A new weekly column where we will study points of interest on Futures volume and CFTC data.

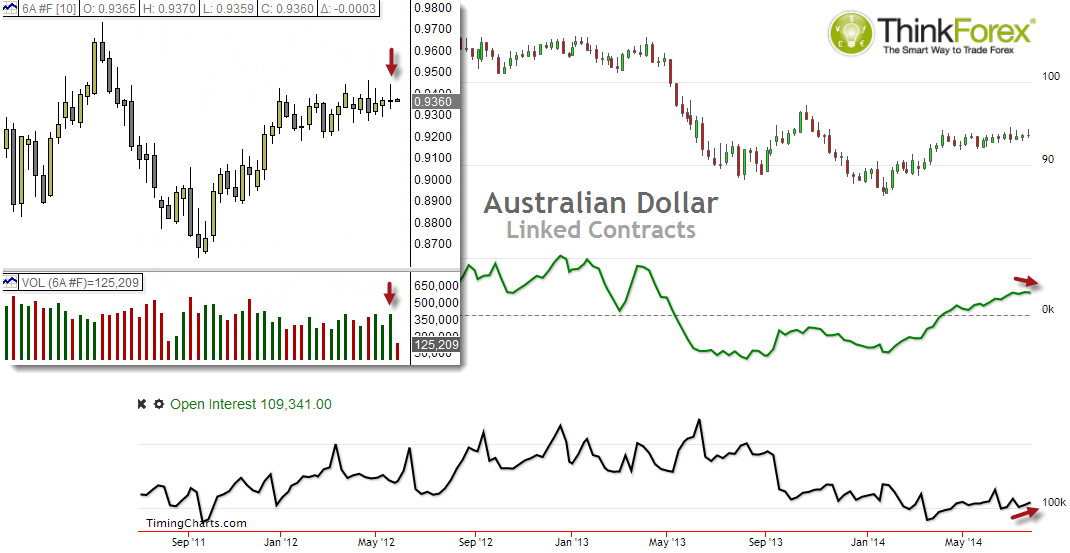

Australian Dollar Futures

The Rikshaw Man Doji is of particular interest because the Futures Charts (left) shows this was on increasing volume to suggest a 'change in hands' from buyers to sellers. Additionally the CFTC data (right) shows that the ratio between Net Longs and Shorts has reduced whilst Open Interest has also increased, to also suggest sellers are coming into the market.

Whilst volatility remains low it would be wise to not become too 'sensationalist', but it does raise more confidence that we are witnessing a topping pattern forming on the weekly timeframe. Whilst volatility remains low on D1 then it is still wise to not become too attached to positions and not outstay your welcome whilst the [suspected] topping pattern continues to form.

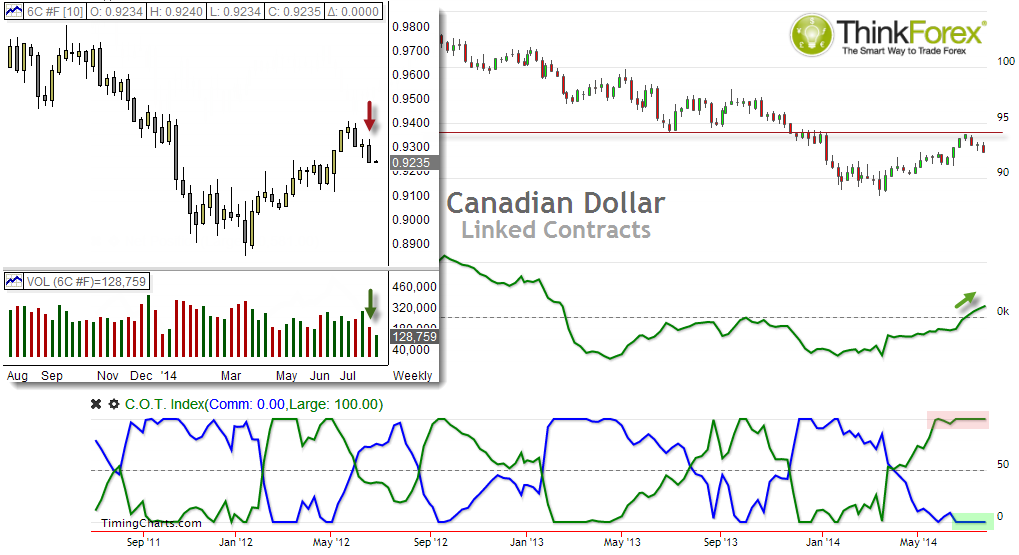

Canadian Dollar Futures

A slightly mixed picture here; Whilst I am satisfied we have seen a sentiment extreme on Canadian Dollar futures after a rejection of 0.94 resistance, we can see that Large Traders have added to their Net Longs and Friday's decline was seen on slightly lower volumes. USDCAD however did close above 1.081 resistance and provides extra confidence that the June low was a multi-month low, but the data here does leave room for some retracements before the movement continues.

