Crude

The oil price was only little changed yesterday and the front-month contract on Brent thus again settled above 66 USD/bbl. Regarding news, the market more or less ignores news that Saudi Arabia may call a truce in specific areas in Yemen as well as reports about a possible closure of a port in Libya.

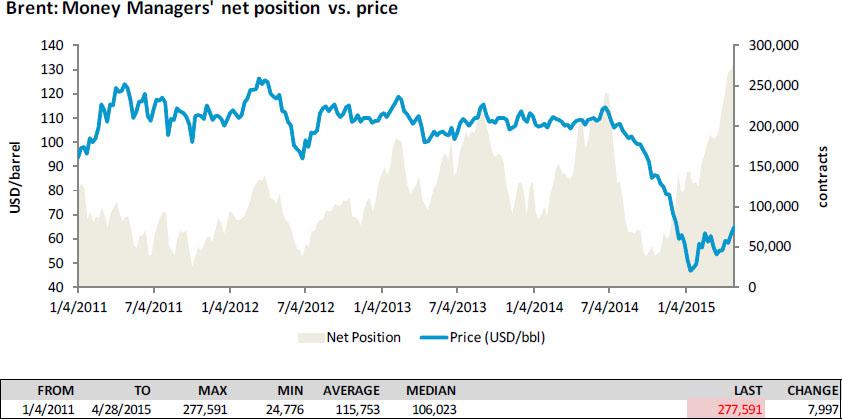

Clearly, market focuses mainly on the situation in the US, namely on the evolution of crude oil inventories. Though the official data is to be released tomorrow, the API will release its own report later today; expectations are set for a relatively modest (in comparison with previous months) increase in crude oil inventories. Figures from the latest ICE Commitment of Traders report suggest that - in spite of a record-high net speculative position in Brent futures (see the chart below) – room may still exist for further increase in the oil price should the inventories growth disappoint as number of traders betting on a decline in prices remain quite high (it, in fact, did not change last week).

Metals

Today in early trading, the copper price falls from a 4-1/2 month high hit on Friday, probably in a response to the weaker than expected data from China. Yesterday, the HSBC China manufacturing PMI was revised lower from a preliminary reading of 49.2 to 48.9, signalling an ongoing loss of momentum in the sector (recall that the LME was closed due to a holiday yesterday so that the reaction is delayed).

On the other hand, news about lower copper production of mining division of Glencore could at least partially offset negative data from China.

Chart of the day:

Net speculative positions in Brent futures hit yet-another all-time high last week.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

No tap dancing around inflation concerns

Tuesday saw U.S. stocks closing considerably lower as investors grappled with economic indicators indicating increasing labour costs and a decline in consumer confidence, all coming ahead of a crucial Fed policy meeting aimed at determining the trajectory of interest rates.