![]()

Often my articles talk about myth vs. reality when it comes to trading, money and markets. Today, I want to discuss a bigger picture issue many people lose sleep over. The issue is the amount of savings needed to live the life style you choose to live today, tomorrow and into retirement. The professionals and financial industry lead everyone to believe that they need a large savings amount or else retirement will not be fun and likely consist of moving in with the kids.

How much do you need? Over the past few years the professionals have suggested a million dollars in savings is a good general number. Recently, TheStreet.com released an article with some interesting information on this topic, read below…

“$1 Million Doesn’t Cut It for Retirement”

“Conventional wisdom says you need to save $1 million for retirement. That target may be easy to remember, but it falls short of the true cost of what’s required for post-career comfort. Longer life spans, the threat of inflation and the uncertain future of Social Security benefits make this long-touted savings advice inadequate for most, advisers say. Scottrade recently polled 226 registered investment advisers on the topic and found that 71% don’t believe $1 million is enough for the average American family. Most said families need to save double, or more than triple, the amount. “Younger generations, especially, need to set their retirement goals higher than other generations and start saving as early as possible,” says Craig Hogan, Scottrade’s director of customer-relationship management and reporting. The survey solicited opinions about the current investment habits of Americans. Questions were broken down by generations to determine advisers’ opinions on average investment goals in today’s dollars for various groups.

Generation Y (ages 18 to 26) needs to save at least $2 million, according to 77% of advisers. Forty percent put the figure at $3 million.

Nearly half of advisers (46%) said Generation X (ages 27 to 42) should at least double the $1 million goal. Twenty-two percent suggested more than $3 million.

For Boomers (ages 43 to 64), 35% recommended $2 million to $3 million. Thirty percent suggested $1.5 million to $2 million.” – The Street.com

So, as you can see, now the experts are suggesting that $1 million should be at least doubled and in some age groups tripled to $3 million. This and many more articles lead people to believe that how much money you make and save has the biggest impact on your financial well-being. If you’re a baby boomer and you don’t have $2 or $3 million lying around in savings this conventional thought can be very scary. Are all these experts correct? I say no, let me explain.

