Price Action Trading

There are a wide range of simple yet effective strategies that we suggest beginner traders try out upon first entering the waters of Forex trading. Among these strategies are various methods and styles incorporating everything from classic indicator trading through to looking at market information and underlying flow, one element that we constantly refer back to is price action.

Simplicity will always serve you best in trading and it really doesn’t get much simpler than price action. The term is banded around a lot by traders and market spectators and often people will be referring to slightly different things, however, at its core, price action trading is simply executing upon the belief that everything you need to know about the market is included right there on there chart in the price action we can see with each candlestick that forms.

Now whilst we don’t necessarily agree completely with this notion, as it’s the underlying order flow that actually drives price action, price can to a certain extent give a decent glimpse into that very underlying order flow and afford us trade-able opportunities. Even within price action trading itself there are a number of different elements to focus upon but for this article we are going to concentrate on one of my favourites; the inside bar.

The Inside Bar

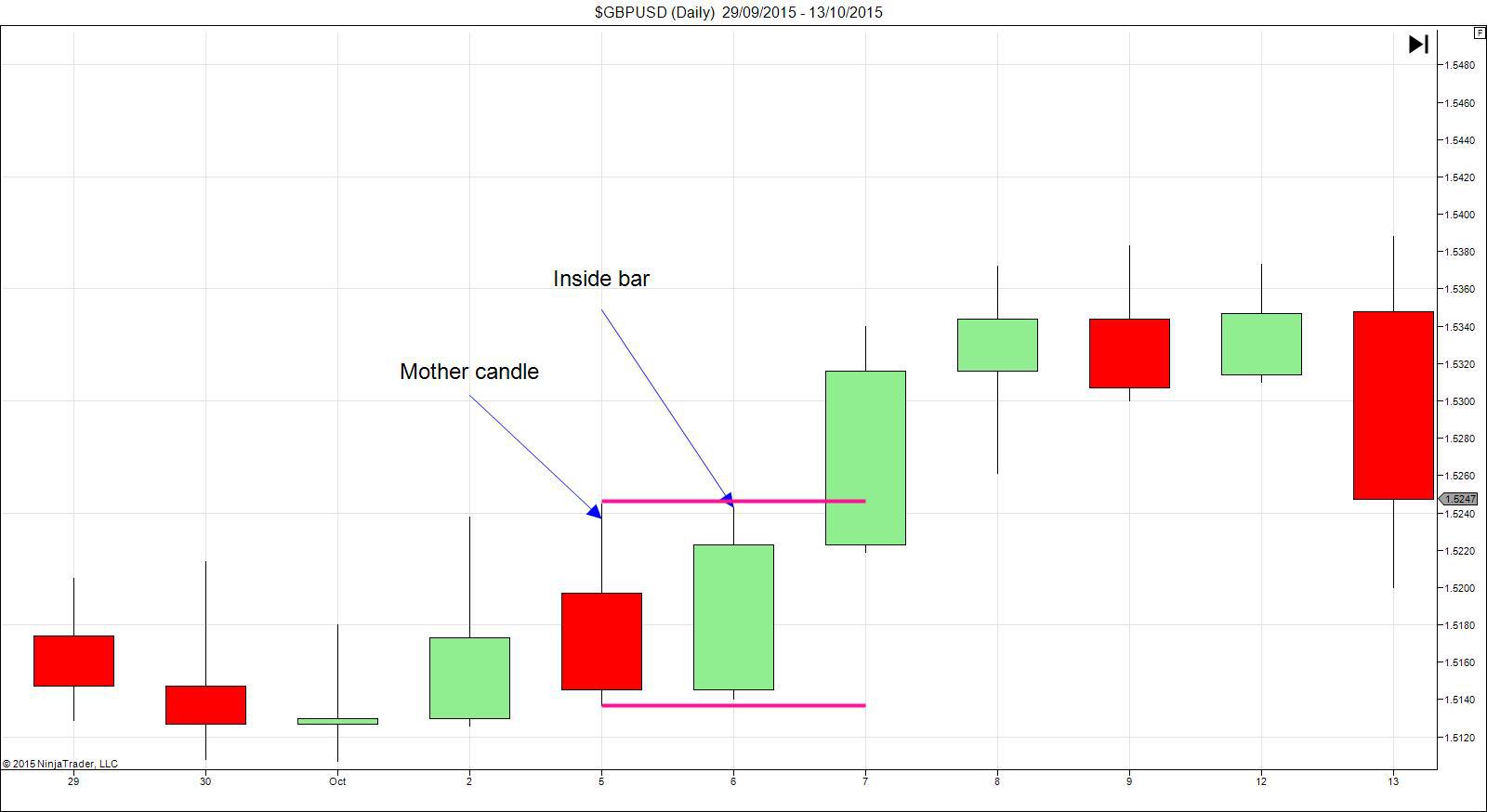

The inside bar or inside candle is an incredibly simple little strategy to work on and can give really great results. Essentially all we are looking for is a candle to form (inside bar) within the high and low of the previous candle (Mother candle). So really the pattern is the opposite of the engulfing candle where we’re looking for a candle to form which completely encapsulates the preceding candle. The inside bar formation looks like this

Notice how the bullish candle forms within the upper and lower limits of the preceding candle? this is our inside bar. This formation often occurs before price sustains a breakout and usually the more inside bars that form, the better the breakout as a consequence.

In the example above notice how price forms several inside bars within the range of the Mother candle before price finally breaks down? This is a really great setup to keep an eye out for and can yield really good results. So why does the Inside bar breakout play occur? Well the reason why this specific price action dynamic exists is the same reason behind all of the various price action formations we see: Order Flow.

As price moves into an area of equilibrium and starts to consolidate within a range we tend to get orders building on either side of the range. Eventually one side wins out and we see price breakout, exactly as shown in the examples above. One situation to be wary of however is the fake-out.

