![]()

The XLT is our live online trading program. After learning our core supply and demand strategy in the classroom or online, students then spend time in the XLT, in the live markets with our instructors, watching them setup trades and execute orders. One of the keys to the XLT and successful trading is to keep things simple. This is also the purpose of this article. I received some important questions regarding a recent trade so I thought I would share all the details of what made that trade work. Not to add complexity but, instead, to dive into the psychology of what made that and many of our other trades work. Always remember that not all trades are going to be profitable, but that is part of trading and that’s ok. Let’s begin…

Understand a simple truth, most retail traders and investors are not very successful when speculating in markets. Short term traders especially tend to lose money overall. Institutions/market makers tend to do very well overall when it comes to short term trading. So, if you’re a consistent losing retail trader it’s likely because you’re thinking and trading like one.

Let’s take a look at a recent buying opportunity in the NASDAQ and get inside the mind of an XLT trader.

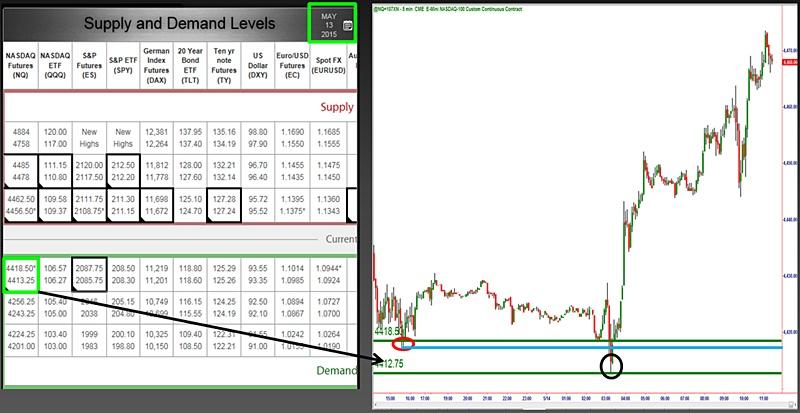

OTA Supply/Demand Grid: 5/13/15 – Nasdaq Futures

Notice the blue line extended from the red circled low on the chart. This line represents a recent Globex (US overnight) low prior to the day session and our early morning trading session. Sitting just below the Globex low is a key demand level from our Supply/Demand grid. Note that the demand level is NOT seen on this chart. The green lines are extended from that demand zone. We know demand exceeds supply at that level because price could not stay at that level and rallied higher from it. It scored out very high with our Odds Enhancer scoring system. So, XLT students know to buy at that level with a protective sell stop just below it and our appropriate targets above. Once that session got going the NASDAQ was still above the Globex low. So, let’s now think about how a retail trader is going to think in that situation. Retail traders who are going to buy that day are likely going to buy at the Globex low with a protective sell stop just below it or buy a breakout of the Globex high. Retail traders who are going to sell short that day are likely going to sell short once the NASDAQ breaks below the Globex low or at the Globex high. Our plan well before the market gets going is to buy at our demand level for all the reasons mentioned above (Odds Enhancers) and one more, the presence of a strong retail Bear Trap. Here is how it works. Once price declines and reaches the Globex low, the retail buyers buy and place their sell stop just below. Once price declines below the Globex low as it did (see chart), the bearish retail traders sell short and those who bought at the Globex low are now stopping out for a loss as their sell stops are triggered and filled. What has just happened is both retail buyers and sellers just sold on the break of the Globex low, just as price is reaching our demand level where we (and institutions) are very willing buyers. In other words, we have just caught both the retail buyers and sellers on the wrong side of the market. As banks and institutions are buying at the demand level, retail is on the sell side, which is why XLT students are buyers as well. If banks and institutions are buying there, we want to buy there as well.

Again, retail traders tend to perform poorly when speculating in markets. The key for you is to stop thinking and trading like a retail trader and start thinking and executing like an institution. Do all institutions make money? No. Overall however, they are significantly more profitable than the retail trading world as most day traders lose money and most longer term investors never achieve their financial goals. Our version of the Bull and Bear Trap, which is very different than the conventional versions, are two setups that occur frequently for the short term trader and long term investor. Learn how to properly identify and trade them to avoid falling for the trap which will cost you money; instead, get paid from the trap. As always, my hope is that this information will help lower your risk and increase your reward.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD retakes 1.1800 on renewed USD weakness

EUR/USD gains ground after three days of losses, re-attempting 1.1800in the European trading hours on Thursday. The US Dollar sees fresh selling interest across the board, despite hawkish Fed Minutes, as the market mood improves and supports the pair. US Jobless Claims data, Fedspeak and geopolitics remain in focus.

GBP/USD recovers above 1.3500 amid better mood

GBP/USD finds fresh demand and rises back above 1.3500 in the European session on Thursday. Improving risk sentiment and renewed US Dollar weakness are helping the pair recover ground ahead of mid-tier US data releases and Fedspeak.

Gold clings to gains above $5,000 amid safe-haven flows and Fed rate cut bets

Gold sticks to modest intraday gains, above the $5,000 psychological mark, through the first half of the European session, though it lacks bullish conviction amid mixed cues. The third round of US-mediated negotiations between Ukraine and Russia concluded in Geneva on Wednesday without any major breakthrough.

Injective token surges over 13% following the approval of the mainnet upgrade proposal

Injective price rallies over 13% on Thursday after the network confirmed the approval of its IIP-619 proposal. The green light for the mainnet upgrade has boosted traders’ sentiment, as the upgrade aims to scale Injective’s real-time Ethereum Virtual Machine architecture and enhance its capabilities to support next-generation payments. The technical outlook suggests further gains if INJ breaks above key resistance.

Hawkish Fed minutes and a market finding its footing

It was green across the board for US Stock market indexes at the close on Wednesday, with most S&P 500 names ending higher, adding 38 points (0.6%) to 6,881 overall. At the GICS sector level, energy led gains, followed by technology and consumer discretionary, while utilities and real estate posted the largest losses.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.