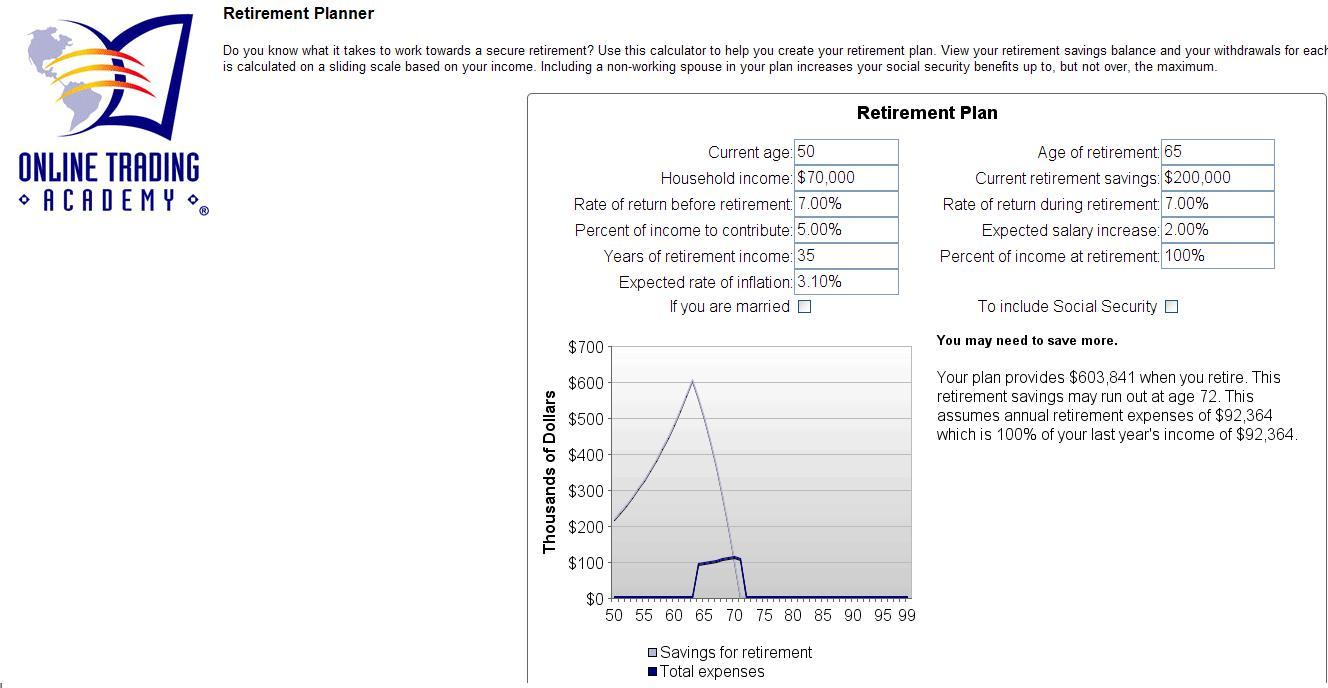

Let me introduce you to the Online Trading Academy Financial Calculators. I strongly suggest you explore and try these calculators, you will find the results of your inputs fascinating. I have taken some screen shots of one of them, the Retirement Planner. I tried to use some average inputs to prove my point that the industry has this retirement savings issue all wrong. In the example above, I input $200,000 of retirement savings, age 50, retirement age of 65, 35 years of retirement income, 7% rate of return (ROR, I chose this because this is the average annual return of the S&P 500), 7% ROR during retirement, $70,000 household income, and 100% of income at retirement. So, as you can see, we want our retirement income to take us at least to age 90, and hopefully beyond for us or our loved ones. With these numbers, obviously we come up very short and run out of savings at age 72. Yuk!

