In a recent Market Timing Class in Washington DC, I had a prospective student talk about how they were so excited to buy the Alibaba (BABA) Initial Public Offering (IPO), when it opened. This investor was blinded by the same hype that most retail investors and traders fall into. If you believed the television and internet news surrounding the stock’s release, a person believed that they would have been able to buy the stock at $68 and could see the stock run to $100 on the first day.

This would be an amazing profit for a trader if you actually had the chance to do this. Unfortunately for most novice traders, they do not realize that this is nearly impossible to do. The NYSE did not start trading on BABA until just before noon. The reason for this delay is that the specialists needed to sort out the large imbalance between the stacks of buy and sell orders before the opening of the trading of that stock.

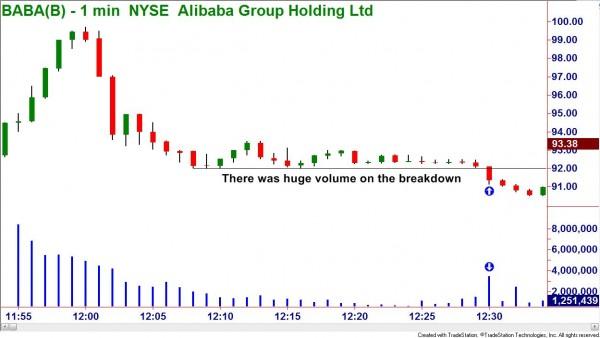

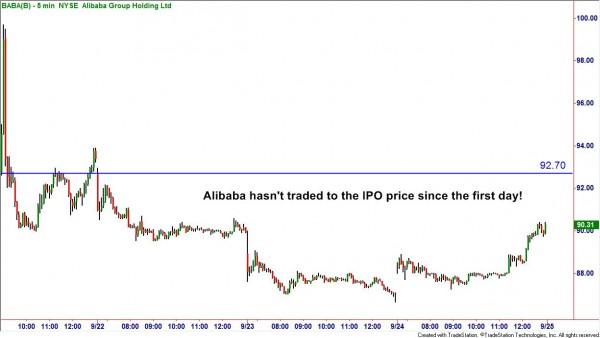

The very first trade was at $92.70, well above the $68 that most investors hoped to buy shares for. Within seven minutes BABA hit its high for the day at $99.70. Two minutes later the price dropped back down near the opening price.

Most retail investors were able to buy but would not have been able to sell until they received confirmation of their buy trade. With the volume of shares traded, it would have been nearly impossible to have made a quick profit. Looking at the price action and volume it appears that many stops were triggered as prices broke down.

Holding onto this “mega IPO” would have been costly too. It traded below and back to its opening price on the first day of trading but has not gotten close to it since. There are a lot of frustrated investors out there and the media has already moved on to other topics.

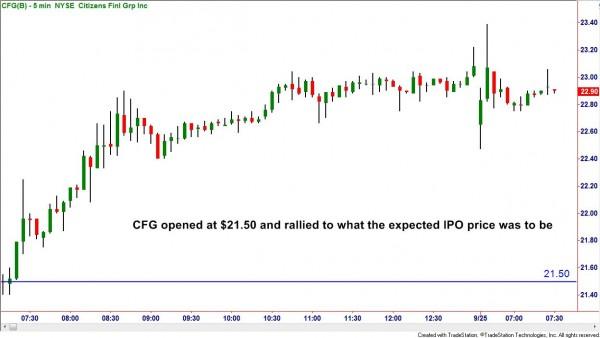

One of the biggest banking IPO’s ever to hit the US markets also debuted recently. Citizen’s Financial Group (GFG), had been expected to start trading between $23 and $25 a share when it became public. Instead, due to lack of interest, it opened at $21.50. But a trader that took this less hyped IPO actually profited as prices did rise to $23 on the first day.

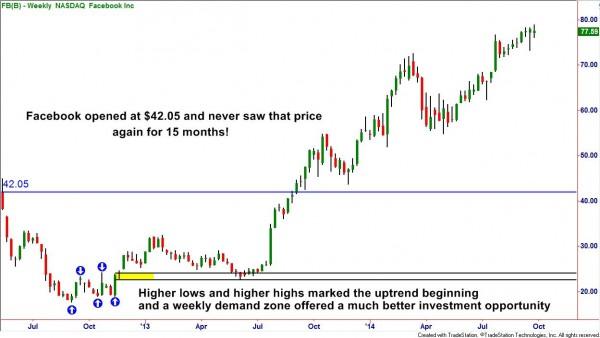

In a recent Extended Learning Track class, a student commented that BABA may be acting like Facebook (FB) in that it dropped to half its opening price before rising to new highs. It may indeed do the same pattern, only time will tell.

The problem is that you do not know if your IPO is going to be a BABA, FB, or CFG. The Online Trading Academy Core Strategy of trend with supply and demand will work with IPO’s. But since the new stock does not have any history, we do not know how it will react in different market environments and involving your money in them is gambling.

Stocks are a lot like people in that they develop personalities. There are many institutions and market makers trading the same stocks daily. When you identify the personality of the stock, you are more likely to successfully predict its behavior in both bullish and bearish markets.

IPO’s have not developed their personalities yet. Even though supply and demand will work, you will have a higher probability for success on longer time frame trading and investing with an “older” stock. As a general rule, I avoid the newer stocks for any trading other than intraday and will not usually look to trade any stock with less than six months of trading history.

In our courses at Online Trading Academy, we teach our students how to screen for high probability opportunities and filter out stocks that may have too high of a risk to your capital. Learn how to find these and protect your money by joining us at your local center today.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD stays weak near 1.1850 after dismal German ZEW data

EUR/USD remains in the red near 1.1850 in the European session on Tuesday. A broad US Dollar bullish consolidation combined with a softer risk tone keep the pair undermined alongside downbeat German ZEW sentiment readings for February.

GBP/USD holds losees near 1.3600 after weak UK jobs report

GBP/USD is holding moderate losses near the 1.3600 level in Tuesday's European trading. The United Kingdom employment data suggested worsening labor market conditions, bolstering bets for a BoE interest rate cut next month. This narrative keeps the Pound Sterling under bearish pressure.

Gold pares intraday losses; keeps the red above $4,900 amid receding safe-haven demand

Gold (XAU/USD) attracts some follow-through selling for the second straight day and dives to over a one-week low, around the $4,858 area, heading into the European session on Tuesday.

Canada CPI expected to show sticky inflation in January, still above BoC’s target

Economists see the headline CPI rising by 2.4% in a year to January, still above the BoC’s target and matching December’s increase. On a monthly basis, prices are expected to rise by 0.1%.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.