Last week we discussed a trading opportunity in the AUDUSD as an illustration to show that if you know what to look for on a price chart, you can see where the smart money is buying and selling in the Forex market, or any other market for that matter. This week, as promised, let’s look at the outcome of this low risk, high reward, high probability trading opportunity.

OTA: May 2016 Daily Market Overview – AUDUSD

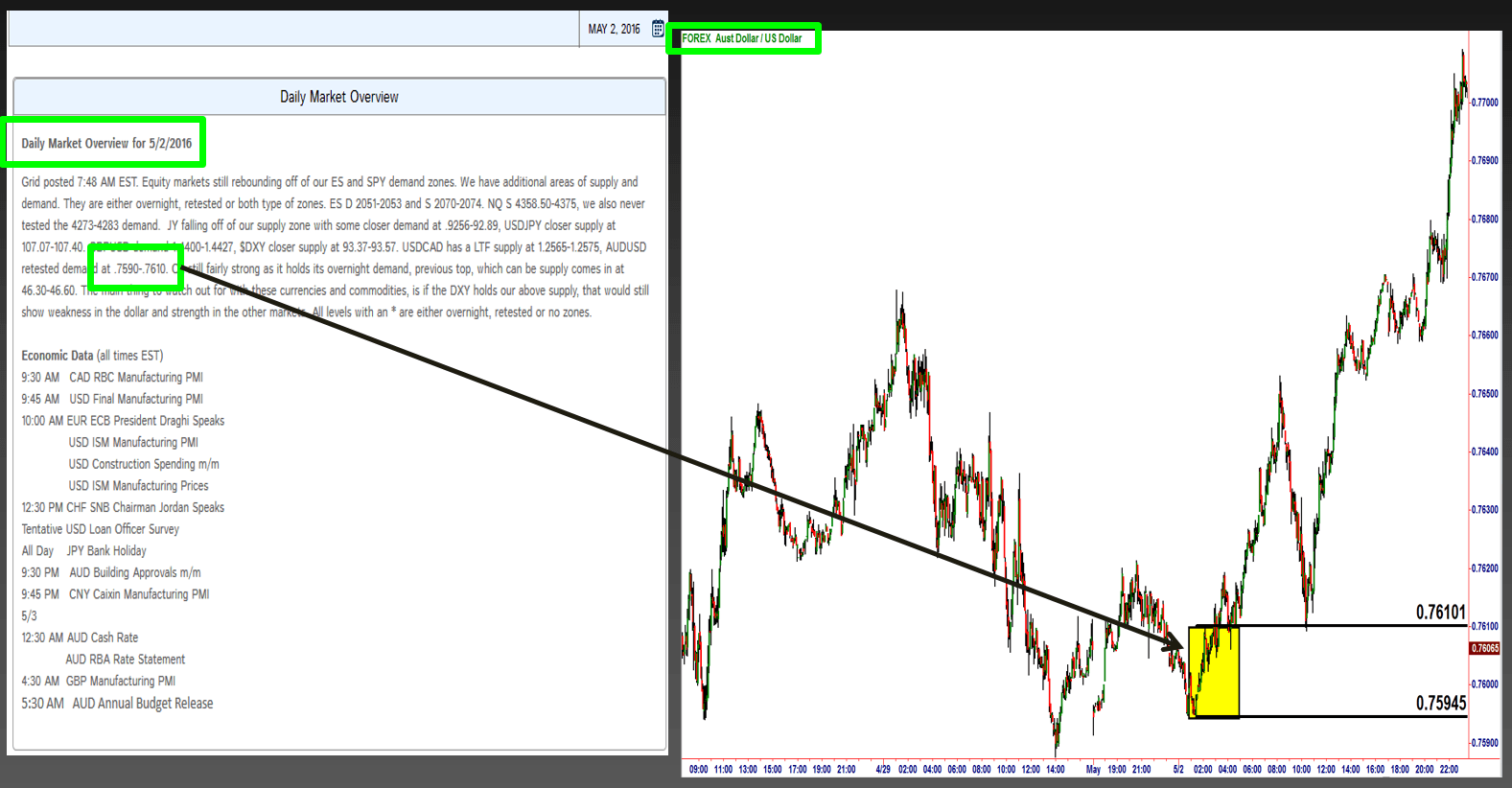

Notice that price “declined” (downtrend) to our demand level (the yellow box in the above chart) where we were willing buyers. Every trading book would say we are breaking the most important rules in trading when buying under those circumstances. Well, how many people do you know who read trading books that make consistent low risk trading profits year after year trading? I would be surprised if you knew one, so be careful with what you read.

The trading book version is conventional thinking which most often has you buying high and selling low, so be careful. Don’t take my word for it however, read a trading book and ask yourself how that book is teaching you to enter positions in markets. Is the book version entry and exit into a market the same as how you make money buying and selling anything in life? If there is any difference, good luck trying to make trading profits from the information.

Like anything in life, there is the book version way of learning to do something and the real world way. All we are doing at Online Trading Academy is simply sharing real world trading and investing with you. We are not trying to reinvent the wheel. How you make money buying and selling anything in life is exactly how you make money buying and selling in markets. I learned reality based trading during my time on the trading floor of the Chicago Mercantile Exchange. Trust me, no one on that trading floor was any smarter than anyone else.

Shortly after reaching our demand level, offering a low risk buying opportunity, price rallied for more than a 3:1 gain for those who took the income trade. This is market timing, and while it does not guarantee trading profits on every trade, it does offer the lowest risk entry, highest reward with that entry and highest probability of success. How high your winning percentage is with the strategy depends on your ability to identify key bank and institution supply and demand levels, which means following our simple strategy rules.

I sometimes hear people say, “I don’t want to try to pick market tops and bottoms; I am only trying to catch the middle of the move”. They are trend followers and say that as if doing that is somehow easier. If price is already moving higher, for example, and you want to buy, where do you enter?, where is your protective stop?, what is your risk / reward? and so on… I want our students to be in the trend as well. I just want them entering at the beginning of the trend, well before the trend is evident to everyone else. The longer we wait to enter, the greater the risk and lower the reward. Another thing I hear people say so often is this: “I wish I knew where the Banks and Institutions were buying and selling”. Every time I hear this I say: “You can see where the smart money is buying and selling if you know what to look for on a price chart”. Banks leave crystal clear footprints for those who know how to identify them. It all comes down to supply and demand, just like buying and selling anything else in life.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.