This Week's Highlights

Sterling under pressure due to weaker data

Mario Draghi signals dovish intent

Non Farm Payrolls the focus

FX Market Overview

Yesterday the Pound was sold after the headline services Purchasing Managers index edged lower in March, continuing its gradual softening since the peak seen in October 2013. Despite the fall the survey still pointed to an above average pace of expansion coming in at 57.6 . All the PMI's for the first quarter have now been released and it is clear that the UK economy has continued to expand at a fast pace in Q1 although a little slower than what was seen towards the end of last year. The recent releases suggest that in the early part of the year growth has moderated and with that expectations of imminent rate hikes should recede. As the data consolidates the risks to the Pound will be to the downside. Attention shifted to the European Central Banks latest interest rate setting meeting. Rates were left on hold for the 5th consecutive month despite rising inflation concerns. In the following press conference however, Mario Draghi , President of the ECB , was pretty dovish indicating that the ECB will ease aggressively if inflation falls further. It looks more and more likely that the ECB is tip toeing towards "unconventional monetary policy" also known as quantitative easing. Now that the ECB is of one voice with regard to QE it seems only a matter of time before Mr Draghi will be able to pull the trigger - next month's inflation data will be very closely watched and the Euro is likely to struggle over the next few weeks. Overnight markets were quiet ahead of today's non-farm payrolls report. This month's report is eagerly awaited and I would anticipate solid gains in March. The 191k rise in the ADP report , the big jump in the employment component of the non-manufacturing ISM and positive jobless claims for March all point to improved sentiment and we could see a figure above the 190k consensus which may see the dollar rally as investors decide that the US economy is once more beginning to gain traction. Ahead of today's main data release prices are likely to remain range bound however there is sure to be volatility around 1.30pm so be sure to contact your Halo Financial Consultant in order to manage your currency risk ahead of the announcement.

