I’m sure I will get a lot of doubters reading this article. Seems the majority of traders you talk to are very bearish on the Commodity and Stock markets at the moment. And that is a good thing if you are bullish. I love watching shorts scramble to cover their positions because they thought the markets were going to zero.

Unfortunately, too many traders are like lemmings and follow some guru or herd right off the edge of the bridge. Trading is a thinking game and using some common sense is very beneficial.

No market goes straight up or straight down, but they move in cycles of different durations causing price to move in large impulse waves (direction of the trend) and short choppy corrective waves (countertrend moves). I’m a trend follower type of trader, but I also follow Seasonal patterns and keep up with macro fundamental events pertaining to markets I’m trading.

I was talking with some traders the other day and the price of oil came up. They could not let go of the fact that Iran is going to start pumping oil and flooding an already crowded market. I always appreciate another trader’s opinion because that is what makes a market: differences of opinion. My response was, “News like that is already in the market and has been discounted.” In the oil market the news of too much oil is as saturated as the tankers trying to hold all of this oil, everybody knows it. The money has been made on that side of the trade. Markets are discounting and forward looking mechanisms.

The markets will not wait until there are obvious physical signs that the inventories are low in oil before it rallies. Keep in mind, I’m not looking for $100 oil anytime soon, but a bounce in price is possible in the future and worth trading if it does, in my opinion.

Note: This is not a trade recommendation. I write this for purposes of getting a trader to think out of the box and use this for educational purposes only. I currently have long positions in the Energy market.

Moore Research (MRCI) is a research company on Seasonal patterns in the Futures markets that I use. If you are interested in a trial subscription they are still offering OTA students a 10% discount after the two week free trial. Each month, they offer approximately 15 outright and Spread trading research ideas.

This month has some interesting patterns. MRCI has found that in the month of February Gasoline, Nasdaq, Crude Oil, Canadian Dollar and the Australian Dollar have all rallied between 80% and 93% of the time over the past 15 years.

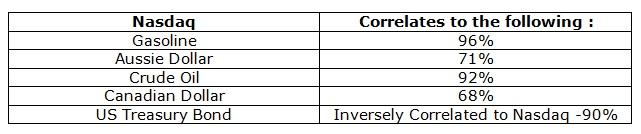

Looking at this and thinking in terms of correlations got me thinking about how closely correlated these markets have been trading in the past. The MRCI website has a free market correlation page. Looking at this correlation page I found that over the last 60 trading days these markets have had the following correlations to one another:

By combining the strong Seasonal tendency that MRCI has identified and the strong market correlations between all of these Seasonal Buy markets, I can see a reason for these markets to turn up in February (excluding the Treasury Bonds).

The Treasury Bonds have a Seasonal Sell this month as well, and looking at how the inverse correlation is at -90% this suggests the Bonds should be going in different directions than the Nasdaq market. Considering how far the Bond market has rallied this trend could be getting weak.

Looking back to the last Quarter of 2015, there was an auto sales report that showed the largest auto sales for a 4th quarter. Typically Energy prices rally into the spring driving season as refiners refine gasoline for the busy summer driving season. My question is, “Do you think that the largest auto sales report will have cars sitting in driveways or out on our nation’s highways this summer with low gasoline prices?”

“Believe you can and you’re halfway there.” Theodore Roosevelt

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

AUD/USD hangs near two-week low vs. firmer USD ahead of key US macro releases

The AUD/USD pair meets with a fresh supply during the Asian session on Friday and remains well within striking distance of a nearly two-week low, touched the previous day. Spot prices currently trade around the 0.7035 area as traders look to the key US macro releases before placing fresh directional bets.

USD/JPY remains strong after Japan’s National CPI cools down

The Japanese Yen shows weakness against the US Dollar during the Asian trading session on Friday. The USD/JPY pair holds onto gains near its weekly high of 155.20 posted on Thursday. The pair is under pressure as the US Dollar continues to outperform due to signals from Federal Open Market Committee Minutes of the January policy meeting that officials see no rush for interest rate cuts, with inflation remaining persistently above the Federal Reserve’s 2% target.

Gold eyes next breakout on US GDP, PCE inflation data

Gold sticks to recent gains around the $5,000-mark early Friday, biding time before the high-impact US macro events. The focus is now on the US fourth-quarter Gross Domestic Product, core Personal Consumption Expenditures Price Index and the Supreme Court’s ruling on President Donald Trump’s tariffs.

CME Group to make crypto products available for 24/7 trading in May

The Chicago Mercantile Exchange Group has announced plans to extend trading hours for its regulated cryptocurrency futures and options to 24/7, starting May 29, pending regulatory approval.

Hawkish Fed minutes and a market finding its footing

It was green across the board for US Stock market indexes at the close on Wednesday, with most S&P 500 names ending higher, adding 38 points (0.6%) to 6,881 overall. At the GICS sector level, energy led gains, followed by technology and consumer discretionary, while utilities and real estate posted the largest losses.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.