It is important that you understand how call options work before moving into more complex option definitions and advanced trading strategies.

A Call gives the holder the right, but not the obligation, to buy at an agreed upon price up until expiry.

The agreed sell/buy price available to an option holder is called the strike rate. An option buyer will benefit if the strike rate can beat the market! If you are holding a Call option, the strike will become more attractive as the market rises.

Let’s look at a scenario where the buyer (holder) of an option on the EUR/USD might buy a call option expiry in 7 days for the premium of 160 USD assuming the current strike price of the call option is at 1.2500.

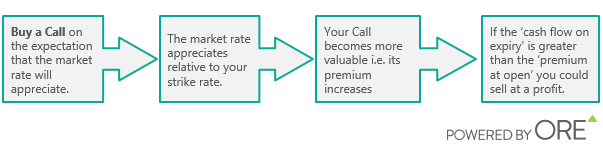

It is important to note that the premium of a buy Call trade increases as the market rises. Why? Because the Call's strike rate becomes more attractive relative to the market rate.

For now, let’s look at two possible results for the buyer in the above scenario:

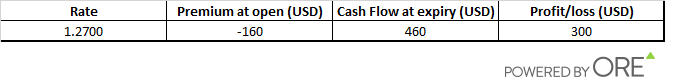

1. The market price for the EUR/USD goes above 1.2540 (break-even point) before 7 days expire: The buyer will sell the option at a higher premium and profit from the difference. If on expiry the rate is 1.2700, they make a profit from the difference between the cash flow at expiry and the premium at open equaling 300 USD, as seen below. Alternately, if you are the seller (writer) of the option in this case, you have lost 300 USD.

2. The market price does not go above 1.2540: The buyer is not going to exercise their option as option’s buyers have the right, but not the obligation, to exercise their options. So, even though the option buyer bought the option, they never have to exercise it! This means the buyer is out the value of the option premium and the seller gains the value of the option premium, in this case 160 USD. Unlike with the direct purchase of an underlying asset, options buyers are only obligated for paying the premium amount not the cost of the underlying asset until they exercise their options.

In the next lesson, I will explain in more detail buying Put options.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.