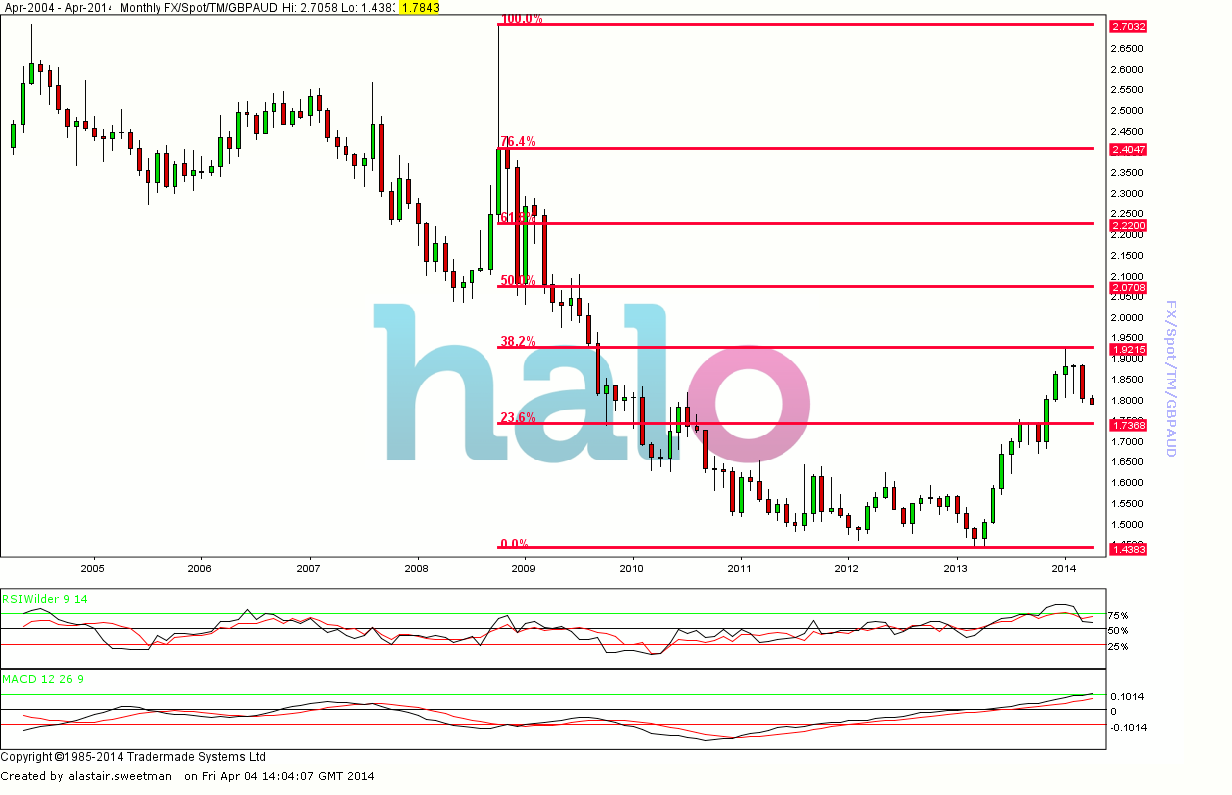

Currency - GBP/Australian Dollar

GBPAUD remains under pressure – the RBA kept interest rates on hold at this month’s meeting and it’s looking unlikely that they are going to cut interest rates again. Some analysts expect an interest rate increase early 2015 and that will help support the Aussie dollar. Economic data has been improving as well and there’s feeling that the Australian economy is starting to pick up. Trading partner China has also announced plans to increase economic stimulus to ensure it hits its GDP targets and that’s also buoying AUD. On a longer term chart you can see GBPAUD hit the 38.2% Fibonacci retracement of the whole move from 2.70 to 1.43 and it failed to break through that level. We’re now heading back towards the 23.6% Fibo which comes in at 1.7368 and so that’s really the target on this move. A break and close above 1.8150 will be good news but there’s not been any real upside since the fall to 1.80 which makes me think we’re heading lower before a bounce. Only glimmer of hope is short term support comes in at 1.7916 (that needs to hold to stand a chance of seeing 1.8150 again).

Currency - GBP/Canadian Dollar

Fundamentally the Canadian economy has picked up in the latter half of 2013 but the Bank of Canada is in wait-and-see mode (similar to Bank of England), taking a view as economic data develops through the year. Analysts expect no change from the current 1% base rate until the second half of next year. GBPCAD has pulled back from the 4 year high of 1.8646 – as you can see from the daily chart it’s had 3 goes at breaking higher and has failed thus far. We’re heading back down and I think as GBPUSD heads lower, GBPCAD could retrace deeper towards 1.80 initially. On the longer term chart GBPCAD is looking quite overbought so again it enforces view that a pullback is in the offing. Technical support comes in currently at 1.8003 then onto 1.7851.

Currency - GBP/Euro

The Sterling Euro exchange rate has also been a tight range this week mainly as markets had been awaiting important employment data from the United States. We were given a glimpse of what policy makers were thinking during the press conference after the recent rate setting meeting though as Mario Draghi stated that the ECB was beginning to consider unconventional measures to combat deflationary pressures. In other words they had discussed quantitative easing. This was more dovish than in the past and the Euro was sold aggressively. With Sterling little changed on the week this has forced Sterling Euro a little higher. For now we are at the top of the current trading range and considering we are very close to near term resistance it may be an opportunity for Euro buyers to cover any near term risk.

Currency - GBP/New Zealand Dollar

Well what a difference a month makes, having spent much of the last 6 months or so trading in the 2.00 region, GBP/NZD has come under increasing pressure over the last few weeks following the RBNZ rate hike from 2.5% to 2.75%. This was widely anticipated by the markets as it had been flagged by Governor Bollard at the previous RBNZ meeting. As outlined in the previous commentaries, it was actually the comments that came with the announcement that was of interest to the market and has driven GBP/NZD lower. The RBNZ did indeed suggest that this was the start of the tightening cycle i.e. there are further rate hikes to come the timing of which will be dependent upon economic data releases. As a rule of thumb, a central bank with a tightening bias (interest rates are likely to go up in the coming months) is a positive for a currency and the kiwi has been one of the best performing currencies of the last month. At this stage, the market has bounced from the lows but we still have some work to do to be convinced this correction is over but for now play the range i.e. sellers target low 1.90’s and buyers high 1.90’s or 2.00.

