![]()

The world of market speculating is made up of everyone from the active day trader to the longer term investor speculating in all kinds of markets and asset classes. There are people all around the globe pushing buy and sell buttons each day in hopes of achieving income and wealth. Never in history have there been so many books written on how to speculate in markets for traders and investors. Each weekend in many cities around the world there are educational seminars given on how to “get rich” from trading. With so much education on how to properly speculate in markets out there, why is it that most people lose money? How can this be? The answer is twofold and is the focus of this piece.

First, it’s because of most of the books and seminars. Most books and seminars are loaded with conventional technical and fundamental analysis which tends to teach you how to buy when everyone else buys and sell when everyone else sells (herd mentality) which is high risk, low reward, and low probability. Conventional technical analysis is based on pattern recognition that has people buying after price has rallied and also offers buy and sell signals based on indicators and oscillators that always lag price which means high risk buying and selling. Conventional fundamental analysis offers buy signals only after good news is present and company numbers are solid. Where do you think the price of a stock is by the time this good news is offered to you? If you guessed high, you’re correct almost always. Remember, the only way to be consistently profitable when buying and selling in markets is to have a strategy that has people buying after you buy, at higher prices than you paid and selling after you sell, at lower prices than you sold at. Conventional technical and fundamental analysis does not help us in this regard, the basic principles of these two ways of thinking ensure you will buy and sell with the herd, when it’s too late, which means high risk and no real edge. Come on… if proper market speculating was as easy as reading a book wouldn’t everyone be a trading millionaire?

The second reason most people lose money in the global trading markets, which is really part of reason number one, is that they throw all simple logic out the window when making buy and sell decisions. When you go to buy a car and you’re at the dealership and see the car you have your heart set on, you see the price and it’s $20,000. Do you go to the dealer and say; “I like this $20,000 car so much, I want to pay you $30,000 for it? Of course you don’t do that, you likely offer $17,000 or something like that. In trading, most people wait for confirmation of higher prices and then buy, which is the opposite of how they buy things outside of trading and makes no sense. I once had a gentleman go through my training program and I will never forget the day I met him and spoke to him about the program. He approached me and said he wanted to learn how to trade and join my program. I said, “Before we commit to this let’s have a conversation or two and make sure this is right for you.” You see, I always want to make sure whoever is coming into the training program has the best chance in succeeding. I don’t want to waste their time or mine. My first question was, “What do you do for a living now?” He happened to own and run a pizza chain that he had just sold. As soon as he said that, I knew he had a good chance at becoming a successful trader because he already knew how to make money buying and selling. In fact, there was nothing about buying and selling in a market that I could teach him that he didn’t already know. I will explain this in a minute.

Our first lesson went like this… I asked him to tell me about his business and he did. He explained that the whole business comes down to the price of cheese. I asked him three simple questions: 1) What is the average price of cheese? “Around $2.00 a pound,” I think he said. 2) If the cheese you buy is selling at $4.00 a pound, how much will you buy? “As much as I need,” he said. 3) If the cheese is selling at $1.00 a pound, how much will you buy? “As much as I can and store it,” he said. I then told him that he was already a great trader and that there was nothing I could teach him about trading that he didn’t already know. What I could teach him however, is EXACLTY what this proper buying and selling looks like on a price chart. He was already buying and selling in a market properly, he just didn’t know what that looked like on a price chart. This was an easy task for me because he already had the foundation of how you make money buying and selling anything down, and had made plenty of money from it. The most important part of today’s article for you to understand is this:

The more you can bring the mindset and rules that you use each day to purchase everyday items at the grocery store, appliance store, and so on into your market speculating, the better you will do. Do you ever use coupons to save some money? If you do, you already know how to buy at a low price. Take that same exact mindset and action into your trading and investing world. The mass illusion is that proper trading and investing is somehow different than how we properly buy things in everyday life. Truth is, there is no difference.

Many so-called professionals like to complicate the process with smoke, mirrors, curtains and slight of hand. They do this to trick you so that you will transfer some of your account into theirs without you realizing it. The key for you is to keep everything “real.” Use your simple logic filter to ensure you will not lose some or all of your account to illusion. For your review, let’s walk through a trade from our Daily Market Overview service.

