There are many skills required to be a consistently profitable trader. Here at Online Trading Academy, we pride ourselves on simplifying education by teaching our students to recognize the things that really matter in today’s currency markets. Let’s face it, there are many different opinions on what tools you need to correctly analyze the markets. Just take a look at the web. This, combined with the thousands of books and articles that have been written on the subject, invites new traders into a relative minefield of overload, not the environment that helps somebody achieve their goals in the currency markets. And it often leads to people looking for information about what to do in their trading in the wrong places.

The beauty of understanding how institutions are buying and selling today’s FX markets, is that it’s really quite simple. Think about how many businesses out there actually make money and I’m sure you’ll agree it’s no more complicated than buying at wholesale cost and selling these goods at a later time for retail prices. As you may not know already, this is the embodiment and foundation of the Online Trading Academy core strategy. We recognize what a picture of institutional demand looks like on a price chart and use that as an area to buy into the currency markets. We also look to institutional areas of supply as these give us the clues as to where we should be selling our currency as well. These lessons are first and foremost of what we teach our students. Once they understand what a true picture of supply and demand looks like on a price chart, therefore giving them a real and objective reason to buy or sell, we can then introduce the next level of education, which are the odds enhancers. The odds enhancers are a series of criteria that allow us to filter the good trades from the bad and stack the probability of success in our favor. They are a vital piece of the analytical process and a true cornerstone of the core strategy itself.

However, one of the more overlooked benefits of using the odds enhancers in our trading analysis and execution, is that they allow us to perform with accuracy and consistency, one of the most vital requirements to becoming consistent in today’s markets: the recording and journaling process. As the title of this article suggests, it can often be easy to jump into a trade without really understanding why you pulled the trigger in the first place. We must always honor our rules and routine when we find and execute our trades, because without this level of consistency, we can never really discover what works for us and what does not. I won’t lie to you though, journaling and recording can be a little bit dull. Most people, including myself at first, are more interested in jumping in at the deep end and getting involved with taking trades.

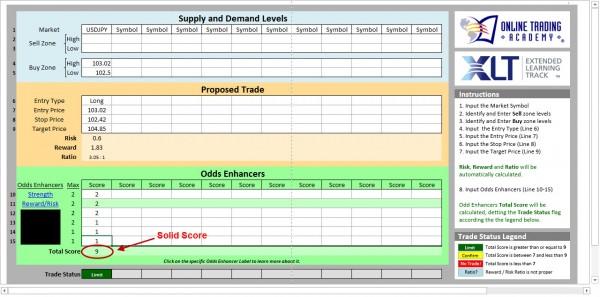

When I educate my students on the necessity of keeping a solid record and journal of their trades, their shoulders usually slouch with a lack of enthusiasm and who can blame them? One golden rule to remember though on your journey is that the only way you will ever be consistent in your trading and investing activities is by being consistent with your recordkeeping. The neat thing about the odds enhancers, is that not only do they help us find and filter out our trades but they also help us record and journal them with ease. Let me show you an example of our XLT odds enhancer and trade planner worksheet:

Above you will see an example of a trade setup that we found in a recent XLT session for FX. The details of the trade have been recorded and planned in the spreadsheet, with exact entries, stops and profit targets planned out in advance. The actual trade on a price chart is shown below:

The trade as you can see, was an opportunity on the USDJPY. It offered us a solid Demand Zone, presenting us with an objective buying setup. The reasons why we liked this trade were detailed in the use of the odd’s enhancers and the unique scoring system we use in our Core strategy methodology. As you’ll see from the screenshot of the trade planner, the details of the trade giving specific entries, targets and stop losses, were placed in advance before taking the trade. The trade planner automatically calculates the risk to reward ratio, which you can see was just over 3 to 1. This automatically gives a maximum score on the odds enhancer sheet of two. The other odds enhancer criteria that I’m sharing with you, is the “strength of move” characteristic. This also scored the maximum score of two, because as you can see we have an explosive move away from our demand zone, signaling a very large imbalance between the willing buyers and willing sellers at this price point. So far on our trade planner, we have a score of 4 from the first two odds enhancers. You will notice however, that I have shaded out the next four of the odds enhancers. Out of respect for the time and effort our growing community of Online Trading Academy students have made in their studies, I am obliged to keep this information private. While I know you can appreciate this, you can also see how the next four sets of criteria can also be scored to produce a maximum total out of 10. Simply put, the higher the score, the higher the probability of the trade. In this case, our USDJPY trade came out with a score of 9 out of 10, suggesting a solid opportunity. Let’s see how the trade worked out:

Now obviously while it is great that the trade worked out, it also could have failed. This is simply the nature of trading, yet as long as the risk to reward ratio is at least 3 to 1 or higher, we can easily take those small losses on the chin because we know the large wins will take care of the account in the long term. The most important thing to remember about this example I have shown you, is that one can clearly see how simple the journaling recording process can be if you know what you’re looking for and apply an objective level of analysis on your trades. The trade planner allows us to go back in time and look at both the winners and losers, this allows us to track the things that worked and also the things that did not.

I always encourage my students to know why they were taking a trade before actually clicking a button. By taking this level of care in your analysis and execution, you’re breeding a recipe for consistency and potential success in the future. I would encourage anybody who has not yet started to track their trades and the outcomes of their trades to put together a simple system, which allows them to emulate the example that I’ve shown you in this article. Remember my friends, consistency comes from being consistent.

Have a great trading week and be well.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

GBP/USD drops below 1.3600 after weak UK jobs report

GBP/USD is seeing a fresh selling wave, giving up the 1.3600 level in Tuesday's European trading. The United Kingdom employment data showed worsening labor market conditions, bolstering bets for a BoE interest rate cut next month. This narrative is weighing heavily on the Pound Sterling.

EUR/USD stays depressed near 1.1850 ahead of German ZEW

EUR/USD remains in the red near 1.1850 in the European session on Tuesday. A broad US Dollar bullish consolidation combined with a softer risk tone keep the pair undermined ahead of the German ZEW sentiment survey.

Gold adds to intraday losses as risk-on mood offsets dovish Fed and subdued USD demand

Gold attracts some follow-through selling for the second straight day and dives to over a one-week low, around the $4,858 area, heading into the European session on Tuesday. The commodity, however, quickly recovers to the $4,900 mark as traders opt to await more cues about the US Federal Reserve's (Fed) rate-cut path before placing fresh directional bets.

Pi Network rallies ahead of its first anniversary

Pi Network trades above $0.1800 at the time of writing on Tuesday, recording nearly 5% gains so far. On-chain data indicate that large wallet investors, commonly known as whales, have accumulated approximately 4 million PI tokens over the last 24 hours.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.