![]()

When it comes to managing your 401(k), most people making three major mistakes that cost them thousands of dollars; and the scary part is they likely don’t even know it. This is article is the first in a three part series on retirement planning and your 401k. The three biggest mistakes that cost people thousands are related to:

Fees

Taxes

Losses

Fees

Most individuals that have a 401(k) plan aren’t aware of how much they’re actually paying in fees. To illustrate this common lack of awareness let me tell you what happened when we met with a Chief Financial Offer at a company several weeks back. He was shocked when we told him that he was paying Wall Street 5.75% on every dollar he was contributing to the company’s 401(k). If an expert in the field of finance who is a CFO is not aware of the hidden fees, how could the average investor know?

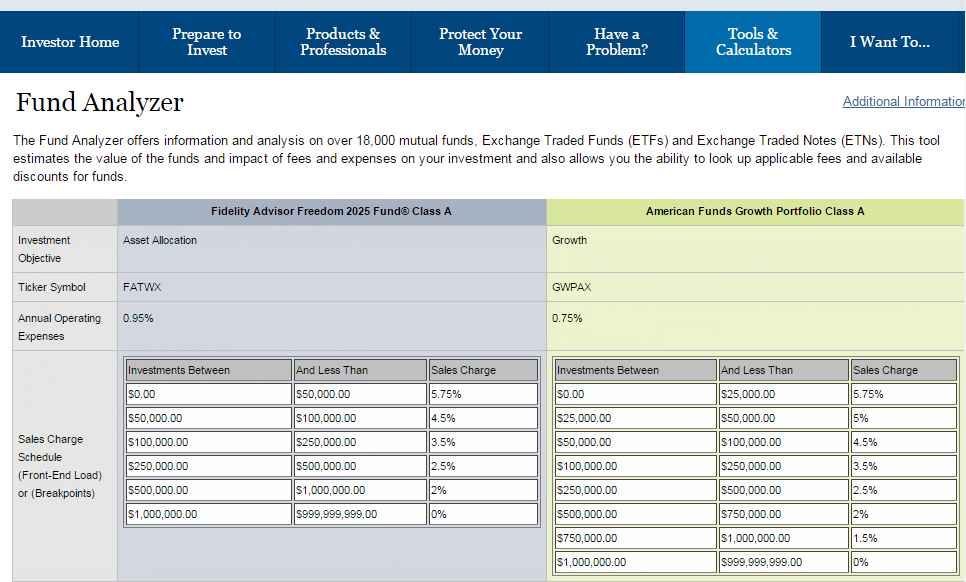

Let’s begin to focus on what you may be doing wrong and how to fix it. It’s important to understand how much you are actually paying in 401(k) fees because it will dramatically impact your investment returns over time. Annual operating expenses, sales charge and investment manager fees are key fees you need to be aware of. To illustrate the fee structures that are embedded with hidden costs let’s look at the screen shot below. What you’re looking at is a screen shot from the FINRA (Financial Industry Regulatory Authority) website. I’ve picked out two very popular mutual funds to make my point. On the left is the Fidelity Advisor Freedom 2025 Fund (a 2025 target date fund) and the second, on the right, is American Funds Growth Portfolio.

What you’ll notice are two expense areas that we should pay particular attention to. The first is the annual operating expenses; this is the operating expenses of the mutual fund itself. You’ll notice that the Fidelity Fund has an annual operating expense of 0.95% and the American Funds annual operating expense is 0.75%. Additionally, you’ll notice the front end loaded sales charge schedule, which is what most people are NOT familiar with. Take note that every dollar you contribute to these 401(k)s has sales charge (some call it a commission) of 5.75%. This is true for both the Fidelity and American Funds below. There may be situations where your company may have negotiated a lower fee structure with the mutual fund companies.

Additionally, what you won’t find in the screen shot are portfolio managers cost (or management fees). Typically these fees range between 0.25% and for smaller plans you may be charged an additional 1.5%. These fees are also known as investment advisory fees (or I like to refer to them as Wall Street’s pension plan). For example, for every dollar that you contribute to your 401(k) the fee can cost you anywhere from 6.5% to 8.0%. So, if the stock market has a good year and goes up 8% on the year, for that year you basically break even.

