Every morning traders wake up looking at their charts in an effort to find opportunities. They are faced with making decisions on whether to go long or short the particular markets they trade. This can be challenging as the markets are in a constant state of motion. One day up, the next down, and on some days the market can change direction intraday. So, with markets constantly changing it’s important that a trader gain the right perspective to start every day.

One way to do that is to look at the big picture. This means looking at daily, weekly or monthly charts. The objective here is to identify the environment a trader is going to encounter. This will enable them to be better prepared to tackle the day’s trading challenges. If you think about it, the markets can only be in two types of environments: trending or in a range (sideways market).

A common misconception many traders have is that they think the markets tend to trend more often than they’re in a range. Regression studies have actually shown that this not the case. Markets generally have larger spells were they are range bound. In looking at larger timeframe trends (weekly and monthly) in the stock index futures or currencies, what you will find is that these markets spend weeks, sometimes months going sideways before they resume the next leg of the trend. Look at the charts and you will see the sideways market for yourself. If this is indeed the case, then traders need to know where the lowest risk trades are found in this environment.

Recently the Euro Currency futures contract has been in a large range for about a month. We can see this on the daily chart below.

In this type of environment the lowest risk, highest probability trades would be at the top and bottom of the range. In other words, look to buy at the bottom of the range and short as we near the top of the range.

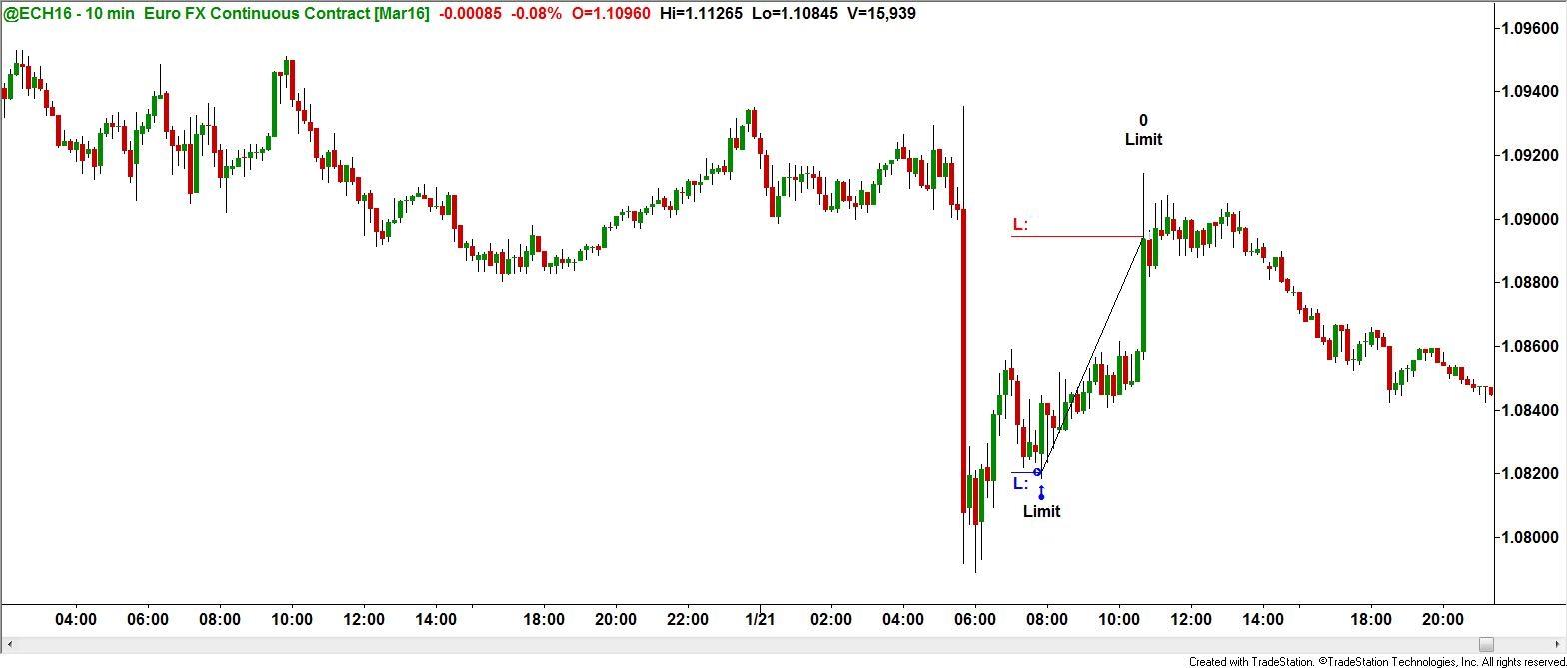

Implementing this strategy, I recently took a trade look in the Euro Futures near the lower part of the range. As we can see from the chart, I took the entry at the origin of a strong move in price (demand) and achieved the profit target right below a supply zone identified by the strong move lower.

Also of note is that the demand zone was located near the lower extremity of the range.

In the next example, we see the Nasdaq mini futures also in a daily range.

Similarly, an opportunity at the lower part of the sideways market presented itself and I took that trade as well. As we can see from the lower chart, the demand zone (highlighted by the two horizontal lines) was the entry and the target was achieved at the opposing level of supply.

As we can see, having the right perspective can assist us in finding low risk trading opportunities. This requires learning a rules based strategy that is consistent in its approach. In this missive, we focused on range-bound or sideways markets. In the next one, we’ll tackle trending markets and how to trade those. Stay tuned…

Until next time, I hope everyone has a great week.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

AUD/USD holds steady below 0.7100 after Australian trade data

AUD/USD moves little following the release of Australian Trade Balance data and consolidates below 0.7100 on Thursday. A goodish recovery in the risk sentiment acts as a tailwind for the Aussie amid bets for another RBA rate hike in May, bolstered by the upbeat GDP print on Wednesday. However, rising geopolitical tensions help limit the safe-haven US Dollar's overnight corrective pullback and cap the currency pair.

USD/JPY retreats further from YTD peak amid intervention fears, softer USD

The USD/JPY drifts lower for the second consecutive day, moving further away from its highest level since January 23, around the 158.00 area, set earlier this week. Fears of intervention, along with expectations that the BoJ will stick to its policy normalization path, support the Japanese Yen and weigh on spot prices amid a softer US Dollar. However, geopolitical tensions could benefit the USD's reserve currency status amid reduced bets for more aggressive easing by the Fed and cap the currency pair.

Gold benefits from a retreating USD; reduced Fed rate cut bets cap gains

Gold attracts some buyers for the second consecutive day on Thursday amid a modest US Dollar pullback from an over three-month high, though it remains below the $5,200 mark. Wednesday's upbeat US macro data further tempered hopes for three rate cuts by the Fed in 2026. Furthermore, escalating Middle East tensions might continue to benefit the USD's status as the global reserve currency and contribute to capping the bullion.

Morgan Stanley files amended S-1 for spot Bitcoin ETF

Morgan Stanley submitted an amended S-1 filing to the US Securities and Exchange Commission on Wednesday, providing additional details on its proposed Bitcoin exchange-traded fund.

First Venezuela, now Iran: The US-China energy war escalates Premium

At first glance, the latest escalation involving the United States with both Iran and Venezuela looks like another chapter in a long-running geopolitical story. But viewed through a broader strategic lens, something else may be unfolding: Energy.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.