Now that you are comfortable determining the ‘moneyness’ of buy call options, I will introduce you to the power of buy put options and their “moneyness”.

AUD/USD has been in a steady downtrend over the past six months. This Thursday, the market has several volatile events for the Australian dollar and the U.S. dollar, such as Australian Employment Change, Australian Unemployment Rate, and U.S. Retail Sales. Those events are likely to impact the AUD/USD. Buying a Put option would allow you profit from a continuation of the pairs downtrend. Read “The Put Option” lesson for an introduction on buying Put options.

Next, you need to decide on the strike of the put option. Depending on the strike level, an option can be in one of three states:

• An option is at-the-money (ATM) when the strike rate equals the underlying market rate. For example, if AUD/USD is trading at 0.7700 and you buy a Put option with strike 0.7700, the option is ATM.

• An option is in-the-money (ITM) when the strike rate is better than the underlying market rate. For example, if AUD/USD is trading at 0.7700 and you buy a Put with strike 0.7800, the option would be considered ITM because 0.7800 is a better sell rate than 0.7700.

• An option is out-of-the-money (OTM) when the strike rate is worse than the underlying market rate. For example, if AUD/USD is trading at 0.7700 and you buy a Put with strike 0.7600, the option would be considered OTM because 0.7600 is a worse sell rate than 0.7700.

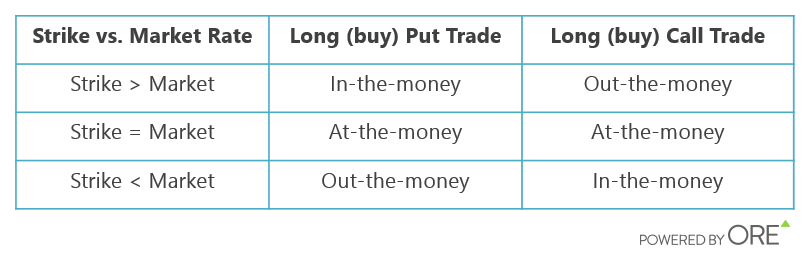

The table below shows the different states of a Put and Call of a strike level in relation to market level changes.

Note: A Put option, with the same strike rate, will always be in a different state to the Call option unless the strike rate equals the market, then both the Put and Call will be at-the-money (ATM).

When an option is in-the-money (ITM), it is more valuable, i.e. its premium is higher. Hence, ITM options are the most expensive to buy, whereas out-of-the-money (OTM) options are the cheapest. Paying more for an option means you are risking more, however an ITM option has a higher probability of returning a profit. Buying an OTM option is a smaller risk, but the probability of profit is lower. In each trade, you enter a strike rate depending on your market outlook and risk appetite.

Buying an at-the-money (ATM) Put option

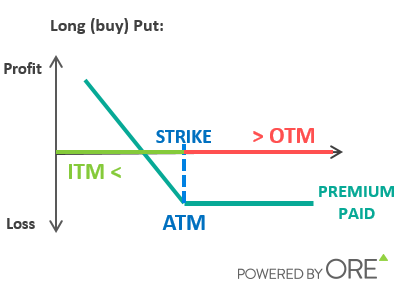

When you buy a Put option with a strike equal to the market rate, it is at-the-money (ATM). If the market subsequently rises, the option will be out-of-the-money (OTM) because the sell price of the strike is lower than the market. But if the market falls, the option will be in-the-money (ITM) as the strike is more attractive than market. The diagram below demonstrates this concept.

