- Bitcoin price is hovering around the psychological barrier of $19,000.

- Three different technical indicators imply that the coin is on the verge of a massive sell-off.

- Only a sustainable move above $19,600 may help invalidate the bearish scenario.

Bitcoin is changing hands around $19,000. The pioneer digital currency lost over 1% in the past 24 hours; however, it is still in the green zone on a week-to-week basis. BTC celebrated the beginning of the first winter month with a new all-time high at $19,915 and retreated to $18,335 on December 2 amid massive leveraged longs liquidation. Since that time, the coin managed to regain some ground but the bullish momentum is not strong enough to take the price to $20,000 and beyond.

Bitcoin price screams sell across the board

From a technical point of view, there are at least three clear signals that promise more pain ahead.

First, the TD Sequential indicator sent a sell signal on BTC's monthly chart. The bearish formation developed as a red nine candlestick, indicating that Bitcoin price is poised to drop further, for one to four monthly candlesticks. But If the selling pressure is strong enough, the pioneer cryptocurrency might even start a new downside countdown.

BTC's Monthly Chart

Second, the Relative Strenght Index (RSI) hit overbought territory on the weekly chart. A popular technical analyst within the cryptocurrency community known as Dave the Wave noted that the RSI exceeded 80, which is usually a precursor for a retreat.

Dave estimates that a sell-off around the current price levels could see Bitcoin crash to $10,000. Such a pessimistic target was determined by a long-term upside trendline that was created since BTC's inception.

FXStreet previously reported that 20-30% corrections are common during Bitcoin's bull runs. A retracement of this magnitude could see prices drop to $13,000-$14,000 instead.

— dave the wave (@davthewave) December 4, 2020

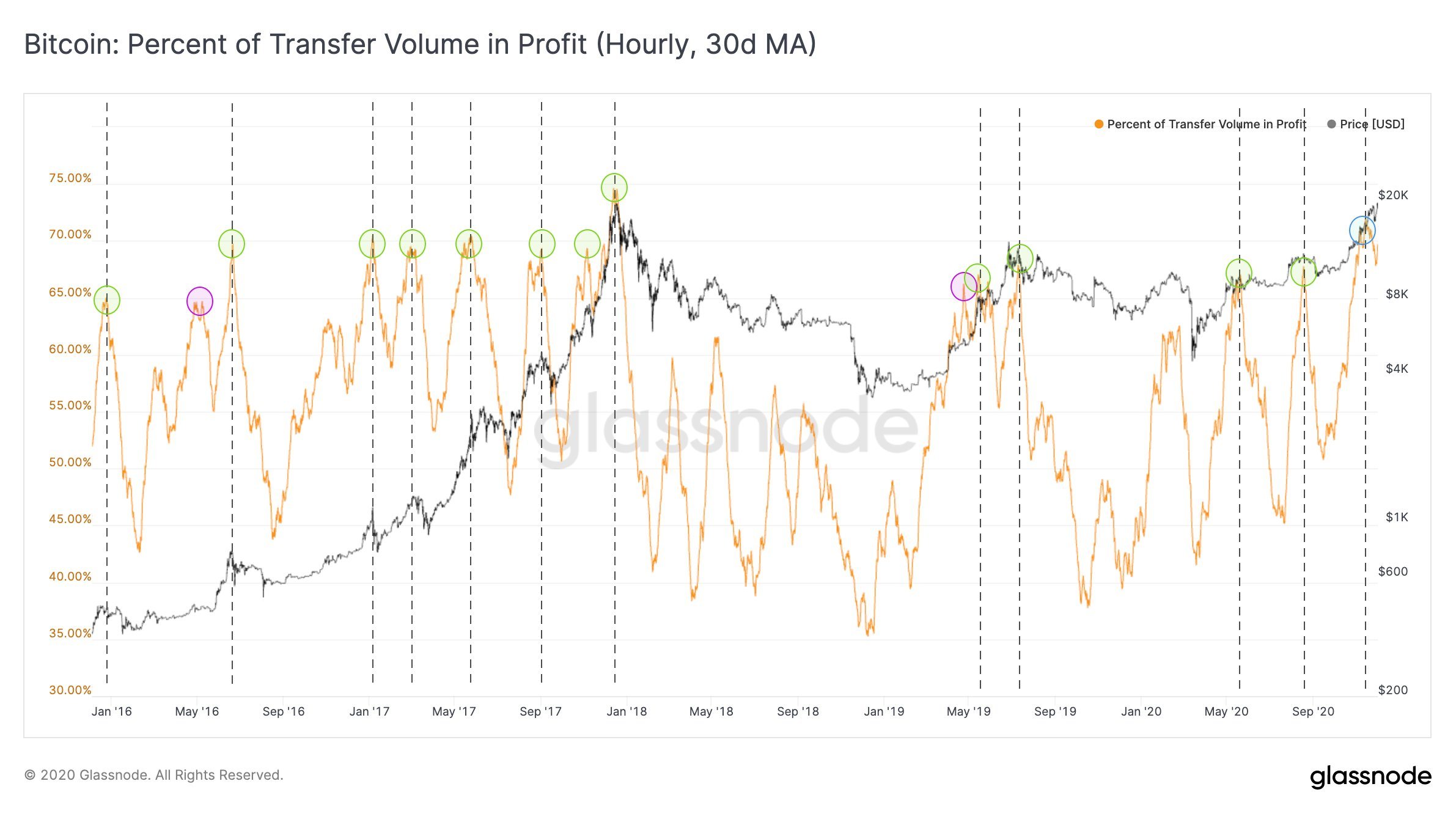

Finally, Glassnode's Percent of Transfer Volume in Profit metric implies that BTC is ready for the correction. This indicator is calculated as a "percentage of transferred coins whose price at the time of their previous movement was lower than the current price." In other words, it tracks the number of Bitcoin moved within its blockchain that sits in a profitable position.

Currently, the on-chain metric shows that the flagship cryptocurrency has reached a potential market top. Read more details on how this indicator works.

Bitcoin Percent of Transfer Volume in Profit

Key levels to watch

Bitcoin is vulnerable to a steep decline with the first local barrier around $18,000. If this one is cleared, sell orders may skyrocket creating a ripple effect across the entire market. Losing $18,000 as support will likely see BTC plummet to $13,500 or even $10,000.

On the other hand, if Bitcoin price manages to settle above $19,600, the bearish forecast will be invalidated. Trading veteran Peter Brandt believes that moving past this resistance hurdle will ignite FOMO among investors, pushing BTC to $50,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto traders brace for short-term volatility with $2.4 billion options expiry on Friday

Bitcoin and Ethereum options market looks bullish on Friday, according to data from intelligence tracker Greeks.live. The firm said it has identified two Bitcoin calls that show an underlying bullish sentiment among market participants.

XRP recovers from week-long decline following Ripple’s response to SEC motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Lido adds 4% gains as protocol rolls out first step towards decentralization

Lido takes the first batch of simple DVT validators to live, a step taken to decentralize the protocol. Lido leveraged technology to expand the protocol to multiple node operators, inviting both solo and community stakers.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

-637426844476943730.png)