Having been in the trading and investing business for more than 20 years now, I have seen arbitrage opportunities come and go, a real strong edge or two fade away, rules or regulations close a loop hole to some free money and so on. Like anything in life, strong and easy opportunities to profit financially typically don’t last because enough people find out and compete for that opportunity, and it’s that competition that eliminates the opportunity. Today, the biggest edge that offers real strong consistent opportunities is in Options trading, and that is the focus of this piece.

Let me clarify, there is fantastic opportunity in Options if you know what you’re doing but that’s just it, most people don’t and there is a reason. Most people go to the Options market for two reasons. Some choose Options because it’s a very cheap market to get involved in. Others choose the Options market because they think you don’t need to know where price is going (market timing) to make money. While the second point is heavily marketed in the industry and very attractive, it’s not true. What’s funny is some Options strategies are called “non-directional” strategies, suggesting that direction doesn’t matter which is completely false. Also, every options platform has pricing models which, in theory, are supposed to give you accurate odds of success and failure and projected payoffs. Again, this is almost meaningless information because it’s flawed logic, yet almost everyone makes decisions on this data. Lastly, there are the Greeks. Again, while the information is interesting and a little helpful, none of it should be part of your primary decision making process, yet for most it is.

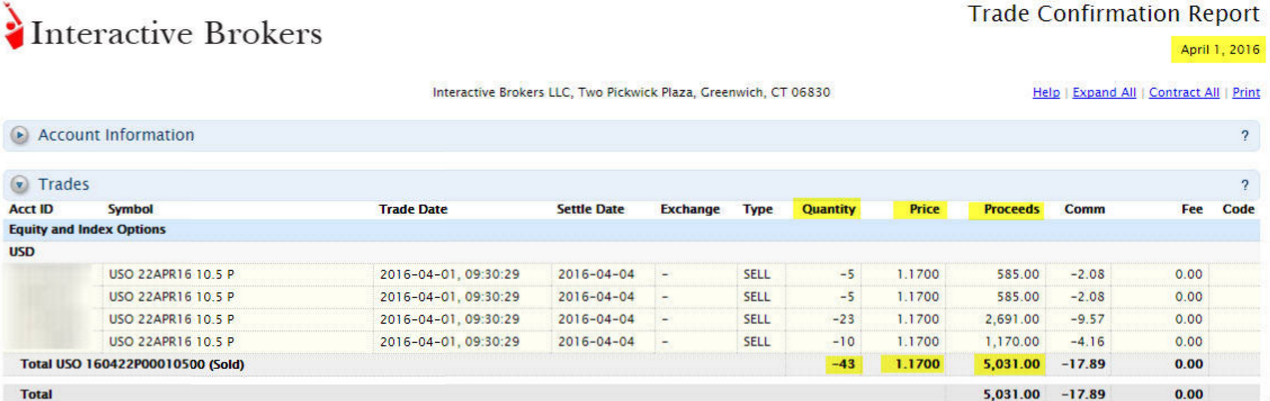

So, you may be thinking at this point that I am completely crazy for making these claims, but here is why I am so confident that I am correct. What the vast majority of Options decisions are made of, what the pricing models don’t at all consider, what the Greeks don’t include and more, are the buy and sell orders in the market. Meaning, real supply and demand is something most options traders and all options tools don’t factor into the decision. Everyone wants the short cuts of automated pricing models and tools, and that’s fine by me. Let’s look at an Options trade I exited last week, a position I was in for at least a couple weeks in Crude Oil (USO ETF).

USO – 60 Min Chart

Notice the Supply level (retail prices). We know this is supply because price fell strong from that level and didn’t remain there very long. This tells me banks are selling USO in that level and that they didn’t fill all the sell orders they wanted to. If they did, price would not have declined from that level, but it did. Next, we have the demand level (wholesale prices) below. We know banks are buying here because price could not remain at that level and rallied away in strong fashion. The trade was to buy puts (the right to be short) at supply, which I did, and then sell those puts at demand for a profit, which I also did. Keep in mind that puts increase in value as price declines. All that was used to make the decision of where to buy and sell was pure supply and demand (the orders). All that was used to make the decision on time to expiration was pure supply and demand (the orders). Also, in case you’re wondering what the red boxes are for on the chart, I wanted to point out that while they may look the same as the supply level I shorted at, they are very different and would not be considered supply levels at all.

I have been involved with Options for more than 20 years and have seen this simple path to profits turn into an equally complicated money losing opportunity for most. Again, the reason is logical decision making has been taken over by faulty data driven decision making. As a trader, I love this because it offers me a huge edge. As an educator, it’s my responsibility to share this info and, of course, this is only my opinion. Had I used the Greeks or pricing models for this opportunity, that would have ensured I would not have taken this trade. The Greeks and pricing models would not have supported this decision and, in many ways, would have had me taking the opposite action. Following pure supply and demand, I am able to buy puts when they are cheapest and about to become expensive, same thing for calls.

So, if you’re an options trader trying to make this work with all the fancy tools and struggling, don’t beat yourself up, it’s not you. Conventional options trading theory is about as flawed a strategy as trying to eat your favorite soup with a fork. Focus instead on the simple logic and always keep in mind that how you make and lose money when buying and selling anything in life never changes.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD retreats toward 1.1600 after upbeat US data

EUR/USD pulls away from session highs and declines toward 1.1600 in the American session on Wednesday. Upbeat private sector employment and ISM Services PMI data from the US help the US Dollar (USD) stay resilient against its rivals, limiting the pair's upside.

GBP/USD meets resistance around 1.3400

In line with its risk-linked peers, GBP/USD stages a modest comeback on Wednesday, although meeting some resistance around the 1.3400 neighbourhood. Cable’s humble recovery struggles to gather momentum as the Greenback benefits from better-than-forecast macroeconomic data releases.

Gold loses traction after testing $5,200

Gold corrects lower after testing $5,200 but manages to stay in positive territory in the second hald of the day on Wednesday. The precious metal remains well supported by the deterioration of the geopolitical scenario in the Middle East, while the US Dollar's resilience caps the upside.

Crypto Today: Bitcoin, Ethereum, XRP rebound amid mixed ETF flows

The cryptocurrency market is showing subtle recovery signs despite heightened global uncertainty following the United States (US) and Israel attacks on Iran and the subsequent retaliations that have morphed into a wider Middle East war.

First Venezuela, now Iran: The US-China energy war escalates Premium

At first glance, the latest escalation involving the United States with both Iran and Venezuela looks like another chapter in a long-running geopolitical story. But viewed through a broader strategic lens, something else may be unfolding: Energy.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.