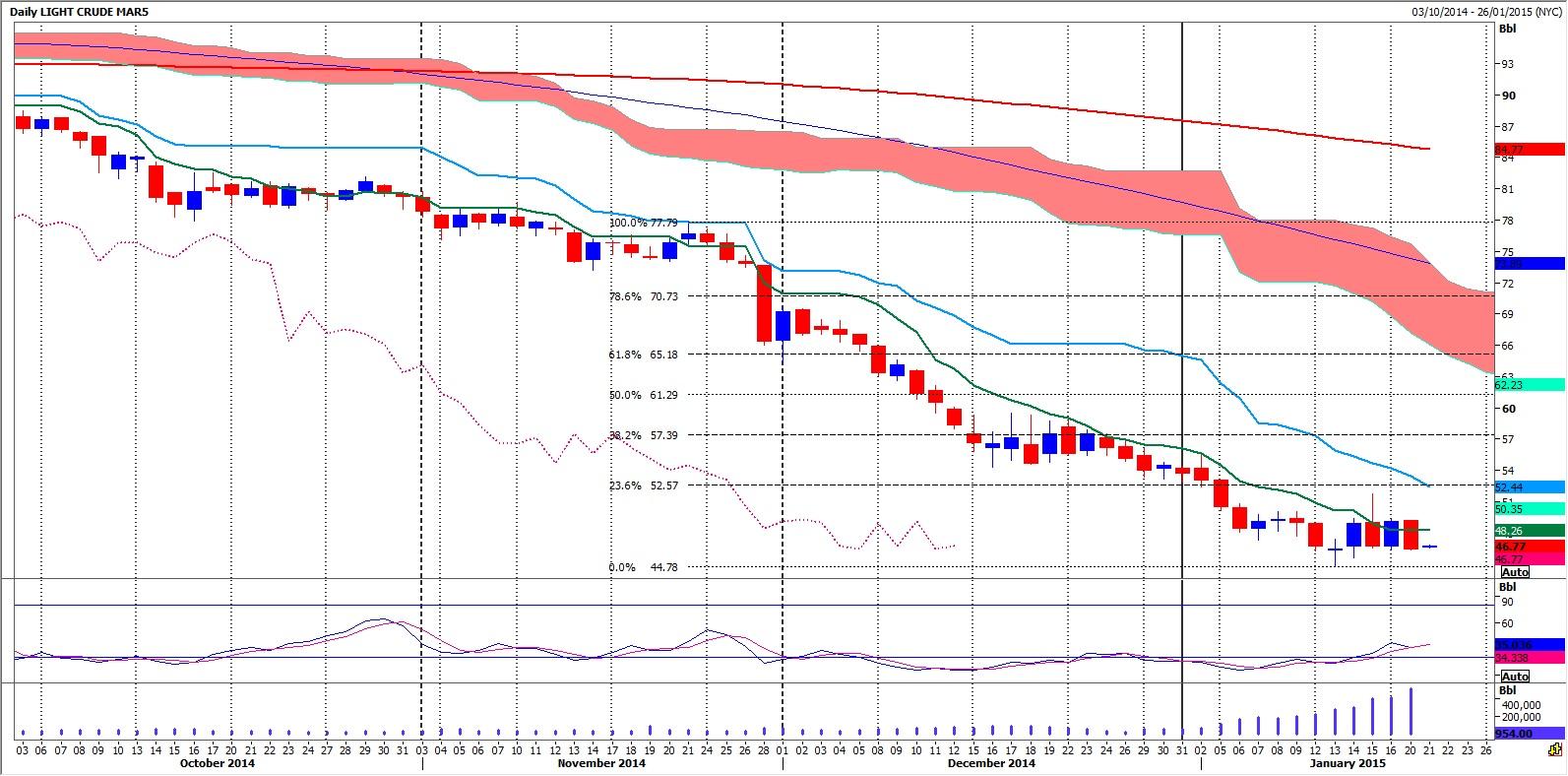

WTI Crude March contract

WTI Crude March support at 4 day lows of 4655/4634 but below here targets 4565 then last week's low at 4478. Obviously a break lower would be negative and signal the resumption of the longer-term Bear trend to target 4420 then 4385/80.

Immediate resistance at 4714/45 but above here we could make it as far as 4820/30. Any further gains in this range trading market meet strong resistance from recent highs at 4920/4940 and any shorts here will need a stop above 4990. A break higher to target 5090. If this does not hold a move higher we could target last week's high at 5170/75. Any further gains offer an excellent selling opportunity at 5245/55 with stops above 5300.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.