The sentiment towards the Sterling/Dollar hit a new low on Monday after the currency pair dropped below 1.50 for the first time since April and fell to a fresh seven-month low at 1.4993. While part of the reason for the decline in the GBPUSD has been due to the resumption of USD strength throughout the currency markets, sentiment towards the Sterling has also been punished by Bank of England (BoE) Governor Carney dealing another blow to buyers by once again seeming to backtrack on the possibility of a UK interest rate rise anytime soon.

The Sterling continues to suffer regular punishment from the BoE’s clear resistance to begin raising UK interest rates, and it now appears that BoE policymakers are beginning to become hesitant towards even discussing any potential timeframe for an increase in UK rates. While it is true that non-existent inflation is diluting any pressure on the central bank to act and this is pushing back expectations, it is also possible that traders are curious to see whetherthe BoE might wait even longer to increase rates depending if the European Central Bank (ECB) ease monetary policy further. This would quite simply be because the UK economy is vulnerable to EU weakness and a further depreciation in the EURGBP due to interest rate differentials between the two central banks could place UK export competiveness at risk.

After such an aggressive fall in the GBPUSD over the past couple of days it is possible that the pair will try to recover some momentum, however investor attraction could be reduced due to the latest news of theUK Prime Minister calling for a vote from MP’s on Wednesday for airstrikes in Syria. Such a scenario can promote a risk-off environment from investors, which we have previously seen hurt the Sterling on multiple occasions throughout the past couple of months.

From a technical standpoint on the daily timeframe, the GBPUSD is heavily bearish as there have been consistent lower lows and lowers highs on the charts. The pair has respected the bearish channel in the chart below and the extension belowpsychologicalsupport at 1.50 invites the potential for a further decline towards 1.49 in the future. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. As long as bears can defend the new 1.5180dynamic resistance, this bearish daily outlook remains valid.

Yuan introduced to the Special Drawing Rights basket

Elsewhere, the sentiment towards China received an uplift on Monday following confirmation from the IMF that the Yuan has been included in the Special Drawing Rights (SDR) basket of currencies. While the inclusion of the Yuan into the SDR has a low immediate impact on the economy of China itself,the markets were very surprised to see the Yuan receive a weighting of 10.92% after some previous expectations that it might only receive as little as 1%.

The highly symbolic gesture from the IMF to introduce the Yuan into the SDR illustrates how powerful China has become withinthe global economy, and the potential of the Yuan when it comes to trading in the future. Even though the economy in China is slowing down, and with future economic data likely to continue highlighting reduced economic growth as well as the instability seen over the past couple of months in the China markets, this has done nothing to prevent the Yuan joining the SDR basket.

After managing to extend as high as $42.58 in the morning session, WTI Oil reversed its early Monday morning rally after a survey suggested higher possible oil production from OPEC in November. It is also possible that the appreciating Dollar pressured prices as commodities are priced in US Dollars. It seems like the reaction to the unexpected and surprising comments from Saudi Arabia last week regarding its willingness to cooperate to achieve stable prices hasclearly worn out and with sellers nearby, WTI Oil may be set for further declines once again.

With the reoccurring theme of an aggressive oversupply in the markets and sluggish global demand for WTI oil is still active and continuously haunting investor attraction, the commodity remains both fundamentally and technically bearish with prices still at risk to another decline towards $39.

The remainder of the week is still set to be a very volatile one for the financial markets with high-risk announcements scheduled throughout the week. Market participants will be waiting for the European Central Bank (ECB) decision on Thursday and the highly anticipated US Non-Farm Payroll on Friday for November. Although the Fed fund futures markets currently illustrate a near 80% likelihood of a US interest rate rise in December, an unexpectedly weak NFP this Friday could sabotage these plans and expose the USD to weakness.

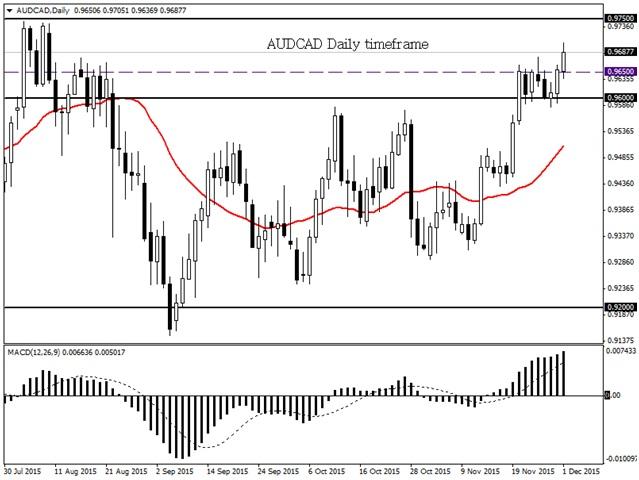

AUDCAD

The AUDCAD is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD trades to the upside. Previous resistance at 0.9650 may act as a dynamic support which should encourage buyers to send prices towards 0.9750.

GBPCHF

This pair is technically bullish on the daily timeframe as there have been consistent higher highs and higher lows. A breakout above the 1.5550 resistance may invite an opportunity for a further incline towards the next relevant resistance at 1.5900.

AUDCHF

The AUDCHF is on the route towards the 0.7500 level which was discussed in the previous report. This pair remains technically bullish and a breakout above 0.7500 may open a path towards 0.7650.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.