![]()

I have been involved with trading and investing for more than twenty years. Low-risk profits are a function of trading what is real, not what I feel. I’m able to eliminate subjective emotions from my trading by basing each and every decision on a simple mechanical set of objective rules that quantify supply and demand. These simple rules stem from three principles of price movement I crafted for my own trading long ago. These three principles form the foundation upon which my trading and investing is based. While everyone’s trading strategy will always be a bit different, perhaps today’s article will help set you on a path that allows you to focus on what is real and not what you feel…

Principle 1: “Price action in any free market is a function of an ongoing supply and demand relationship within that market”.

Principle 2: “Any and all influences on price are reflected in price.”

Principle 3: “The origin of motion/change in price is an equation where one of two competing forces (demand and supply) becomes zero at a specific price.”

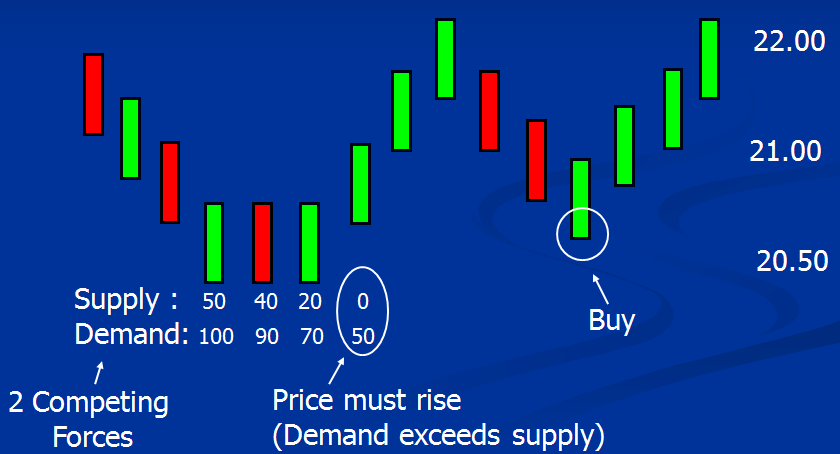

First, understand that there are always two competing forces at work in the market, buyers (demand) and sellers (supply). Our goal is to quantify those forces and identify price levels where the imbalance is greatest as this creates change, or movement in price.

Let me tell you a quick story… Years ago, I was speaking at a University in California. My lecture showed how to quantify supply and demand in the markets. While on a break, a gentleman mentioned to me that he had been actively educating himself on proper investing for years and still felt he had more to learn as nothing he had come across made much sense. He mentioned that he was really enjoying my material and asked me a couple questions. I asked him to briefly explain his background as that would best help me assist him with his question and help move him toward his goal. One of the first things he mentioned was that he had studied earthquakes in his past, it was what he did for a career many years ago.

I stopped him right there. I asked him if he knew exactly what causes an earthquake. He replied “yes, of course,” as if I was asking him if he knew how to tie his shoes. I then told him that I was about to give him the most valuable trading information he had ever received. I explained that with his earthquake knowledge, he had all the foundation knowledge he needed to trade or invest properly and achieve consistent low risk returns in any market. I explained that there is absolutely no difference in how one quantifies a potential earthquake to how someone quantifies a potential trading/investing opportunity. In an earthquake, two competing forces (in this case two giant plates of earth) press against each other until a threshold is met that creates change/movement (the earthquake). When one mass of earth overwhelms its competitor (the opposing plate of earth) the earth moves and we have an earthquake. The two competing forces in trading/investing are buyers and sellers. How we quantify these two forces is no different from how we quantify the two competing forces that lead to an earthquake, or any other example where two opposing forces come into play.

Principle 1: Price movement in any free market is a function of an ongoing supply and demand relationship within that market.

Put quite simply, a trading and investing market is made up of three components: buyers, sellers and a widget being bought or sold. These widgets may be shares of a stock, S&P futures, foreign currencies, bonds and many more tangible and intangible “widgets.” For example, let’s say the widget is a stock. This stock has some value. That value or “price” as we call it is determined simply by the supply and demand for the stock which is the ongoing interaction of all the buyers and sellers taking action with regard to that particular stock.

A market is always in one of three states of price action:

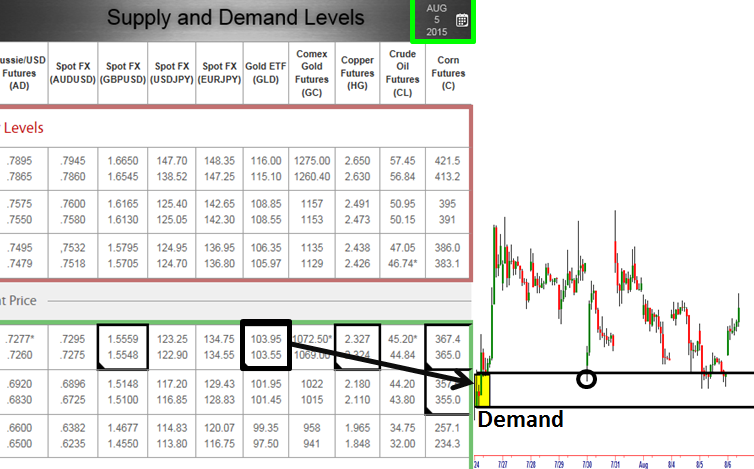

First, it can be in a state where demand exceeds supply which means there is competition to buy and that leads to higher prices. What does this look like on a price chart? Below is one of the many demand levels I have shown on charts over the years.