Example of buying Long Put option – ATM, OTM, ITM

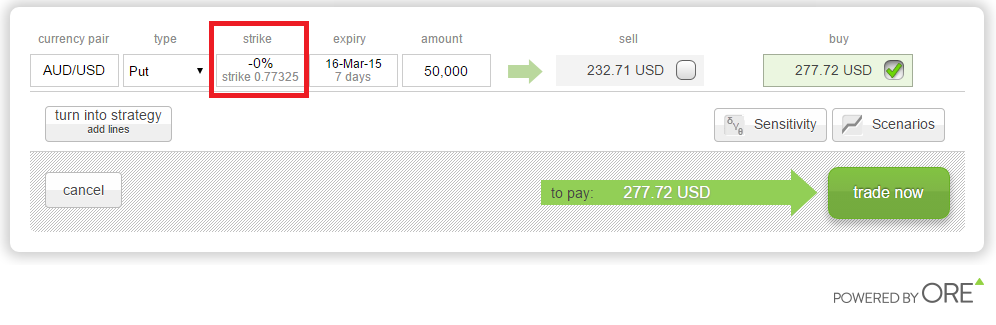

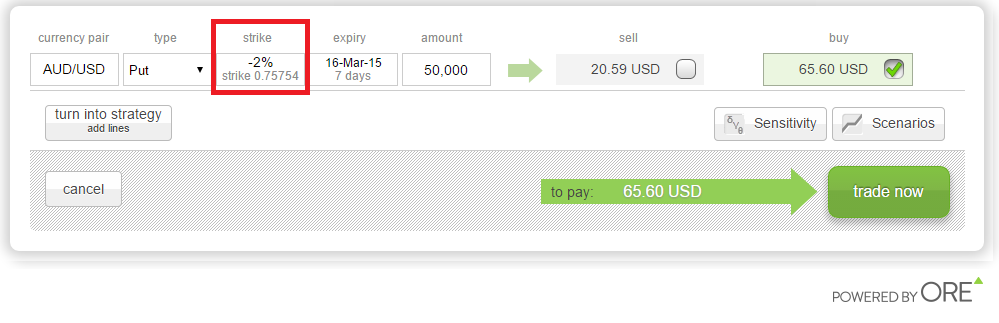

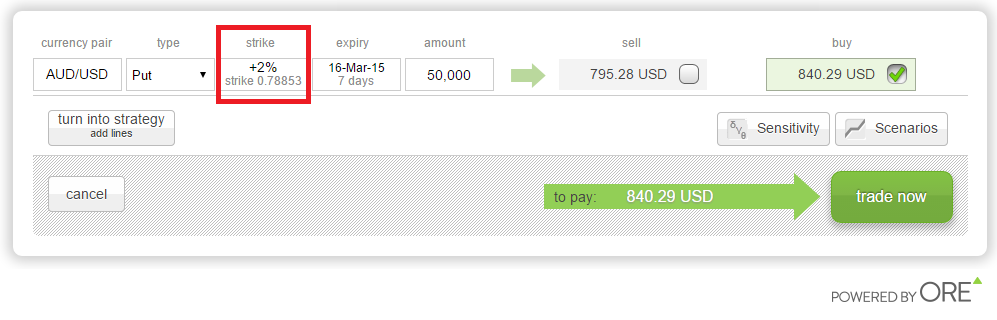

The following three images depict AUD/USD buy Put options ATM, OTM, and ITM.

In the ATM buy Put option image above, the underlying AUD/USD market rate and the strike are the same at 0.77325 and the option costs 277.72 USD to buy

In the OTM buy Put option above, a strike price -2% below market has been selected. This means the trader is reserving a worse rate than what is currently available in the market and the cost to buy the option has decreased to 65.60 USD.

In the ITM buy call option above, a strike price +2% above market has been selected. This means the trader is reserving a better rate than the market and the cost to buy the option has increased to 840.29 USD.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Editors’ Picks

AUD/USD remains close to three-year top amid the Fed-RBA divergence

AUD/USD attracts some dip-buyers near mid-0.7000s during the Asian session on Monday, stalling last week's modest pullback from a three-year peak. The US Dollar continues with its struggle to attract any meaningful buyers amid bets for further rate cuts by the Fed, bolstered by the softer US CPI report on Friday. In contrast, the Australian Dollar retains a bullish bias on the back of the RBA's hawkish stance, which further acts as a tailwind for the currency pair.

USD/JPY retakes 153.00 after Japan's weak Q4 GDP print

USD/JPY kicks off the new week on a positive note as Japan's weak Q4 GDP growth tempers bets for an immediate BoJ rate hike and undermines the Japanese Yen. Investors, however, seem convinced that the BoJ will stick to its policy normalization path amid hopes that PM Takaichi's policies will boost the Japanese economy. In contrast, cooling US consumer inflation reaffirmed bets for more Fed rate cuts in 2026, which acts as a headwind for the US Dollar and should cap the currency pair.

Gold holds above $5,000 as bears seem hesitant amid Fed rate cut bets

Gold edges lower at the start of a new week, though it defends the $5,000 psychological mark through the Asian session. The underlying bullish sentiment is seen acting as a headwind for the bullion. However, bets for more rate cuts by the Fed, bolstered by Friday's softer US CPI, keep the US Dollar bulls on the defensive and continue to support the non-yielding yellow metal as the focus now shifts to FOMC Minutes on Wednesday.

Week ahead: Data blitz, Fed Minutes and RBNZ decision in the spotlight

The US jobs report for January, which was delayed slightly, didn’t do the dovish Fed bets any favours, as expectations of a soft print did not materialize, confounding the raft of weak job indicators seen in the prior week.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.