![]()

Firstly, I would like to say a very sincere thanks to every reader who took the time to vote for my fellow trader, Rick Wright, and I in the recent FXStreet Forex Best Awards. Our article won the Best Educational Content Award for the 3rd year now and it is a great honor to win once again. Many thanks to you all.

This week, I would like to discuss a recent economic news event which occurred on Feb 2nd, namely the RBA Cash Statement for the Australian Dollar. As you may know, FX traders worldwide tend to work themselves into a frenzy when it comes to major economic news, especially when interest rates are concerned. They sit by their computer eagerly awaiting the news to be released and then attempt to guess which way the market is going to move based on the numbers. Let’s say, it is not for the faint-hearted! Yet who can blame them when every major currency broker and textbook on trading FX tells people to trade the economic news in FX because it is fair and transparent and it gives you a level playing field to trade the news as it comes out.

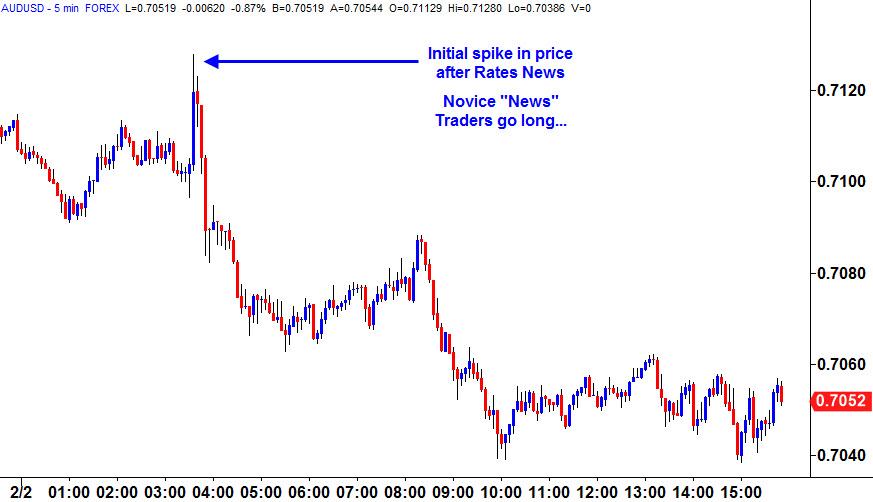

You then try that in real life and things suddenly do not seem quite as fair. You scour the news websites looking for the latest data figures as they come out, clicking the refresh button on the web browser so as to get a glimpse of the numbers only to watch the market move away from them. Another option is to simply wait for the price to start moving before doing anything and then try to jump on board for the ride as it happens, hopefully catching the momentum in time to make a quick return. Again, this tends to pay off on the odd occasion but never consistently enough to make a real strategy out of it. Most of the time, news traders find themselves getting stuck with a ton of slippage and frustrated as the market gives many false signals. Let’s take a look at the aforementioned example of the AUDUSD currency pair as it had the all-important interest rates announcement recently:

The actual figures stated that the RBA wanted to hold rates where they were; this information was released at 3.30am on Feb 2nd. Now, for a start, it is impossible to determine which way prices are going to go when the rates are being held at the same level, so any guess on direction going up or down is nothing more than that, namely a guess. As we can see form the chart above, in the first 5 minutes of the economic news being released the AUDUSD spiked up violently, only to then reverse and drop almost 100 pips lower throughout the rest of the trading day. If you had been a news trader in this case and clicked the buy button at market as the news event came out and the market started to rally, you would have likely been filled at a pretty poor price with some nasty slippage. This is one of the downsides to using a market order as it will always fill you at your price, or likely potentially worse, in a very volatile market. How then would you feel buying at the high price only to watch the price fall rapidly to the downside?

Another perspective is to think and act like the major banks and institutions instead. Ask yourself what they were doing at this time? Do you really think that they were waiting for confirmation or do you think they already had a plan? Do most businesses have a plan? In fact, maybe they had already been attempting to sell the AUD a few days prior and not gotten all of their orders filled, resulting in an imbalance of sellers and buyers, thus creating a supply level? Take a look at the screen shot below:

Notice how price rallied from the economic news announcement straight into the level of supply, where the banks were originally selling the AUDUSD. Price moved sharply up but could not breach the level of unfilled orders and came crashing back down for a drop of almost 100 pips. The major difference between the novice news trader approach and the professional institution approach is that the former like to chase the opportunity while the latter allow the opportunity to come to them. Who, therefore, takes on the lowest risk and higher overall reward?

Since this event the AUDUSD has gone on to rally much higher, causing even more frustration for the people who bought it high hoping to see it move higher still. They endured a loss on the trade, only to be proven right on the direction much later and have only a loss to show for it. Proper trading is about knowing your entry, stop and target ahead of time and using these rules to approach the market systematically. The idea of Market Timing is alien to many but logical to a few. In two weeks we will explore the concepts of Market Timing further and its application in the world of FX.

Be well and thanks again for your ongoing support.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.