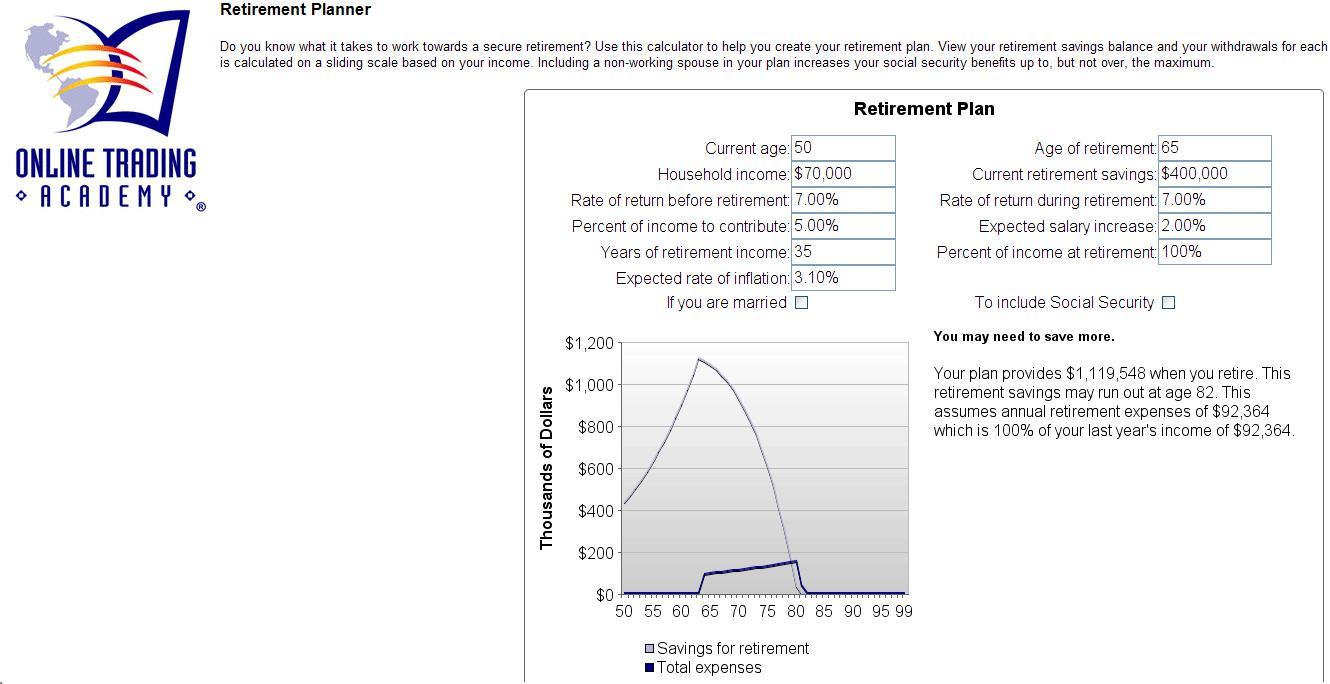

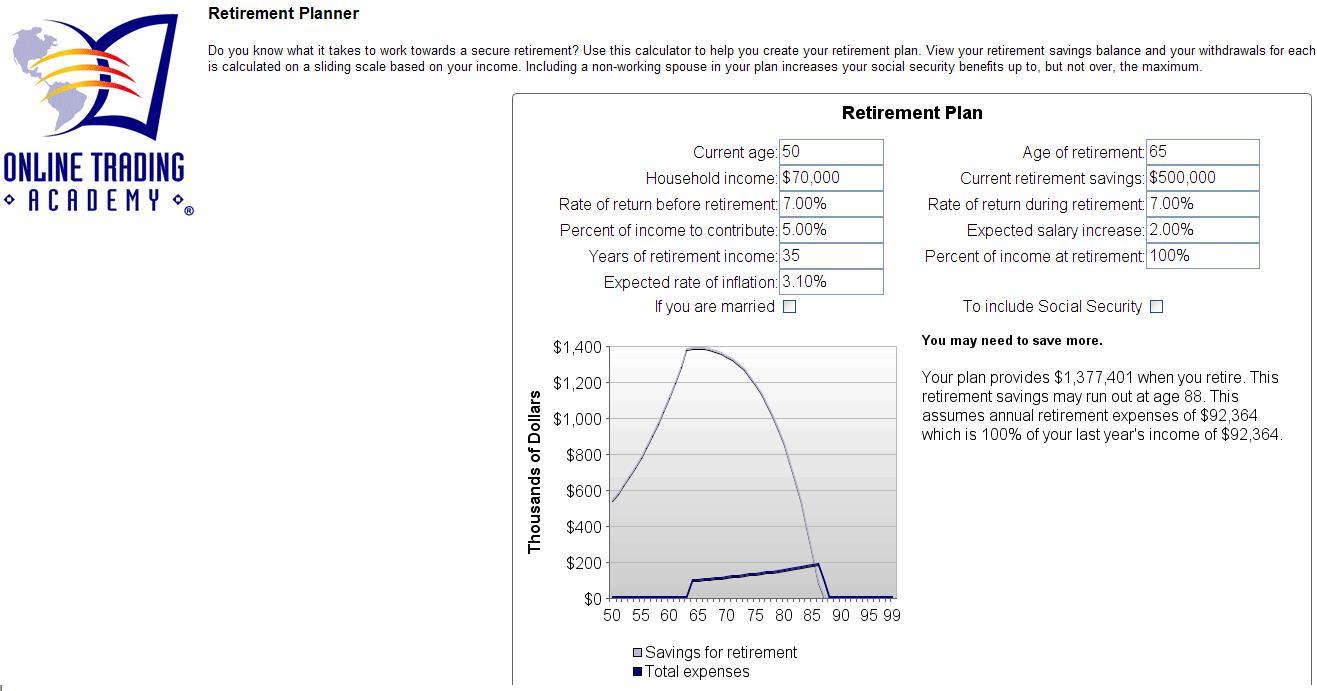

Remember, the industry tells us we need to focus on and increase our retirement savings and make sure it’s in the millions, according to the financial advisors. In this plan above, the only change I made was to increase that $200,000 in savings to $400,000 which is a HUGE increase from the original $200,000. Notice with our graph however, we still don’t make it to our goal and run out of money at age 82. Yikes, what a time to move in with relatives… In the plan below, I added even more to the savings, bumping up that number to $500,000 from the original $200,000, but when we look at the graph we still fall short of our goal. The important point to note here is that we are making monumental changes to the savings amount just as the experts say we should but it’s having very little effect on our financial well-being.

