Reports of my death have been greatly exaggerated?

We used a Mark Twain quote to good effect in our article the numbers game last week and in a pleasing turn of fate we are able to reference the great man once again this week. Regular readers will be well aware that a lack of inflation and in particular the lack of inflation growth has been one of our major criticisms of both Central Banks and political policies across the developed world.Though we have acknowledged that in certain cases core inflation measures, that strip out volatile items such as food and fuel are much closer to targets, than the broader inflation measures in the same economy. To our mind however to ignore or exclude items, that are essential to everyday life, in an inflation calculation, is akin to saying that’s it’s not wet if you ignore the fact that it’s raining. As such we think we need some new inflation metrics for the modern world that make use of data on real prices paid by consumers, in real time. But that’s a discussion for another day.

Still pretty bleak

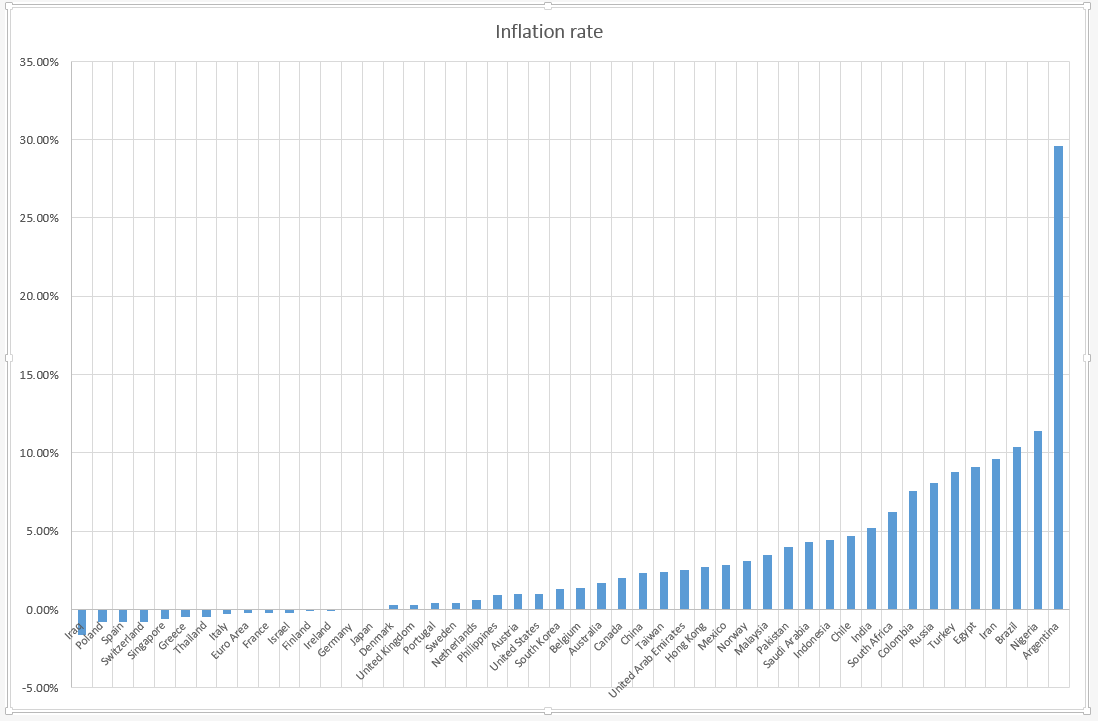

The inflation picture on a global scale is still pretty bleak and highly polarised. That is to say that in many developed economies there is little or no inflation. Whilst in the emerging markets there are plenty of examples of inflation effectively running out of control. As these economies wrestle with a combination of financial mis-management, the negative effects of QE in the developed world and plunging commodity prices, as is illustrated below.The chart below plots the rate of inflation in selected Developed and Emerging economies.

Maybe there is a thaw

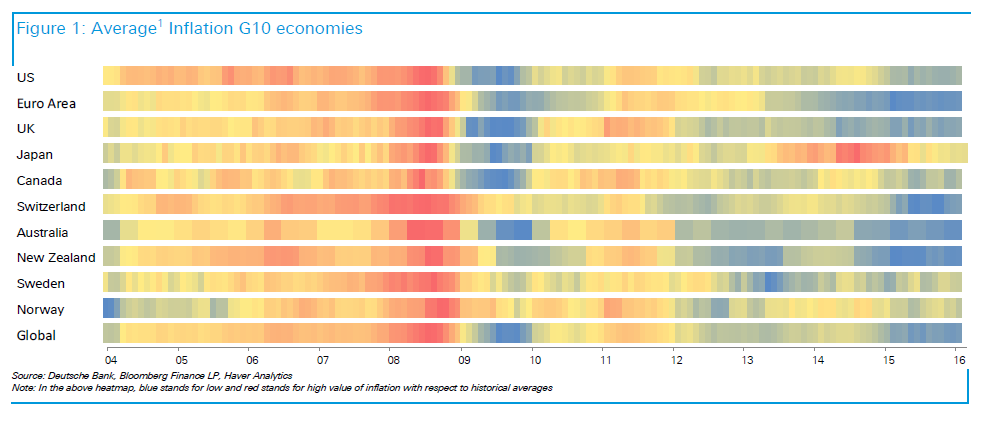

As we can above see many of the world’s major economies are clustered on the left hand side of the chart and many of those have inflation levels close to or even below zero. This is a problem because once deflationary pressures becoming ingrained into an economy then, like a red wine stain on white table cloth they become very difficult to shift. But in recent weeks there are signs that change may be afoot. Just as the weather has begun to warm up in anticipation of the arrival of spring, so there are signs of thaw in levels of inflation. Though you do have to look quite hard to find them.The graphic below tracks the change in average inflation levels amongst the G10 economies over a 12 year period. Red areas indicate rising inflation (warming up) Blue areas indicate falling inflation (cooling down).

