![]()

Ask the majority of people who want to enter the world of speculative market trading what they like the idea of most and the majority will tell you “Day Trading.” In my experience I believe that the idea of day trading has a certain level of mystique attached to it, leading many to believe that it is not only glamorous, but a lucrative way to approach generating consistent profits in the markets. However just like longer term trading, day trading, be it in Forex, equities or futures has its advantages and disadvantages which we must consider. Of course if you have a good plan and the right education you can make money as a day trader but the definition of what day trading is depends on the perspective from which you look at it.

One thing I would certainly bring your attention to is that day trading the equity market is probably not the most economical way to approach your short-term income goals. Don’t get me wrong, I have nothing against anybody who does like to work with the equity market as a day trader but I do believe that the stock market doesn’t exactly lend itself best to this particular style of trading. The reasons include the fact that you need at least a $25,000 account to be able to even partake in pattern day trading and also because stocks can be very expensive. You typically find that the higher price stocks are the ones which move the most and of course the higher the price of the stock, the less of it that you can trade with a small account and with the limited margins the brokers are willing to give to you; even as a pattern day trader the most you will ever get is 4 to 1.

These factors combined with the fact that it can be difficult to even find a quality stock to trade, considering that there are literally so many out there, leave many people to consider the currency market as the ideal choice for day trading. As somebody who trades Forex regularly I can’t really disagree, however there are some guidelines that it would be wise to follow if you are going to consider day trading the currency market yourself. It doesn’t really matter what asset class you choose to trade, the fact remains the same: you need to understand how the market really works and you need to know what having a good trade plan is really all about.

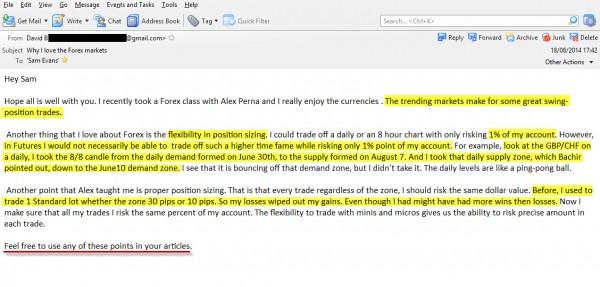

Obviously, this comes down to getting the right education and that starts with recognizing how the biggest institutions trade. The Online Trading Academy patented core strategy focuses only on what institutions do and where they create the biggest levels of Demand, where our students buy, and the largest levels of Supply, when our students look to sell. When you know what the picture of a true imbalance looks like on a price chart, then and only then can you hope to emulate the most successful institutions and find the lowest risk and the highest potential profit trades available on a daily basis. So how does this work in the world of day trading FX? To answer that question, I thought I would share with you a recent email I received from one of my ongoing Extended Learning Track (XLT) students. This way you can see how one of our graduates approaches the market through the eyes of an institution. Let’s take a look:

The above email was kindly sent to me by David B, who happily gave me permission to share this email in one of my articles. As you will see from the above email, I have highlighted certain points which he makes and I would like to show you the trade which he is talking about so you can get a strong idea of how a truly objective and well-educated trader approaches the market.

Firstly, it is important to note that sometimes a day trade doesn’t necessarily mean that you have to be on a trade for just one day. It can often make sense to allow the trade to run that bit further if that is what the chart suggests. David takes day trading to a whole other level by actually using the daily charts to find a couple of fantastic low risk/high reward set-ups on the GBPCHF currency pair. Note how he also uses the flexibility of the currency market and its position sizing, to ensure that he only risks 1% of his account when he takes his trade. By doing this he is not being greedy, instead he is focusing on the opportunity and his number one priority to maintain low risk in the event that the trade does not work.

David knows from the teachings of his instructors, that the safest way to attain consistent profits in these markets, is to make sure that you minimize risk and maximize reward. Solid risk management in the currency markets is not simply about having a stop loss and correct position sizing, but also about knowing where the right place to buy and the right place to sell actually is. Let’s take a look at an example of the trade he mentions in the email:

Notice how on this chart David bought when prices fell in a strong fashion to his predefined institutional area of demand. His reason: simply because this highlighted an objective area where willing demand exceeded willing supply. What I also like is how we decided to take profit at the opposing supply level. This is not always easy to do when a trade is going in your favour strongly and in my own experience of teaching literally thousands of students around the world, I have found that one of the most difficult practices that new traders have to learn, is taking a smart profit.

To me, David then does something which is incredibly difficult for someone with limited experience in trading. He looks past his win that he took on the long side and then immediately takes a short sale on the same currency pair at the supply level, targeting again the opposing demand area for an objective and unemotional profit. This to me, is the classic day trade, as the market drops over 100 pips in literally one day. Now that’s the kind of day trading I love in the currency markets.

As you will notice, the market then fell even further, however nobody is to know that this is going to happen and taking the profit that David did was the right thing to do. As we teach our students, nobody goes broke by taking a decent profit when the risk to reward ratio is solid. While there are many ways to day trade and many markets to choose from, FX is by far one of the most attractive with its low margins, leverage of around 50 to 1, starting account sizes as little as $100 and no restrictions on how many trades are allowed each day. As I said though, we need to look to approach these markets in a smart way and emulate the attitude and approach of people such as David if we hope to maintain success and consistency in our trading. Thank you David for sharing your experience with us all.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD stays below 1.1850 after dismal German sentiment data

EUR/USD stays in negative territory below 1.1850 in the second half of the day on Tuesday. Renewed US Dollar strength, combined with a softer risk tone keep the pair undermined alongside downbeat German ZEW sentiment readings for February.

GBP/USD falls toward 1.3550, pressured by weak UK jobs report

GBP/USD remains under bearish pressure and extends its decline below 1.3600 on Tuesday. The United Kingdom employment data suggested worsening labor market conditions, bolstering bets for a BoE interest rate cut next month and making it difficult for Pound Sterling to stay resilient against its peers.

Gold recovers modestly, stays deep in red below $4,950

Gold (XAU/USD) stages a rebound but remains deep in negative territory below $4,950 after touching its weakest level in over a week near $4,850 earlier in the day. Renewed US Dollar strength makes it difficult for XAU/USD to gather recovery momentum despite the risk-averse market atmosphere.

Canada CPI expected to show sticky inflation in January, still above BoC’s target

Economists see the headline CPI rising by 2.4% in a year to January, still above the BoC’s target and matching December’s increase. On a monthly basis, prices are expected to rise by 0.1%.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.