Beware The Fake-Out

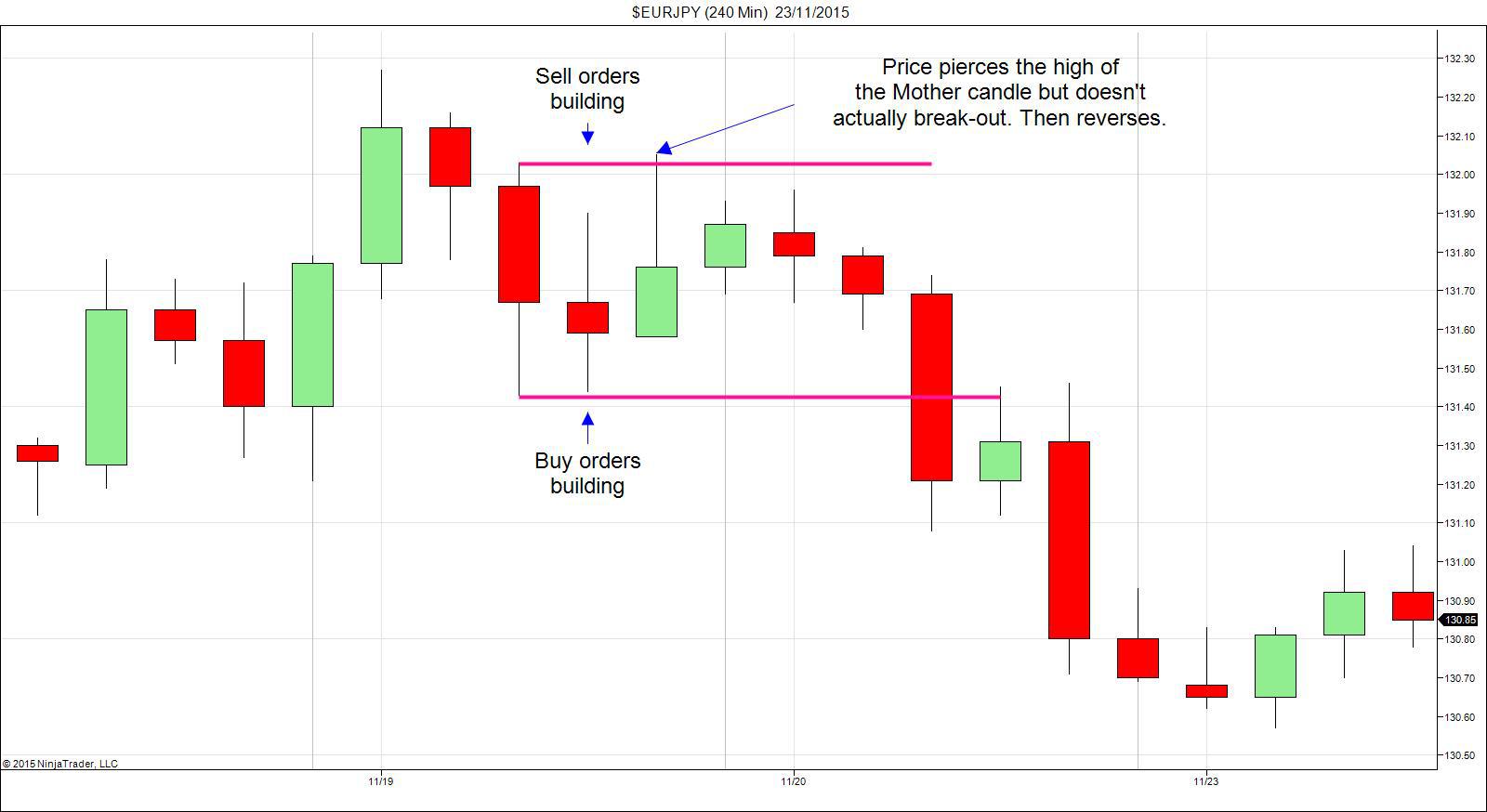

The fake-out is a situation whereby prices runs through one side of the range set by the Mother candle but doesn’t actually sustain a full breakout and reverses to trade back within the range of the Mother candle. Why does this happen? Price sustains enough momentum to push out and test the orders on one side of the range but not enough to break through them, causing the reversal.

In the example above we have a Mother candle setting our range, we then get a subsequent inside bar confirming our set-up. Price then trades up and tests the sell orders sitting above the range but is unable to break them and indeed reverses back down inside the range. We then get a few more inside candles that show just how pent-up orders are outside the range, before finally price breaks down through the range low erasing buy orders beneath the range.

So for the sake of added confirmation and being more conservative with our trading, we want to wait for a candle close outside of the Mother candle range to trigger a trade, that way we can avoid the dreaded fake-out. Of course, this isn’t to say that waiting for a close will win 100% of the time, because we know that nothing does, but it does greatly reduce the chances of us getting whipsawed!