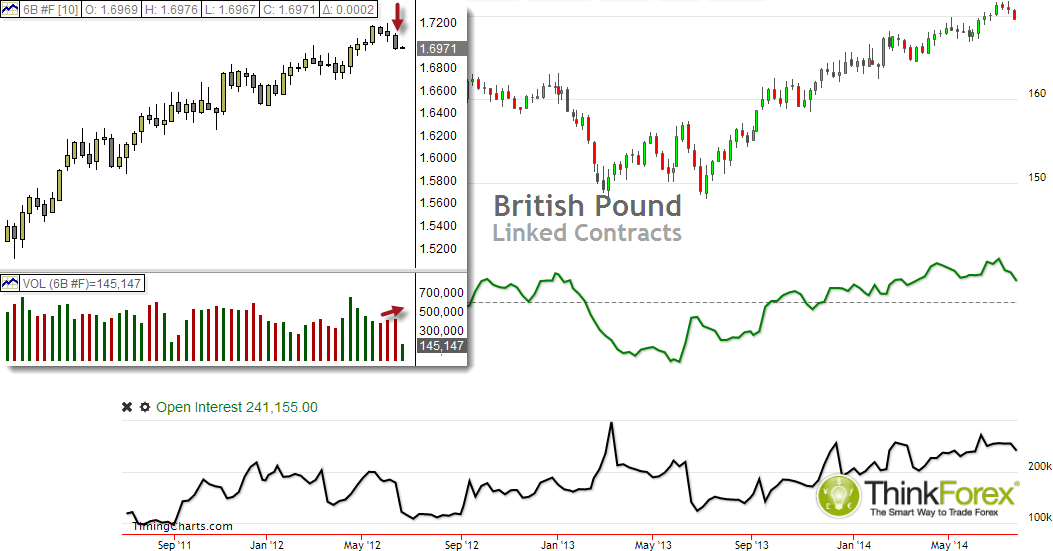

British Pound Futures

A reduction of Net Longs on CFTS data along with an increase of bearish volumes on the Futures last week does leave room for further losses this week for GBP pairs. Open interest however also saw a reduction so I still suspect that current losses are corrective and GBP will resume its bullish structure soon enough.

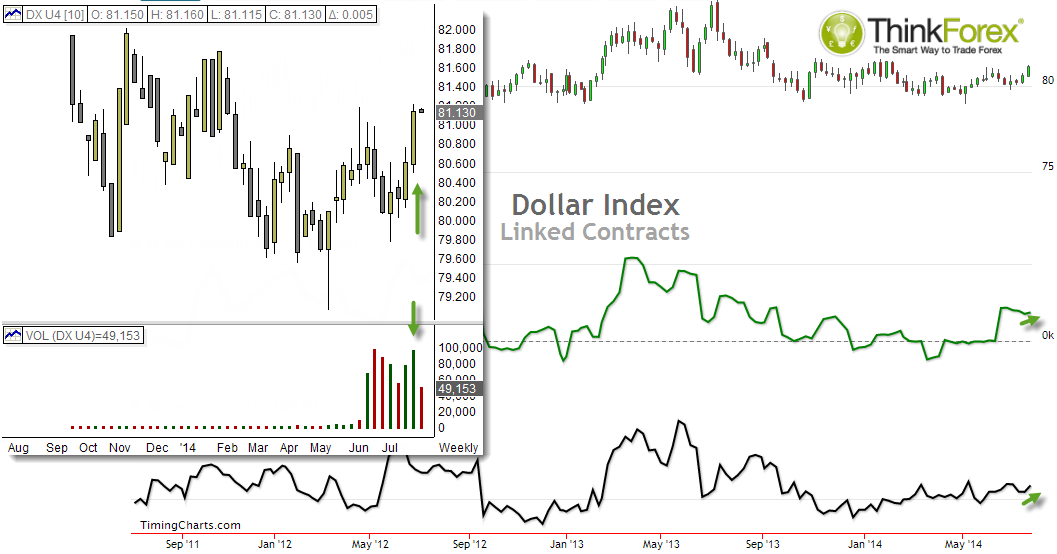

US Dollar Futures

A slight increase in Net Longs on rising Open interest accompanied the break to a 24-week high for the Greenback. Futures volume last week also positive to paint a more bullish picture for the near-term. Friday’s bullish close (not pictures) was seen on lower volumes which leaves room for retracements early this week. Overall the Greenback continues to paint a more bullish picture going forward.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD nears 1.0800 on broad US Dollar weakness

Optimism continues to undermine demand for the American currency ahead of the weekly close. EUR/USD hovers around weekly highs just ahead of the 1.0900 figure.

GBP/USD reconquers 1.2500 with upbeat UK GDP

Following BOE-inspired slump on Thursday, the British Pound changed course and trades around 1.2530. Better-than-anticipated UK GDP and a weaker USD behind the advance.

Gold resumes advance and trades above $2,370

XAU/USD accelerated its recovery on Friday, as investors drop the USD. Dismal US employment-related figures revived hopes for a soon-to-come rate cut from the Fed.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Euro area annual inflation is expected to be 2.4% in April 2024

Euro area annual inflation is expected to be 2.4% in April 2024, stable compared to March. Looking at the main components of euro area inflation, services is expected to have the highest annual rate in April.