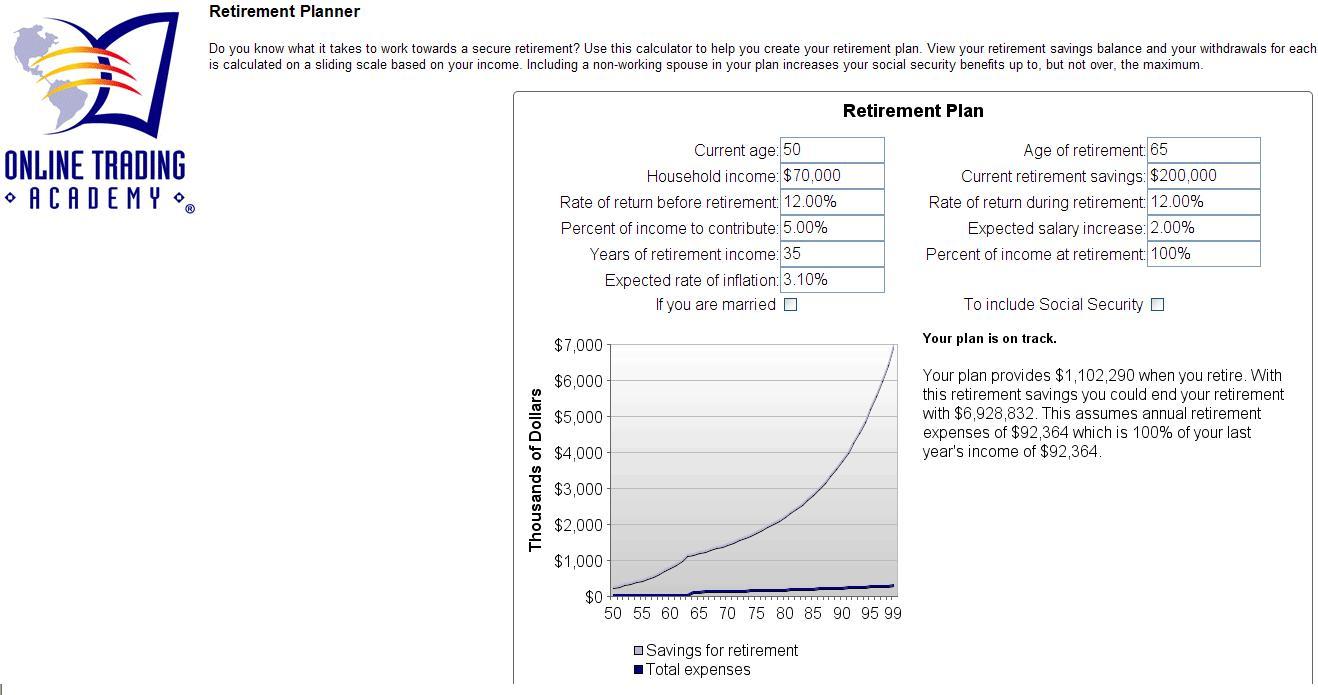

Now, let’s change our focus from conventional Wall Street wisdom and instead of focusing on the amount of savings, let’s focus on what we at Online Trading Academy consider to be the most important focus, the Rate of Return (ROR). In the plan below, I have brought the $500,000 savings back down to $200,000 and changed the ROR from 7% to 12%. A minor change in this number has monumental positive results on our financial well-being. Not only do we meet our goal, we don’t ever touch our principle and have plenty of money left over for our loved ones.

The main point is that the proportion of contribution (savings) doesn’t have as big an impact as you thought it might. What has the biggest impact on your financial well-being? RATE OF RETURN!

Why do the big firms typically push the investing public into thinking more savings contribution is the key factor that leads to a healthier financial retirement? Well, the answer here is typically found by investigating what is in the firm’s best interest, not yours. Most firms make their money on management fees existing of anywhere from 1 – 4% annually. Very few firms actually derive profits based on the “performance” of client accounts. Given this information, what leads to higher revenue for the financial firms are larger accounts, not necessarily strong performance for their clients. The fear tactic of needing that $2 million is powerful, don’t let it scare you…

The path that leads to a standard of living that you desire to live consists of a few steps. First, determine what the health of your wealth really is, how much savings do you have? Next, figure out what annual income you need to live the life style you desire to live today, tomorrow and during retirement? Then, it is easy to figure out the rate of return (ROR) you need to attain that annual income? Re-creating or creating your paycheck from an objective and rule based strategy is the answer. Consider learning to do what Wall Street does, not what Wall Street tells you to do.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD retreats to daily lows near 1.1570

EUR/USD briefly pushed higher earlier in the session, climbing toward the 1.1650 area, but the recovery quickly lost momentum and the pair has drifted back to test the 1.1570 region. A more cautious market mood, driven by the escalating conflict in the Middle East, together with broad-based strength in the US Dollar, is making it difficult for the pair to maintain its footing.

GBP/USD loses the grip, focus is on 1.3300

GBP/USD remains on the defensive on Thursday, hovering around the 1.3320 region. The British Pound is coming under pressure amid growing concerns that rising energy prices could expose the UK economy to stagflation risks, while renewed safe-haven demand for the Greenback continues to weigh on the pair.

Gold falls as demand for the US Dollar resurges

Gold turns lower on Thursday, slipping back toward the $5,100 area. Persistent strength in the US Dollar (USD) is preventing the precious metal from building a meaningful recovery, even as markets remain risk-averse amid the deepening conflict in the Middle East.

Crypto Today: Bitcoin, Ethereum, XRP hold weekly gains despite US-Iran war

The cryptocurrency market is gaining strength on Thursday, building on Wednesday's upswing, which saw Bitcoin reach a weekly high above $74,000. Ethereum and Ripple are moderating their recent gains amid uncertainty stemming from the escalating war in the Middle East.

Two PMIs, two Chinas Premium

China’s economic data are often treated with a degree of caution by global investors. The challenge is not necessarily that the numbers are incorrect, but that they can describe very different parts of a vast and complex economy. Nowhere is that more evident than in China’s PMIs.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.