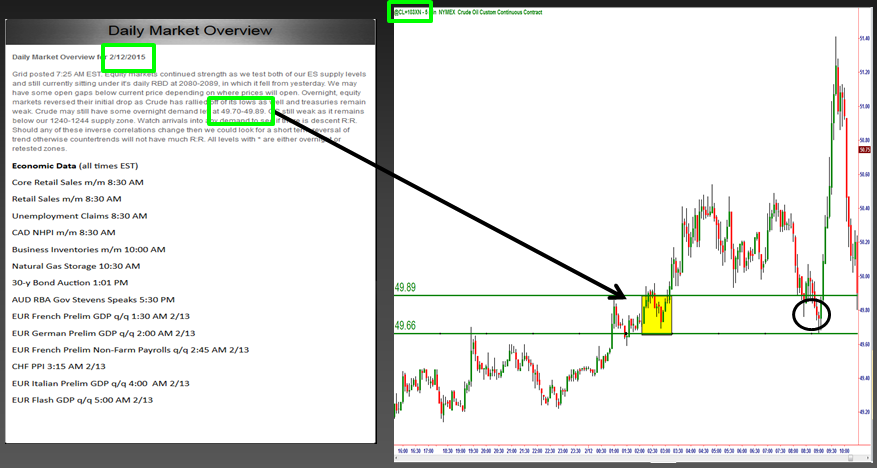

Crude Oil Trade: 2/12/15. Source – OTA Daily Market Overview

Above we have the Crude Oil market that is falling fast and reaching what our strategy determined to be an objective demand zone (wholesale prices). Most people would not want to buy in that circled area because there is a little downtrend and every book says to never buy in a downtrend. The news also may have been bad, causing price to fall which would make people very nervous when buying at that level. So, most people would not only not buy, some actually sold in that circled area. What if I changed the market and made it the market for Samsung Smart (very smart) TVs like you also see above. If you saw price decline like that would you be more inclined to buy or not? Would you be afraid to buy on that decline or would you be very excited? Of course, we would all be thrilled to buy that TV at a discount. Why then does just about everyone on the planet have opposite feelings or emotions with these two examples. The answer is simple, one is a financial market and the other is an example of anything else we buy and sell in life. Furthermore, you have been brainwashed to think that how you make money buying and selling in a financial market as a trader or investor is somehow different from how you make money buying and selling anything in life.

Our trade worked out fine. Price turned higher giving us a low risk profit on that trading opportunity. The reality is that Crude Oil was on sale for a short period of time and there was only a small amount for sale at that price, meaning once they were all bought price would rise. The chart gives us all this information if you understand the basic supply and demand strategy.

There is nothing wrong with following the rules of a trading book, just make sure you are the author and that your strategy has you buying at wholesale prices and selling at retail prices. To do this, start with using all the powerful buying and selling knowledge you already possess and use on a daily basis outside of the trading world. Bring this key but simple strategy into trading and you will soon be spotting “blue light specials” all over the place. Never forget, how you make money buying and selling anything in life is EXACTLY how you make money buying and selling in the financial markets.

Hope this was helpful. Have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD looks sidelined below 1.1600

EUR/USD remains on the back foot in the latter part of the NA session on Thursday, now attempting a consolidative theme in the sub-1.1600 region. A more cautious market mood, driven by the escalating conflict in the Middle East, together with broad-based strength in the US Dollar, is favouring the continuation of the leg lower in spot.

GBP/USD stays offered near 1.3340

GBP/USD fades Wednesday’s uptick and trades with decent losses in the 1.3340 zone in the latter part of Thursday’s session. Cable’s weakness, alongside the rest of the risk complex, follows the strong performance of the Greenback amid intense geopolitical jitters.

Gold: further weakness could challenge $5,000

Gold comes under fresh selling pressure on Thursday, slipping back below the $5,100 mark per troy ounce. Persistent strength in the US Dollar (USD) is preventing the yellow metal from building a meaningful recovery, even as markets remain risk-averse amid the deepening conflict in the Middle East.

Crypto Today: Bitcoin, Ethereum, XRP hold weekly gains despite US-Iran war

The cryptocurrency market is gaining strength on Thursday, building on Wednesday's upswing, which saw Bitcoin reach a weekly high above $74,000. Ethereum and Ripple are moderating their recent gains amid uncertainty stemming from the escalating war in the Middle East.

Two PMIs, two Chinas Premium

China’s economic data are often treated with a degree of caution by global investors. The challenge is not necessarily that the numbers are incorrect, but that they can describe very different parts of a vast and complex economy. Nowhere is that more evident than in China’s PMIs.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.