Wow, what a wild ride the markets have been going through. The big question on all traders’ and investors’ minds is whether or not this is the beginning of a bear market. There is no doubt that the current bull market is extremely fragile. An environment of lackluster earnings and sharp reactions to news while waiting for the Fed to cut or not cut rates has been setting everyone on edge.

Some time ago I wrote about two moving averages that can be applied to the weekly chart of the S&P 500 to indicate a potential change in trend and confirm the beginning of bull and bear markets. Let’s review the use of those indicators and apply them to the current market condition.

The 40 week simple moving average, (40 SMA) is the same as the popular 200 day moving average that is talked about in books and television. When price closes below that average, it is a sign that investors are getting nervous. It is not a signal for a bear market but is a warning. When prices close back above the 40 SMA, this is not the signal for the bull market beginning but does indicate that buyers are entering the markets again.

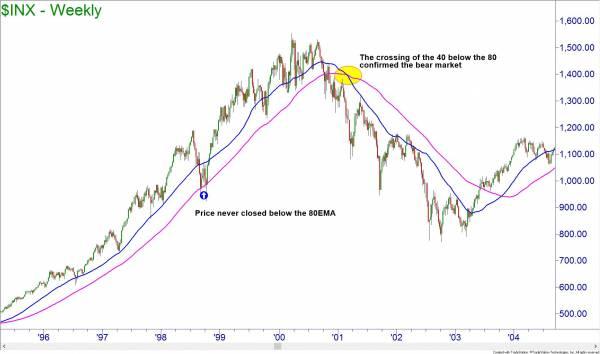

The 80 week simple moving average, (80 SMA) is more critical. The S&P 500 index does not usually close below that average unless there is a bear market looming. Looking back at the stock market’s tech bubble from 1996 to 2000, you can see that prices did not close below that average until the bear market was underway. The 40 SMA moving below the 80 SMA confirmed the bear market. During the bear market, the index used the 40 SMA as a resistance level. In mid-2003 the bulls returned and the index closed above the 80 SMA. The bull market confirmation arrived with the 40 SMA crossing above the 80 SMA later that year.

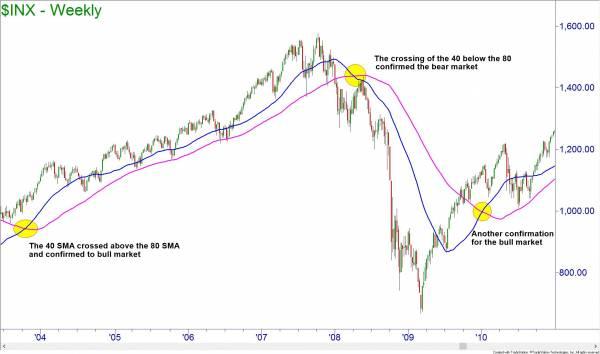

The next bull and bear market followed the same pattern. During the housing bubble of 2004 to 2008, the index never closed below the 80 SMA. There were closes below the 40 SMA but they were near the end of small corrections. In January 2008, the index did close below the 80 SMA and the bull-run came to an end.

Just as it did in 2003, the bear market ended with the S&P 500 index closing above the 80 SMA in late 2009 and the 40 SMA crossing above the 80 SMA shortly after.

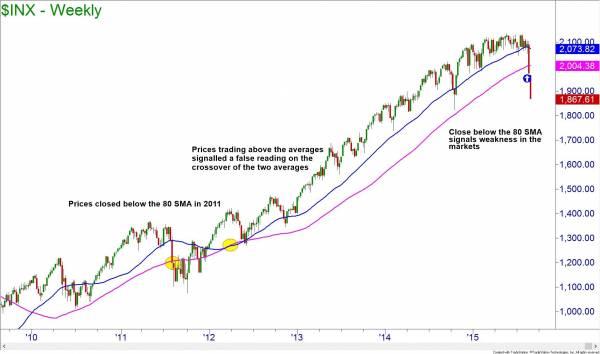

These indications from the S&P 500 index have been remarkably accurate. There was one false signal in 2011. However, the fact that the index was trading above the moving averages when they crossed it warned of a false signal.

The week ending August 21st saw the S&P 500 index closing below the 80 SMA for the first time since early 2012. This was not preceded by a close below the 40 SMA as a warning since it was such a sharp drop. The next signal to watch for will be the 40 SMA crossing below the 80 SMA. Since the price drop was so drastic, this may not happen for some time. When and if this happens, watch to see if the index is trading above the moving averages. If it is, it is likely a false signal and we are only experiencing a correction. But if the index is below the averages when they cross, the bear market is in place.

It is important to remember that this is a lagging signal and is not as reliable as being able to read price. You need to trade as the institutions do. This is the basis of Online Trading Academy’s core strategy. Come learn how to not just survive, but how to thrive in tumultuous markets by visiting your local Online Trading Academy center today.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

Gold trims losses, back below $5,400

Gold now surrenders part of the earlier advance past the $5,400 mark per troy ounce at the beginning of the week. Indeed, the precious metal’s strong uptick remains fuelled by increasing geopolitical tensions in the Middle East amid the intense demand for safer assets.

Oil eases from tops, back to around $71.00/bbl

Crude oil prices are now giving away some gains after the initial 12% advance, with WTI hovering just above the $71.00 mark per barrel, its strongest levels since June. The jump in prices comes as markets continue to react to heightened geopolitical risk after US and Israeli military strikes on Iran and the effective shutdown of shipping through the Strait of Hormuz.

EUR/USD keeps the offered stance just above 1.1700

EUR/USD is coming under heavy selling pressure in what has been a rather grim start to the new trading week, with the pair now trading close to the 1.1700 support area as the US Dollar stages a solid rebound. The prevailing flight to safety mood continues to favour the Greenback, as investors react to the escalating conflict in the Middle East and trim risk exposure across the board.

Bitcoin on brink of breakdown amid US-Iran war

Bitcoin (BTC) remains under pressure near the key support level of $65,700. Trading at $66,400 at the time of writing on Monday, a breakdown below this critical level would suggest a deeper correction ahead.

The Fed is finally talking about AI – Here's why it matters for the US Dollar Premium

AI is moving from earnings calls into the heart of monetary policy discussions, forcing Federal Reserve officials to confront a new question: How to act if AI reshapes inflation, employment and interest rates at the same time?

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.