Trading The Inside Bar Formation

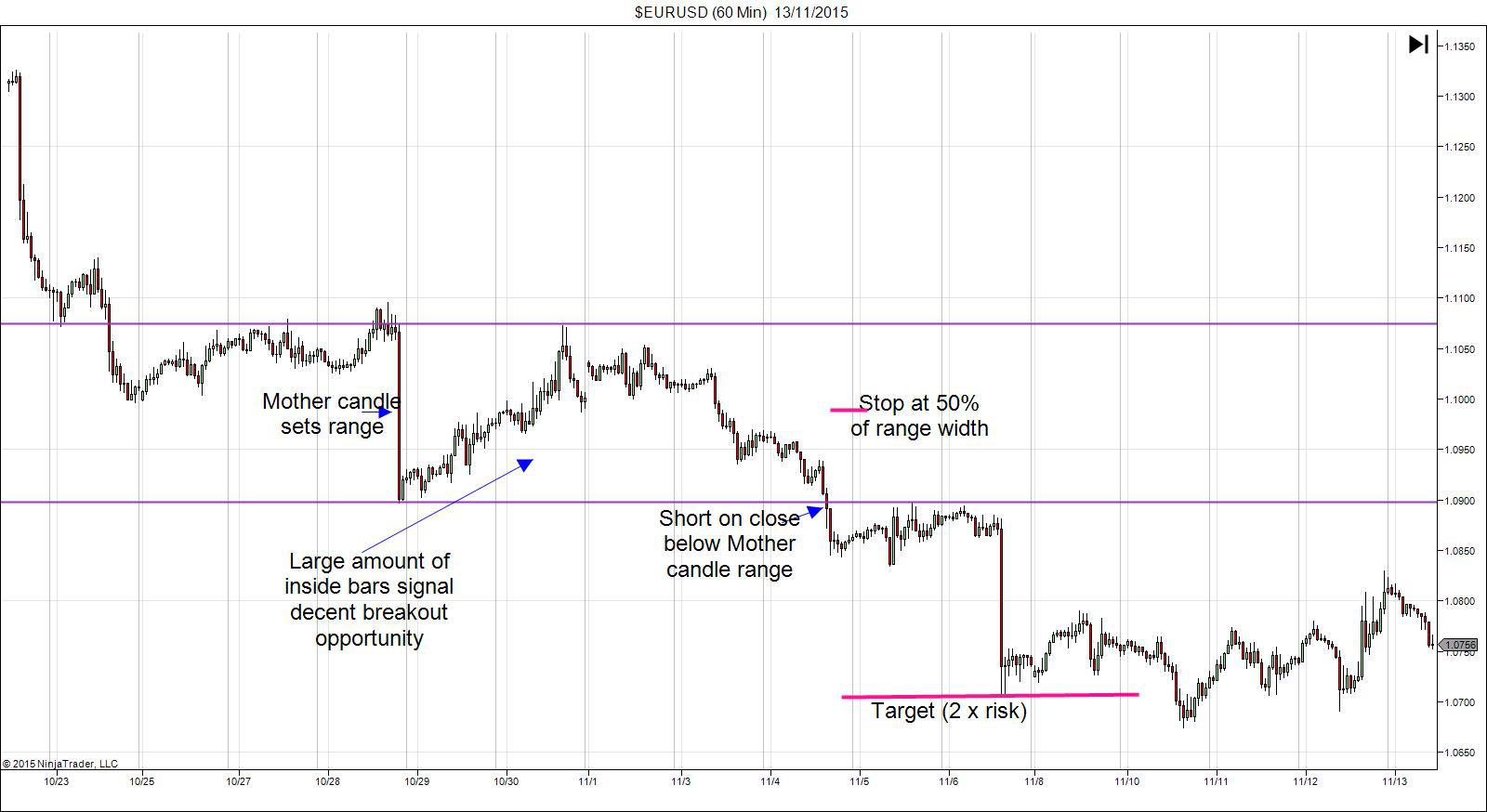

Trading the inside bar formation is essentially just a breakout play and as such as adopt pretty much the same basic strategy that we outline for breakout trading. We look to enter as price breaks the range with a stop 50% the width of the range, targeting at least twice our risk.

In the example above we have a fantastic example of a recent inside bar setup in EURUSD. As you can see we got a large bearish Mother candle which set the range, which was respected for five days resulting in a large number of inside bars. We then eventually saw price close outside of the range, closing below the lower limit allowing us a short entry. With our stop at 50% of the range width and our target at 2 x risk this would have been a textbook inside bar play.

In part two we will discuss some key points to consider when trading inside bars as well as take a look at some other ways in which you can trade this formation…

All comments, charts and analysis on this website are purely provided to demonstrate our own personal thoughts and views of the market and should in no way be treated as recommendations or advice. Please do not trade based solely on any information provided within this site, always do your own analysis.

Editors’ Picks

EUR/USD struggles near 1.1850, with all eyes on US CPI data

EUR/USD holds losses while keeping its range near 1.1850 in European trading on Friday. A broadly cautious market environment paired with a steady US Dollar undermines the pair ahead of the critical US CPI data. Meanwhile, the Eurozone Q4 GDP second estimate has little to no impact on the Euro.

GBP/USD recovers above 1.3600, awaits US CPI for fresh impetus

GBP/USD recovers some ground above 1.3600 in the European session on Friday, though it lacks bullish conviction. The US Dollar remains supported amid a softer risk tone and ahead of the US consumer inflation figures due later in the NA session on Friday.

Gold remains below $5,000 as US inflation report looms

Gold retreats from the vicinity of the $5,000 psychological mark, though sticks to its modest intraday gains in the European session. Traders now look forward to the release of the US consumer inflation figures for more cues about the Fed policy path. The outlook will play a key role in influencing the near-term US Dollar price dynamics and provide some meaningful impetus to the non-yielding bullion.

US CPI data set to show modest inflation cooling as markets price in a more hawkish Fed

The US Bureau of Labor Statistics will publish January’s Consumer Price Index data on Friday, delayed by the brief and partial United States government shutdown. The report is expected to show that inflationary pressures eased modestly but also remained above the Federal Reserve’s 2% target.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.