Occam’s Razor, a scientific principle that suggests the simplest answer is typically the right answer to a given question. This is truly a principle I have lived by simply because it works. I am always fascinated with the origin of things and specifically, the simple thought process behind the idea. For example, have you ever wondered about the origin of numbers? I mean, the numbers 1 – 10 are a part of our everyday life. We see them everywhere, on street signs as we drive, at every store we shop at, on television, in every room in our home whether they are on a clock, in a book, on a kitchen appliance, a scale in our bathroom and so on. Numbers are everywhere, but do you know why they look like they do? Another interesting everyday item is money. Have you ever wondered where “currency” started and how?

Foreign Currency (Forex) trading traces its history centuries back since before the Babylonians. While they were the ones credited with the first use of paper notes and receipts, forms of currency had existed for quite some time already. In the beginning, the value of goods and services was expressed in terms of other goods and services, also called “the barter system”. Limitations of this system were the catalyst for establishing more generally accepted mediums of exchange.

The evolution of means of payment and a reliable store of value began with stones, teeth and feathers. This gave way to metals such as gold and silver. Next, it was governmental paper money. Before the First World War, most Central Banks supported their currencies with convertibility to gold. However, according to some, the gold exchange standard had its weakness of boom-bust patterns. As economies moved more and more to paper money not supported by gold other problems arose. I could go on and on but that is the origin of money in a nut shell. As you can see, money started out very simple with gold, silver, and so on… Of course, leave it to people to complicate things but that’s another story.

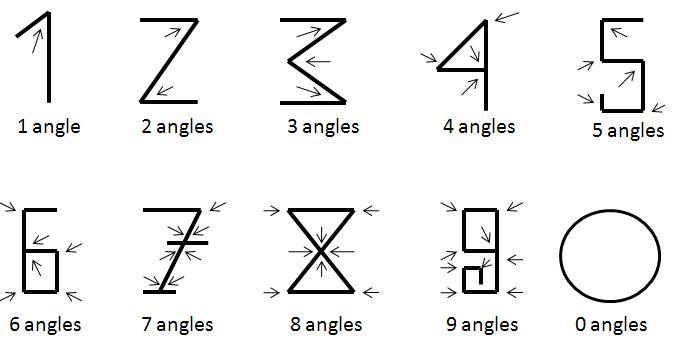

Let’s take a look at something even simpler than money; let’s look at how numbers started and why they look the way they do. The number system we use today (1, 2, 3, 4, 5…) is called the Arabic Numbers System. We also have the Roman Number System (I, II, III, IV, V…) which is rarely used in everyday life. While Arabs popularized Arabic numbers they actually date back to Phoenician merchants, according to most historians. Why does one look like 1, two look like 2 and so on? The answer is extremely simple. They are all “angles”.

When it comes to successful buying and selling in markets as a trader or investor, how this actually works is also quite simple yet most completely over complicate it.

March 30th, 2016 – Supply Demand Grid

S&P Income Trading Profit: $1,084.00

Price charts clearly show us “wholesale” (demand) and “retail” (supply) price points in any and all markets. News, indicators, opinions, economic reports and so on are not what Wall Street uses to make successful trading and investing decisions. They simply focus on buying at wholesale prices and selling at retail prices, like I did on the chart above.

Whether it’s trading, or numbers, or how you tie yours shoes, the simple approach is typically the right one to take.

Hope this was helpful. Have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD stays below 1.1850 after dismal German sentiment data

EUR/USD stays in negative territory below 1.1850 in the second half of the day on Tuesday. Renewed US Dollar strength, combined with a softer risk tone keep the pair undermined alongside downbeat German ZEW sentiment readings for February.

GBP/USD falls toward 1.3550, pressured by weak UK jobs report

GBP/USD remains under bearish pressure and extends its decline below 1.3600 on Tuesday. The United Kingdom employment data suggested worsening labor market conditions, bolstering bets for a BoE interest rate cut next month and making it difficult for Pound Sterling to stay resilient against its peers.

Gold pares intraday losses; keeps the red above $4,900 amid receding safe-haven demand

Gold (XAU/USD) attracts some follow-through selling for the second straight day and dives to over a one-week low, around the $4,858 area, heading into the European session on Tuesday.

Canada CPI expected to show sticky inflation in January, still above BoC’s target

Economists see the headline CPI rising by 2.4% in a year to January, still above the BoC’s target and matching December’s increase. On a monthly basis, prices are expected to rise by 0.1%.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.