Durable Goods Soar

According to US Commerce Department figures, orders for goods meant to last for three years or more soared in the month of December by 4.6% - gaining for the fourth straight month. The advance beats estimates of a 2% gain in orders, with core figures showing a subsequent addition of 1.3%. Core figures strip more volatile transportation equipment from the headline number.

The better than expected figure is estimated to shed optimistic light on the US economy when the world’s largest economy releases advanced Gross Domestic Product figures this week. Advanced estimates are anticipated to the show a 1.1% annualized pace of growth, positive but still slower than the 3.1% seen earlier.

Counters Housing Decline

The positive durable goods figure overshadows relatively negative reports from the National Association of Realtors. According to the trade group, pending home sales declined in the month of December, the first time since the end of the summer. Overall, the index of sales declined by 4.3%, as both Western and Northeastern parts of the US were hit hard by slowing sales. West Coast pending sales decreased by 8.2% while Northeastern interest declined by 5.4%.

Although widely negative, as pending homes account for 90% of the market, the figure seems to be digested as normal pullback from the recent string of gains for the report. The notion places increasing emphasis on next month’s figures.

What Will the Fed Do

Given that baseline economic fundamentals remain well supported, through retail sales and manufacturing, speculation is growing that Fed policymakers may hint at an early exit from recently implemented monetary stimulus as the notion of a rebound continues to surface. With the Fed balance sheet growing to $3 trillion in the last month, the potential scenario has become more of reality now. And, any innuendos of a retraction of stimulus would be particularly bullish for bond yields, which could translate into US dollar strength in the medium term.

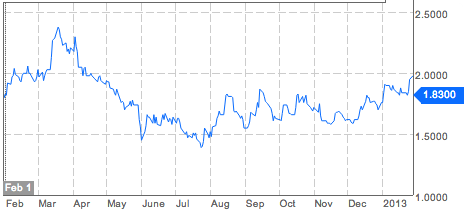

Source: Bloomberg

Source: Bloomberg

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

EUR/USD grapples with higher ground as Fed cuts weigh on Greenback

EUR/USD found the high end on Thursday, holding fast to the 1.1150 level, though most of the pair’s bullish momentum comes from a broad-market selloff in the Greenback rather than any particular bullish fix in the Euro.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.