A term that trips up a lot of Futures traders Pro and Novice alike is Ticks and Monetary Tick Values. A tick is the minimum amount a price can change for that market. The Stock market trades in minimum tick increments of .01 (one cent) per share unless a market maker trades between the bid and ask, then the minimum tick could be smaller. However, in the Futures markets there are no market makers (can I hear a hooray?), so the minimum tick is just that, “always” the minimum tick as long as the order is traded on the electronic platform.

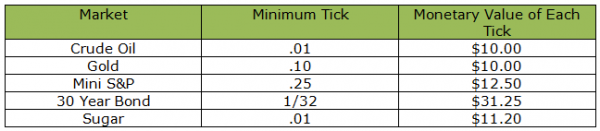

The difference is that each Futures contract has a different minimum tick increment. And since each market has a different tick increment then the monetary value of each of these ticks will be different as well. Table 1 illustrates some market examples with minimum ticks and tick values.

The best way to find a minimum tick value for a Futures contract is to go to the contract specifications page of the Exchange website where the product trades at. For example, the 30 Year Bond (US) trades on the CMEGroup Exchange. Go to www.cmegroup.com and locate the product on the home page then find the contracts specification tab. Once there the minimum tick is identified for you. If a trader wants contract specifications for Sugar they should visit www.theice.com. All traders should be familiar with the Exchange websites that the products they choose to trade are actually traded on.

There is plenty of other useful information on the contract specification page. One of them that we are going to address more in this article is contract size or point value.

Have you ever wondered where the monetary value for each tick comes from in a Futures contract?

From Table 1 you can see the differences in monetary tick values yet sometimes the minimum tick can be the same as another market with a different monetary tick value, such as Crude Oil and Sugar which have the same minimum tick increment, but completely different monetary tick values.

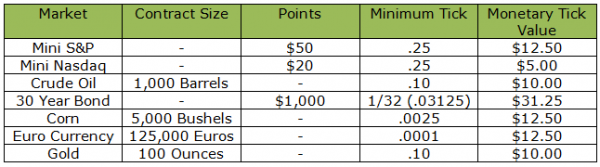

Futures trade in contract sizes or point values. Table 2 illustrates some examples.

When you read a price quote (last price) that is on your chart, order platform, in a newspaper etc. you are reading a unit price for that product. Crude Oil is priced in dollars and cents per barrel, Grains are priced in cents per bushel, Sugar is priced in cents per pound etc. A Futures contract is made up of multiples of these units. If the Futures contract does not trade in units then the Exchange assigns a point value to that contract. The Stock Index and Interest Rate Futures use Point values instead of contract size.

Knowing the contract size or points and minimum tick value can help you identify what the monetary tick value is for the product you are trading. Table 3 will illustrate some of the markets you may be trading already.

To find the monetary tick value for any Futures contract you can use the following formulas:

Stock Indexes and Interest Rates

Points X Minimum Tick = Monetary Tick Value

All Other Markets

Contract Size X Minimum Tick = Monetary Tick Value

It is of the utmost importance that a trader knows and understands the product that he is trading.

“Never be bullied into silence. Never allow yourself to be made a victim. Accept no one’s definition of your life: define yourself.” Harvey Fierstein

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD holds losses below 1.1650 on renewed USD uptick

EUR/USD is off the low but remains in the red below 1.1650 in European trading on Thursday. The pair faces headwinds from a renewed uptick in the US Dollar amid a negative shift in risk sentiment. Surging energy prices due to the Middle East war keep the bearish pressure intact on the Euro. The US Jobless Claims data are next of note.

GBP/USD stays weak near 1.3350 amid UK stagflation risks

GBP/USD sticks to losses near 1.3350 in the European session on Thursday. The Pound Sterling loses ground amid fears that the United Kingdom economy could face stagflation risks due to higher energy prices, while the US Dollar attracts fresh havem demand ahead of the US Jobless Claims data.

Gold climbs near $5,200 as Iran war fuels safe-haven demand

Gold price extends its gains for the second successive session on Thursday as traders seek safety amid the ongoing war in the Middle East. US and Israeli strikes across Iranian territory and widespread Iranian missile and drone retaliation across the Middle East, including attacks on regional targets and military sites, prolong the crisis and its impact.

Three reasons to be bearish on Bitcoin

Bitcoin is holding up well taking into account the uncertainty stemming from the Middle East. Despite this week’s rally, the long-term outlook remains bearish. Here are three reasons why I think the storm for the largest cryptocurrency isn't over yet.

FX alert: When Energy still writes the macro script the Dollar holds the pen

The market is quietly sliding back into the trade nobody wanted to own, but everyone now has to respect again. The no quick off-ramp trade. Yesterday’s bounce in risk assets already looks less like a turning point and more like a classic relief rally in a market that briefly inhaled before realizing the room was still on fire.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.