Supply/Demand Grid Aug 5, 2015 – Demand:

Second, it can be in a state where supply exceeds demand which means there is competition to sell and this leads to declining prices. What does this look like on a price chart? Below is one of the many Rally – Base – Drop supply levels I have shown over the years.

Supply/Demand Grid Aug 5, 2015 – Supply:

Third, it can be in a state of equilibrium. At equilibrium, there is little to no competition to buy or sell because the market is at a price where everyone can buy or sell as much as they want. However, as the market moves away from equilibrium, competition increases which forces price back to equilibrium. In other words, competition eliminates itself by forcing markets back to equilibrium. Even though equilibrium is where the majority of candles are, we don’t really want to trade in that area.

Principle 2: Any and all influences on price are reflected in price.

At any given moment there is a ton of financial information being created and passed on around the planet. This information can be in the form of an earnings report, news, income statement, analyst opinion, economic report, terrorist attack and so on. All this information creates thoughts and perceptions that are different for everyone depending on their individual belief system. Be careful to notice that most humans assume other’s belief systems are the same as their own. This, of course, is simply not true.

As I have said before, beliefs lead to ACTION; and in trading and investing, action is either buying or selling. Each action to buy or sell takes place at a specific price. Therefore, price is all that the consistently profitable trader and investor needs to focus on. Adding ANY other information will distort your perception of the supply/demand reality in any given market.

Principle 3: The origin of motion/change in price is an equation where one of two competing forces (buyers and sellers) becomes zero at a specific price.

The Candles on your screen represent the footprints of buyers and sellers. Each and every candle is created because of an ongoing demand and supply relationship. This order flow is driven by demand and supply based on people’s perceived value, fear and greed.

Let’s now put numbers to the simple supply and demand I keep mentioning. Here, we have 100 on the demand side and 50 on the supply side at price level: 20.50. Price will remain stable, meaning supply and demand will appear to be in equilibrium until the last sell order is filled. Price will then begin to increase or change when the last amount of supply is bought. It is when the last sell order is filled that we are left with 50 on the demand side and no sellers. One of the two competing forces has exhausted itself. In this case it was the sellers. What appeared to be supply/demand equilibrium was actually disequilibrium or imbalance; it just took a certain amount of time for this unbalanced equation to play out.

While everything in this piece only means something if you know what supply and demand looks like on a chart, the goal of this piece was to get you to turn back the clock and focus on the foundation of your trading and investing strategy. If there is any illusion or subjective information in your quest for truth, truth will never be found.

Hope this was helpful, Have a good day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD retakes 1.1800 on renewed USD weakness

EUR/USD gains ground after three days of losses, re-attempting 1.1800in the European trading hours on Thursday. The US Dollar sees fresh selling interest across the board, despite hawkish Fed Minutes, as the market mood improves and supports the pair. US Jobless Claims data, Fedspeak and geopolitics remain in focus.

GBP/USD recovers above 1.3500 amid better mood

GBP/USD finds fresh demand and rises back above 1.3500 in the European session on Thursday. Improving risk sentiment and renewed US Dollar weakness are helping the pair recover ground ahead of mid-tier US data releases and Fedspeak.

Gold clings to gains above $5,000 amid safe-haven flows and Fed rate cut bets

Gold sticks to modest intraday gains, above the $5,000 psychological mark, through the first half of the European session, though it lacks bullish conviction amid mixed cues. The third round of US-mediated negotiations between Ukraine and Russia concluded in Geneva on Wednesday without any major breakthrough.

Injective token surges over 13% following the approval of the mainnet upgrade proposal

Injective price rallies over 13% on Thursday after the network confirmed the approval of its IIP-619 proposal. The green light for the mainnet upgrade has boosted traders’ sentiment, as the upgrade aims to scale Injective’s real-time Ethereum Virtual Machine architecture and enhance its capabilities to support next-generation payments. The technical outlook suggests further gains if INJ breaks above key resistance.

Hawkish Fed minutes and a market finding its footing

It was green across the board for US Stock market indexes at the close on Wednesday, with most S&P 500 names ending higher, adding 38 points (0.6%) to 6,881 overall. At the GICS sector level, energy led gains, followed by technology and consumer discretionary, while utilities and real estate posted the largest losses.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.