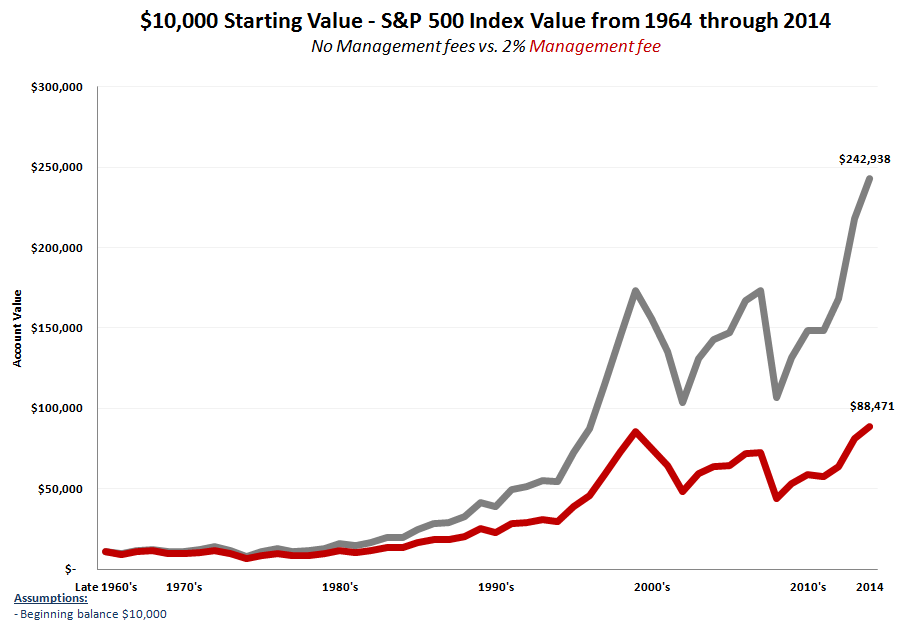

That’s why it’s important for you to be aware of all these different fees within your 401(k). The fees will reduce your overall performance and the amount of money you’ll have available to you when you need it the most, during your retirement years. Let me illustrate by using the chart below.

Below is a screen shot of the S&P 500 index value for the past 50 years, from 1964 through 2014. The beginning value of this hypothetical example is $10,000. The grey line represents the growth of that $10,000 over the 50 years with no management fees. That total is $242,938. The red line, however, is what most people experience with the growth of $10,000 in a typical 401(k). Please note that this red line has a 2% management fee and its value over 50 years is $88,471. The difference in account value between the two is approximately $150,000. This begs the question. “Where did the $150,000 go?” Hint, that’s the banks money – the pension you’re helping build for Wall Street. Think about it, you’re providing 100% of the money, taking 100% of the risk and only receiving 35% of the profits.

Here’s how you can reduce some or all of your 401(k) fees and keep more of what you make. First, check within your existing 401(k) on your investment options and find funds with the lowest expense ratio by using the “Fund Analyzer”. Look for the lowest expense ratio funds and reallocate your positions to those funds. Typically look for funds with no front end load fees and expense ratios below 0.50%.

If your 401(k) does not offer funds with low expense ratios then you may want to consider transferring your existing balance (the balance that is vested) into your own IRA. Once you have your IRA established you’ll be able to choose from a variety of low cost funds and ETF’s. As I have mentioned so many times over the years, there is a major gap in profits between Wall Street and the average investor. The more you understand how the financial system really works, the more empowered you will be to make financial decisions that benefit you, not Wall Street.

We’ll discuss taxes and losses in the next two articles. Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD falls to near 1.1600 due to persistent bearish bias

EUR/USD depreciates after registering modest gains in the previous session, trading around 1.1610 during the Asian hours on Thursday. The technical analysis of the daily chart suggests a persistent bearish bias as the EUR/USD pair remains within the descending channel pattern.

GBP/USD underperforms as UK faces stagflation risks amid Middle East war

The Pound Sterling trades lower against its major currency peers, is down 0.22% around 1.3340 against the US Dollar, during the Asian trade on Thursday. The British currency faces selling pressures amid fears that the United Kingdom economy could face stagflation risks due to higher energy prices, a situation in which inflation accelerates with economic growth and employment conditions remaining stagnant.

Gold climbs near $5,200 as Iran war fuels safe-haven demand

Gold price extends its gains for the second successive session on Thursday as traders seek safety amid the ongoing war in the Middle East. US and Israeli strikes across Iranian territory and widespread Iranian missile and drone retaliation across the Middle East, including attacks on regional targets and military sites, prolong the crisis and its impact.

Top Crypto Gainers: Decred, Zcash, and Dogecoin lead recovery as Bitcoin crosses $72,000

Bitcoin trades above $72,500 at press time on Thursday, holding its 6% gain from the previous day, contributing to a broader market recovery. The total cryptocurrency market capitalization stands at over $2.43 trillion as the broader market sentiment improves significantly.

First Venezuela, now Iran: The US-China energy war escalates Premium

At first glance, the latest escalation involving the United States with both Iran and Venezuela looks like another chapter in a long-running geopolitical story. But viewed through a broader strategic lens, something else may be unfolding: Energy.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.