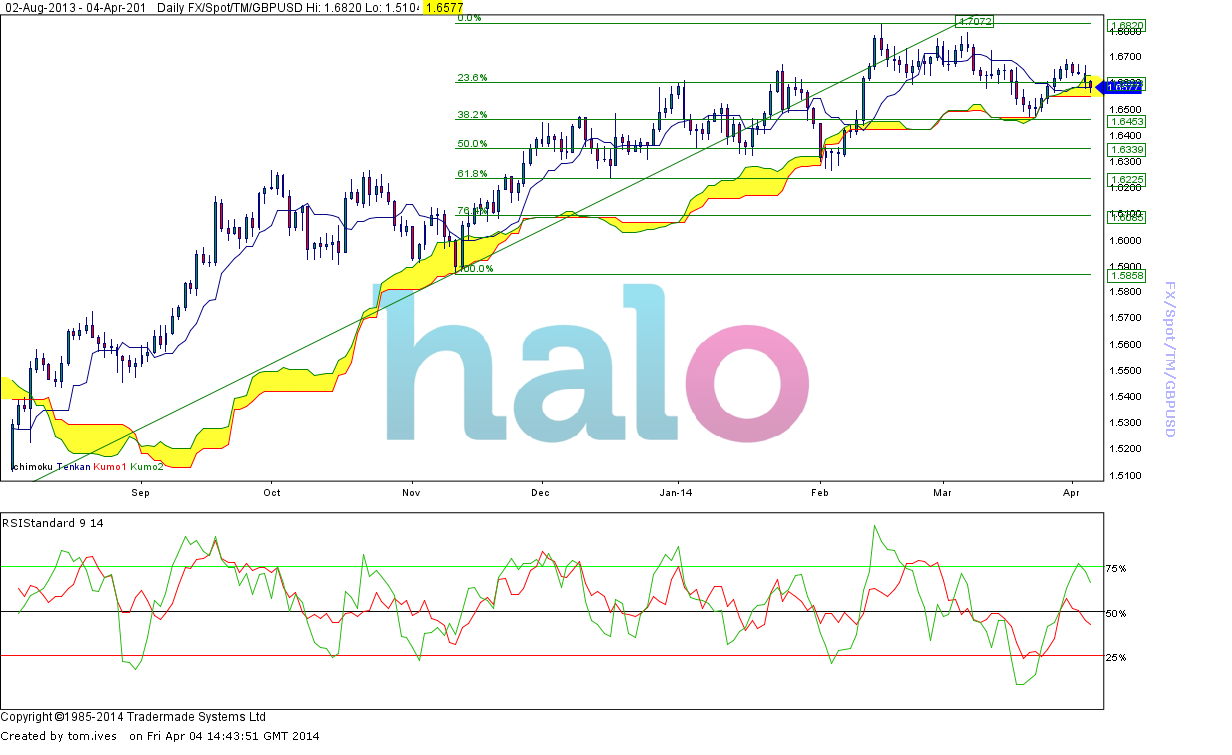

Currency - GBP/US Dollar

The sterling dollar exchange rate has traded in a fairly tight range this week with a slight downward bias due to weaker than expected UK data. The headline service PMI data was released yesterday and it came in at 57.6 which, although above the 50 level which denotes the difference between contraction , still disappointed markets. All PMI surveys for Q1 in the UK have now been released and it is clear that the economy continues to expand at a fast pace in Q1 albeit one that is consolidating after such a stellar fourth quarter. I feel that if the status quo is maintained and the data continues to flatten than Sterling may continue to struggle to make significant gains. Next week's Bank of England rate setting meeting will focus minds even though no change to policy is expected.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.