Fundamental Forecast for Australian Dollar: Neutral

- AUD/USD finishes flat despite a bumpy week on RBA minutes, China data, and geopolitical shocks

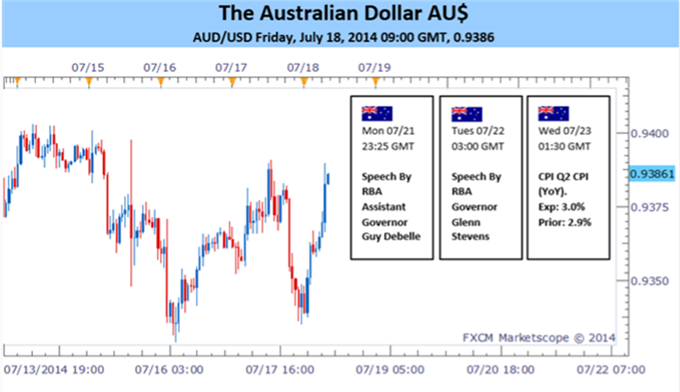

- CPI figures and Stevens’ speech unlikely to shift expectations for a “period of stability” for rates

- If geopolitical tensions fail to intensify, traders could return to the Aussie for its yield appeal

The Australian Dollar’s consolidation continued over the most recent week with AUD/USD remaining within its narrow range between 0.9210 and 0.9440. A status-quo set of Minutes from the RBA and positive Chinese second quarter growth figures failed to inspire the Aussie bulls. While a sell-off on heightened geopolitical tensions proved to be short-lived, with the currency bouncing back during Friday’s trading. Over the week ahead, two key themes are likely to continue to offer the Aussie guidance; policy expectations and risk appetite.

On the risk-appetite front; geopolitical turmoil carries the potential to put pressure on the risk-sensitive currencies like the Aussie. There is considerable uncertainty over whether the flare-up between Israel and Hamas, as well as tensions in Eastern Europe could escalate, which could leave traders hesitant to move back to the Aussie. Investors’ reactions to the latest developments suggests that the market is highly sensitive to outside shocks at present. If either situation were to intensify, it could lead to an unwinding of AUD carry trade positions built up over recent months.

However, we have witnessed several of these geopolitical shocks this year, which have ultimately failed to leave a lasting impact on sentiment. When the dust settles from the latest flare-up traders could again be tempted to return to the Aussie for its yield appeal.

Next week’s domestic CPI data and speeches by RBA officials could feed the policy expectations theme. A surprise second quarter inflation reading may see a knee-jerk reaction from the currency, however given a shift in the rate outlook remains unlikely at this stage, follow-through could prove limited.

Similarly, another attempt at jawboning the Aussie lower from Stevens may fail to leave a lasting impact on the unit. In recent addresses the RBA Governor has simply been delivering the central bank’s view that the currency is overvalued, and at this stage remains unwilling to take action such as intervention to put pressure on the AUD. For views on the US Dollar side of the AUD/USD equation, refer to the US Dollar outlook available here.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.