Many Futures traders struggle trade execution; they don’t consistent pulling the trigger when their setups occur. They can find many reasons why they did not put the trade in before price got there. And once price leaves their zone they get this urge of chasing the market. Once they chase the price after it has already moved away from their zone they make the biggest mistake of all and put in a very close protective stop to the current price action. Within minutes price has stopped them out of their trade and the market resumes in their intended direction without them.

Sound familiar?

If it does, don’t feel alone. Part of the problem for being so late into the trade is possibly a lack of confidence, too small of a trading account, fear of being wrong and your ego reminding you of that, or perhaps not having a defined trading plan to follow.

Perhaps you have a trading plan, but you do not follow it like you should because you never really got into the habit of doing so.

This is where perfection comes in to play for traders. So many times novice traders setup trades with more focus on the outcome rather than the actual trade execution.

Here is a quote you might want to print out and paste near your trading desk so you can see it before you take each trade.

“Perfect your execution of the trade and don’t try to perfect the results of the trade.”

Why do so many traders fail even if they have a trading plan? The fear of losing and the fear of risking more than 1% of your account balance on any one trade. Both of these fears are a result of focusing on the results more than on your trade execution.

When a trader is starting out and they make a lot of money they don’t see the risk they are taking, they only see the rewards. Unfortunately we all have losing trades. And to make larger rewards generally takes larger risk which most novice traders should not do.

Trading our Futures markets today requires discipline and plenty of working capital to trade the full size contracts. The volatility is higher today than it has been in most of our markets. To a professional trader this creates opportunity, to a novice trader it could create ruin.

If a trader takes a trade in a market and uses a bigger stop than they are comfortable with they will be using emotions to make their decisions. The fear of losing a lot of money will not let them follow their trading plan.

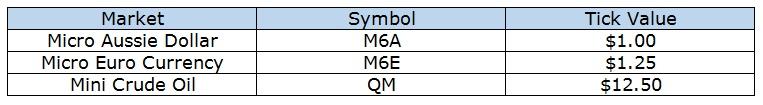

One of the ways a Futures trader can practice execution of their trading plan and still have a little risk in the game is to trade a smaller contract of the market they usually trade. Unfortunately not all mini and micro markets have good liquidity. I have written recently about considering these markets to have smaller risk:

These are just a few that are available to trade. Once a trader has a written trading plan and has practiced on the simulator for a little while, they are then ready to try live trading. But instead of trading markets that have very large stops try practicing your trade execution using these smaller Futures contracts. Obviously the risk is less, but that also means the rewards are less.

The process of starting out with smaller Futures markets to trade is not to make a lot of money. It is about following your trading plan precisely as it is written. Without the excessive risk you will find the fear of loss not an issue and you will find it easier to set and forget your trades. Trade management will now be done methodically and not emotionally.

Trading is a probabilities business. One loss or one win does not define a trader. It takes a series of trades in which the trading plan is followed consistently before a trader is able to say they are ready have the ability to trade like a professional trader.

Once you have proven that you have the discipline to follow your own rules consistently, you can then consider trading the larger Futures contracts. But this time you will be more prepared on how to handle your trades and you won’t find yourself chasing markets like you used to. Proper trade execution is the key.

“The two most important days in your life are the day you are born and the day you find out why.” Mark Twain

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD rebounds from session lows, stays below 1.1650

EUR/USD is recovers modestly from session lows but remains in the red below 1.1650 in European trading on Thursday. The pair faces headwinds from a renewed uptick in the US Dollar amid a negative shift in risk sentiment. Surging energy prices due to the Middle East war keep the bearish pressure intact on the Euro. The US Jobless Claims data are next of note.

GBP/USD stays weak near 1.3350 amid UK stagflation risks

GBP/USD sticks to losses near 1.3350 in the European session on Thursday. The Pound Sterling loses ground amid fears that the United Kingdom economy could face stagflation risks due to higher energy prices, while the US Dollar attracts fresh havem demand ahead of the US Jobless Claims data.

Gold climbs near $5,200 as Iran war fuels safe-haven demand

Gold price extends its gains for the second successive session on Thursday as traders seek safety amid the ongoing war in the Middle East. US and Israeli strikes across Iranian territory and widespread Iranian missile and drone retaliation across the Middle East, including attacks on regional targets and military sites, prolong the crisis and its impact.

Three reasons to be bearish on Bitcoin

Bitcoin is holding up well taking into account the uncertainty stemming from the Middle East. Despite this week’s rally, the long-term outlook remains bearish. Here are three reasons why I think the storm for the largest cryptocurrency isn't over yet.

Markets attempt to rally on positive news from Iran

There’s been an abrupt change in sentiment this morning, European stock markets are higher and oil and gas prices are moderating, after comments from Iran’s deputy minister about pre-conflict talks between Iran and the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.