Inflation heat map for the G10 economies 2004 to 2016 (source Deutsche Bank)

Clearly there is more cool blue on the map at the moment than anything else however if we dig deeper into the inflation story we can find the odd suntrap.

We can see this most clearly in the USA

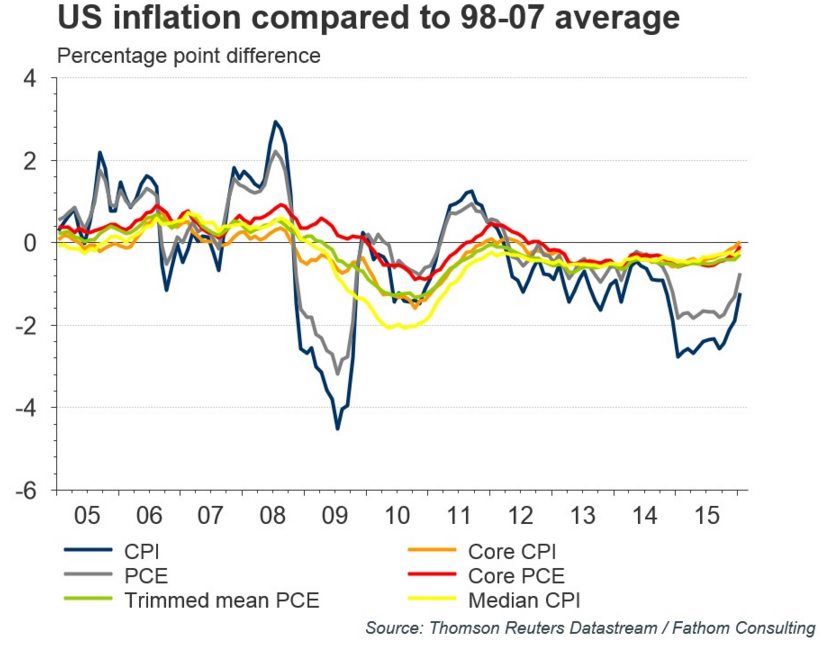

The chart below looks complex but in fact is quite straight forward. It shows a variety of inflation measures, within the USA between 2005 and 2016 and plots them against the average of US inflation between 1998 and 2007. A period during which inflation was present in the US economy.Chart plots selected measures of US inflation 2005/2016 vs average inflation between 1998 and 2007

What this chart clearly shows is that all of these inflation metrics are rising relative to the 1998 /2007 average. And that both CPI and PCE inflation measures (the latter is one the Feds preferred inflation gauges) are gaining upward momentum. The core versions of these two measures (Red and Orange lines) could shortly move in to positive territory relative to the historical average as well.

Research from Deutsche Bank that accompanied the heat map above, highlighted that Norway and Sweden are also good examples of countries that are showing signs of progress on inflation. Indeed Norway is one of the few economies that could legitimately claim to be on the right hand side of our inflation chart at the top of the article. I have my own reservations re Sweden, based on the weaker Krona and negative interest rates that are in effect there. (I wonder whether that may stir up price inflation in Sweden without an accompanying rise in domestic economic growth).

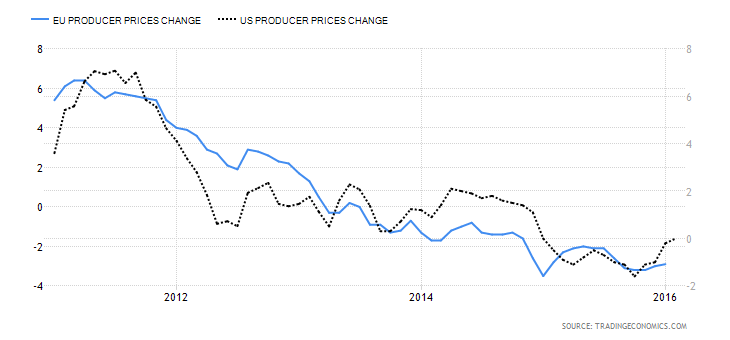

There are also signs that the weakness in PPI or factory gate inflation may be moderating or falling at a slower rate, in two of the world’s major economies. As can be seen in the chart below.

Chart shows the change in PPI or Factory Gate inflation n in the USA and Eurozone.

One swallow does not a summer make

The pickup in inflation, particularly in the USA does give pause for thought. Clearly these are green shoots rather than a full blown flowering, if we may use a gardening metaphor.But the fact that the Feds inflation of target of 2% is now looking more obtainable and perhaps more importantly sustainable, calls into question the central banks accommodative stance at its recent meeting.

Or to put it another way the Fed could be seen to be more concerned with external factors than it is with domestic ones. As was the case in the autumn of 2015.

Since Wednesday’s (16 March) meeting dollar weakness has returned and fittingly a move back to levels last seen in October 2015 could be on the cards. The mid October low was 93.80 on the weekly chart.

We could be in for a very interesting Q2 indeed if US inflation data continues to improve. But yet the Fed continues to stay its hand. Indeed we could see a 180 degree turnaround as markets become more hawkish on interest rates whilst at the same time the Federal Reserve becomes dovish.

The concern then will be that Fed will find itself quite literally behind the curve.

Trading with currencies and CFDs is speculative in nature and could involve the risk of loss. Such trading is not suitable for all investors. Before using the services of Admiral Markets AS please acknowledge the risks associated with trading, terms and conditions of the services and consult and expert if necessary.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.