Written by: Steve Ruffley, Chief Market Strategist at InterTrader.com

It seems like the world sees history and thinks, ‘this time things will be different’. So many big plans and bold statements from governments signaling change and no more return to the bad old days, under someone else’s term in office. Yet here we are once again in the UK. Indices making record highs, property prices returning to 2007 highs, bonds with good yields… I don’t know about anyone else but if everything investors put their money in is yielding returns, I’m at a loss to know who is losing? One think I do know is that the idea of balanced portfolio for investors no longer exists and people investing for the future is a both a lie and a myth.

With house prices one again rallying, especially in the South people believe that the place to put their money is still bricks and mortar. It may well be. The problem with using property as an investment vehicle is that eventually it will have to be cashed in and profit realised. The property market rises are unsustainable for two reasons. Firstly the billionaires that London rely on to fund the top end can go as quickly as they came. London is a tick on the box, nothing else. The lower end of the market with interest rates could dry up at any minute. People generally exaggerate their income and bonuses to get mortgages, so with banks’ lending less and money going up, with real wages rises London house process are out the reach of a lot of people.

So what happens in the meantime is people who have made profit in property cash in, this inflates the property market and prices rise. What happens however when generation X, the Mums and Dads who are sat on all the majority (of ordinary household) profit pass away? Do you think the children of the recent tough economy will hold on to the houses they inherit? Would you? No I don’t think so, the majority of the £1trillion worth of property will be spent. This is no bad thing.

With interest rates west to rise in early 2015, it is now that we have to understand where the UK will be in the next 5, 10, 20 and 50 years. For the short term, although things have been tough for the average man on the street, as I have explain form houses, stocks and bonds most people in the UK over 40 have done ok. The Pound is up to a 6 year high against the Dollar, and with London seemly on an unstoppable boom the Pound can only get higher. People may say we are over valuing the Pound, but we are far from it as this chart shows:

The rise of the Pound from 2007 has to reach 1.73132 a key pivot before we can truly say that we are overbought. Personally I have been predicting that the UK would be 1st to move on rates for nearly a year, so I suspect as the rest of the world now jump on the Pound it can only go higher in the short term.

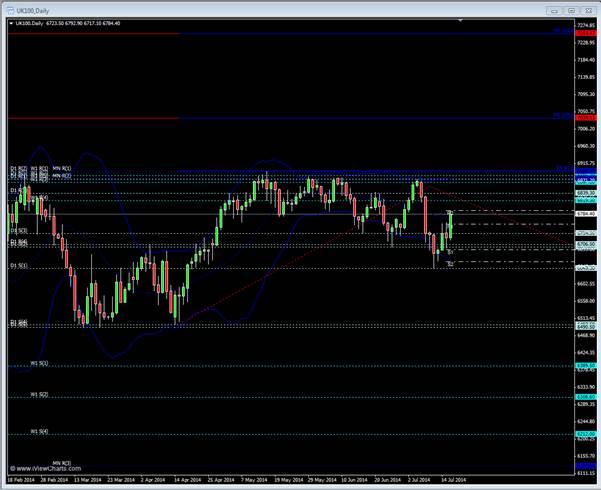

We are certainly not topped out in the FTSE 100 either. With the Dax and Germany reaching 10,000, with seeming a lot wider issues like EU debt and unemployment, I see no reason why the stronger UK and US indices will not reach 7,000 and 2,000 in the S&P before we make a major correction.

I would say in the UK it is time to make hay while, timing it perfectly with the actual weather, the sun shines. With the company balance sheets at record highs and the bank recapitalised it’s the time of big business to cash in. No that necessarily helps the wider economy, but it certainly helps the indices. With 2014 set to be a record year for M&A activity the indices can only push higher until there is some significant fear or indeed a better place for all that capital. FTSE hits 7034 and 7253 before we see the inevitable correction.

Would suspect by this time next year we are trading in the FTSE closer to 6200 than 7200.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.