EURUSD: With further decline occurring the past week, additional downside pressure is likely in the week. Support is seen at 1.1500 level with a cut through here opening the door for more downside towards the 1.1450 level. Further down, support lies at the 1.1400 level where a break will expose the 1.1350 level. Below here will pave the way for a move lower towards the 1.1300 level. On the upside, resistance lies at the 1.1650 level where a violation will aim at the 1.1700 level where a break will aim at the 1.1750 level, its psycho level followed by the 1.1800 level. Further out, resistance comes in at the 1.1850 level. All in all, EUR remains biased to the downside in the medium term.

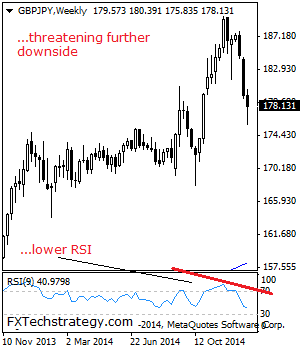

GBPJPY: Bearish, Extends Weakness

GBPJPY: With the cross extending its weakness the past week, further decline is envisaged in the new week. However, following the mentioned weakness it should trigger a corrective recovery in the new week. On the downside, support comes in at the 175.83 level where a violation will aim at the 175.00 level. A break below here will target the 174.00 level followed by the 173.00 level. Its daily RSI is bearish and pointing lower supporting this view. On the upside, resistance lies at the 179.00 level followed by the 180.00 level where a break will aim at the 181.00 level. A cut through here will aim at the 182.00 level. All in all, the cross remains biased to the downside short term.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.