USD/ZAR 4H Chart: Channel Down

Comment: The U.S. Dollar has been in the downtrend since late January when USD/ZAR touched a five-year high of 11.3931. The bearish trend was distinguished by the continuity of large declines and small gains until mid-March. After that, the decline became more distinct and the pair entered a channel down pattern.

Now the currency couple is sitting at the tunnel’s upper limit at 10.5136; however, the breakout is unlikely since about 70% of players at the SWFX bet on depreciation of the pair. Technical indicators also suggest that the instrument may retreat in the medium-term.

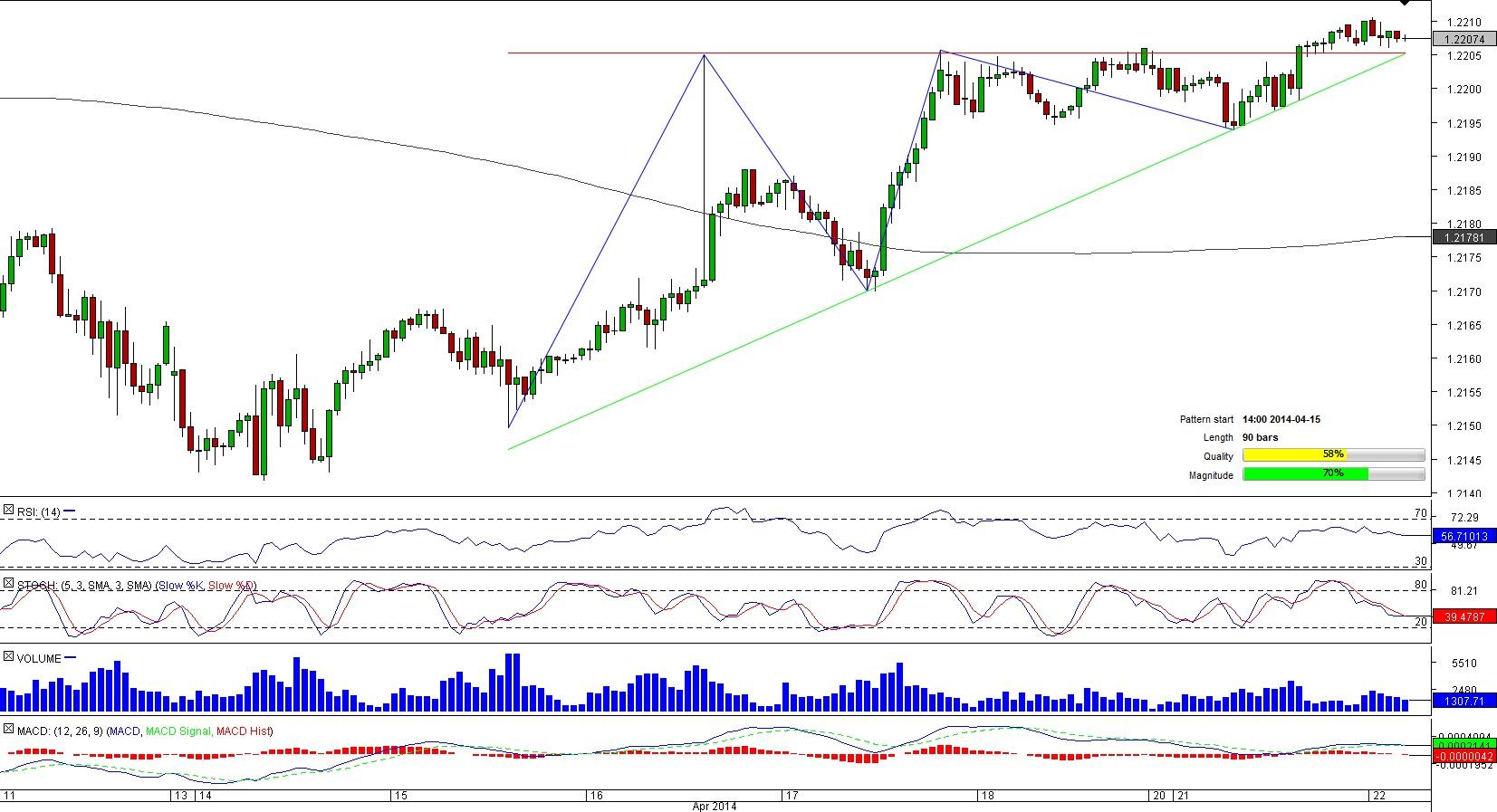

EUR/CHF 1H Chart: Ascending Triangle

Comment: Following a sharp 10-day decline ended April 14, EUR/CHF started to erase losses and formed an ascending triangle pattern that now is about 90-bar long.

Recently, the currency couple has broken through the upper limit of the triangle at 1.2205 and has been sitting above this important mark for more than 12 hours. Considering this as well as the fact that the pair has almost reached the apex, we may claim that the breakout took place. However, bullish expectations have not materialized yet and the rally seems doubtful as only 52% of positions at the SWFX are long.

GBP/USD 1H Chart: Triangle

Comment: April proved to be a positive time for the British Pound that managed to perform an accelerating appreciation against its U.S. peer. GBP/USD attained a five-year high on April 17, only a day after the pair commenced formation of the triangle pattern.

The currency pair has recently exited the formation by crossing the lower boundary of it. Despite the fact the sharp decline did not happen, the pair is not strong enough to prove the breakout was false by returning to the pattern as the 50-hour SMA at 1.6794 is blocking the upswing. According to the technical data, the pair is likely to slide in the next hour but may advance in the medium and long perspectives.

NZD/CAD 1H Chart: Triangle

Comment: After a false breakout a day earlier, NZD/CAD re-entered the 123-bar long triangle it has been forming since the beginning of the month.

Currently, the pair is vacillating close to the apex that will be reached later in the day. This solidifies the view that the real breakout is looming; however, the direction of the exit is not clear since SWFX participants are not univocal on the pair-around 52% of them are bullish and circa 48% are bearish. Technical indicators also send mixed signals, pointing to a rally in the short-term and to a decline in the medium-term. In the one-day period, technical signals are neutral.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.