Pound Sterling Price News and Forecast GBP/USD: British pound loses ground as markets doubt BoE hike in November

GBP/USD Forecast: British pound loses ground as markets doubt BoE hike in November

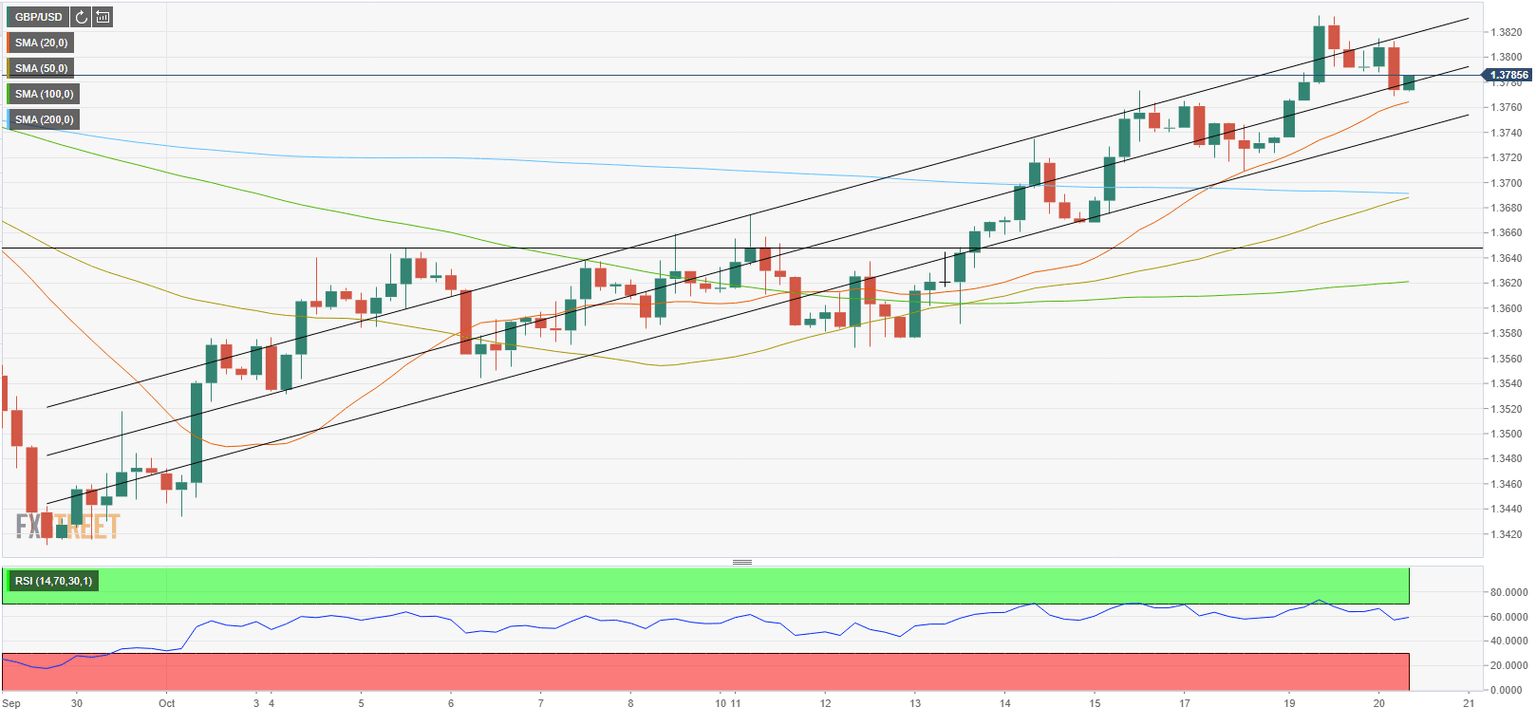

British pound has lost its traction after softer-than-expected inflation data. Odds of a BoE rate hike in November declined to 32% from 59%. Dollar finds its footing on rising Treasury bond yields. Following Tuesday's rally to a fresh five-week high of 1.3835, the GBP/USD pair has reversed its direction and fell below 1.3800 on Wednesday after the data from the UK showed that inflation in September wasn't as scary as anticipated. Read more...

GBP/USD bounces up again and returns above 1.3800

Sterling's reversal finds support at 1.3745 before bouncing back above 1.3800. The pair faltered after weaker than expected UK inflation data. GBP/USD approaching key resistance at 1.3910/30 – SocGen. The British pound has resumed its uptrend on Wednesday, to resume the last two weeks’ rally after a corrective reversal seen during the European session. The pair has found buyers at 1.3745, to bounce up again during the US trading time and return above 1.3800, a few pips below one-month highs at 1.3835. Read more...

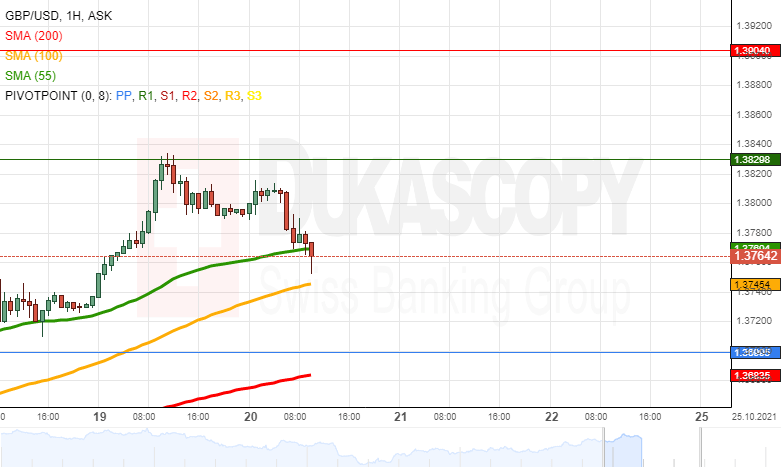

GBP/USD analysis: Respects pivot point

On Tuesday, the GBP/USD surged and reached the resistance of the weekly R1 simple pivot point at the 1.3830 level. The pivot point's resistance held and caused a decline. By the middle of Wednesday's European trading hours, the decline had passed the support of the 55-hour SMA at 1.3769 and was heading to the 1.3750 mark. Read more...

Author

FXStreet Team

FXStreet