A few weeks ago I wrote several articles regarding the Renko charting method. This type of charting can be used to see the larger time frame’s trend on securities and also the broad markets. Renko charting can also be used on smaller time frames in order to enter and exit trades as well.

The US Equity markets have been very choppy since the beginning of the year. To analyze the trend on daily or weekly charts for trading purposes let’s look at them using Renko charts. We know the dominant trend will help traders and investors take positions on the right side of those trends. Trading on the right side of the trend and knowing where the trend is likely to reverse is crucial to success in the markets.

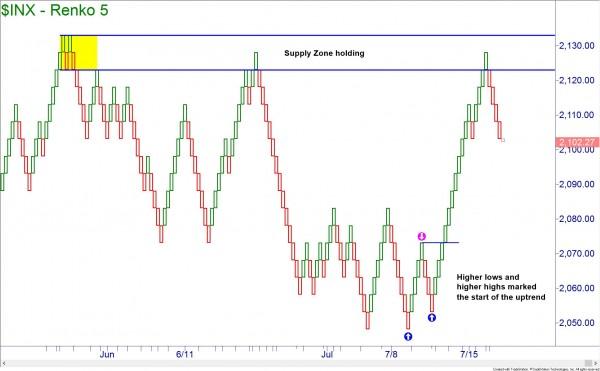

The S&P 500 appears to be holding supply that has been tested once already. You will notice that the uptrend began with higher lows and higher highs. We are not in a downtrend on this index and should not short until a lower low is established after a lower high.

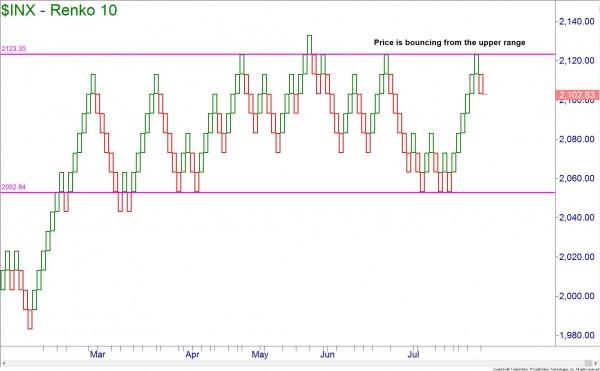

Viewing a larger brick size on the S&P 500 index, we can clearly see the tight range that price has been stuck in for many months. It is no surprise that we have found weakness as price hit the upper portion of the range and is just reverting to the mean as there was no reason to continue making new highs.

At the time I was writing this article, the Nasdaq 100 was flirting with a trend change. There was a lower high already established but the lower low to confirm a downtrend was still pending. There is also a demand zone near 4540 that could cause a small bounce. A trader would wait to short until the bounce pushes prices into a supply zone.

While the Dow has not made lower highs and lows, it is much weaker than the other indexes. The talking heads on TV will blame it on weak earnings, but the supply zone was touched and held before the news was released. This proves that you do not need to watch the news to trade properly.

Just as I mentioned for the Nasdaq, it may be best to wait for lower highs and lower lows in the Dow before looking for longer term shorting positions. Currently, we would only look for intraday shorts as smaller trends have turned bearish.

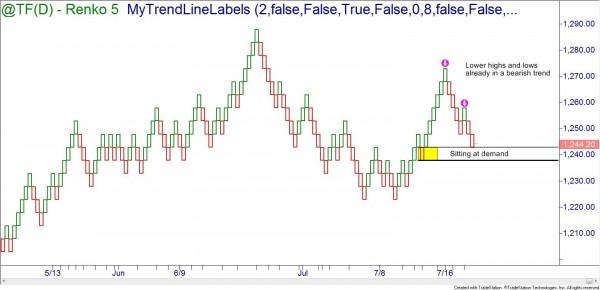

The market that usually leads major trend is the small cap Russell 2000. This index has already been showing a lot of weakness and a downtrend.

As I write this article, the Russell 2000 is sitting at a demand zone. I would not be surprised to see a small bounce, but with the bearish trend established this should serve as an opportunity to short the bounces into a supply zone.

In conclusion, the markets are showing weakness. They have not confirmed a trend reversal to end the bull-run but have at least shown there is room for movement downward for a couple of weeks. A trader could look at shorting these markets on an intraday basis but would only want to take swing trade shorts if high quality opportunities present themselves.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD remains heavy near 1.1600 after hot EU inflation data

EUR/USD remains heavily offered near 1.1600, six-week lows, in the European session on Tuesday. The pair fails to find any inspiration from a surprise pick up in Eurozone inflation for February, as the US Dollar continues to attract safe haven flows amid escalating geopolitical tensions in the Middle East.

GBP/USD attacks 1.3300, refreshing three-month lows

GBP/USD is deep in the red near 1.3300, accelerating its downside to renew three-month lows in European trading on Tuesday. The ongoing escalation in the Iran war, combined with rising Oil prices, weighs negatively on the higher-yielding Pound Sterling as the US Dollar capitalizes on increased haven demand.

Gold falls below $5,300 as stronger USD counter Middle East woes

Gold attracts some intraday selling and falls below $5,300 on Tuesday. The US Dollar climbs to a fresh high since January 20 and turns out to be a key factor exerting downward pressure on the commodity. However, concerns about a broader regional conflict in the Middle East continue to weigh on investors' sentiment and underpin demand for the traditional safe-haven bullion.

Stellar risks deeper losses as derivatives metrics turn negative

Stellar is trading red below $0.16 at the time of writing on Tuesday, after a slight recovery the previous day. Weakening derivatives data caps the recovery, while an unfavorable technical outlook projects a deeper correction for the XLM token in the upcoming days.

Middle East conflict ramps up a gear as energy price spike rips through markets

It’s another risk off day as geopolitical headwinds continue to batter financial markets. Although markets calmed during the US session and US stocks managed to post gains on Monday, this has not fed through to the European session, and stocks and bonds are sharply lower for a second day.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.