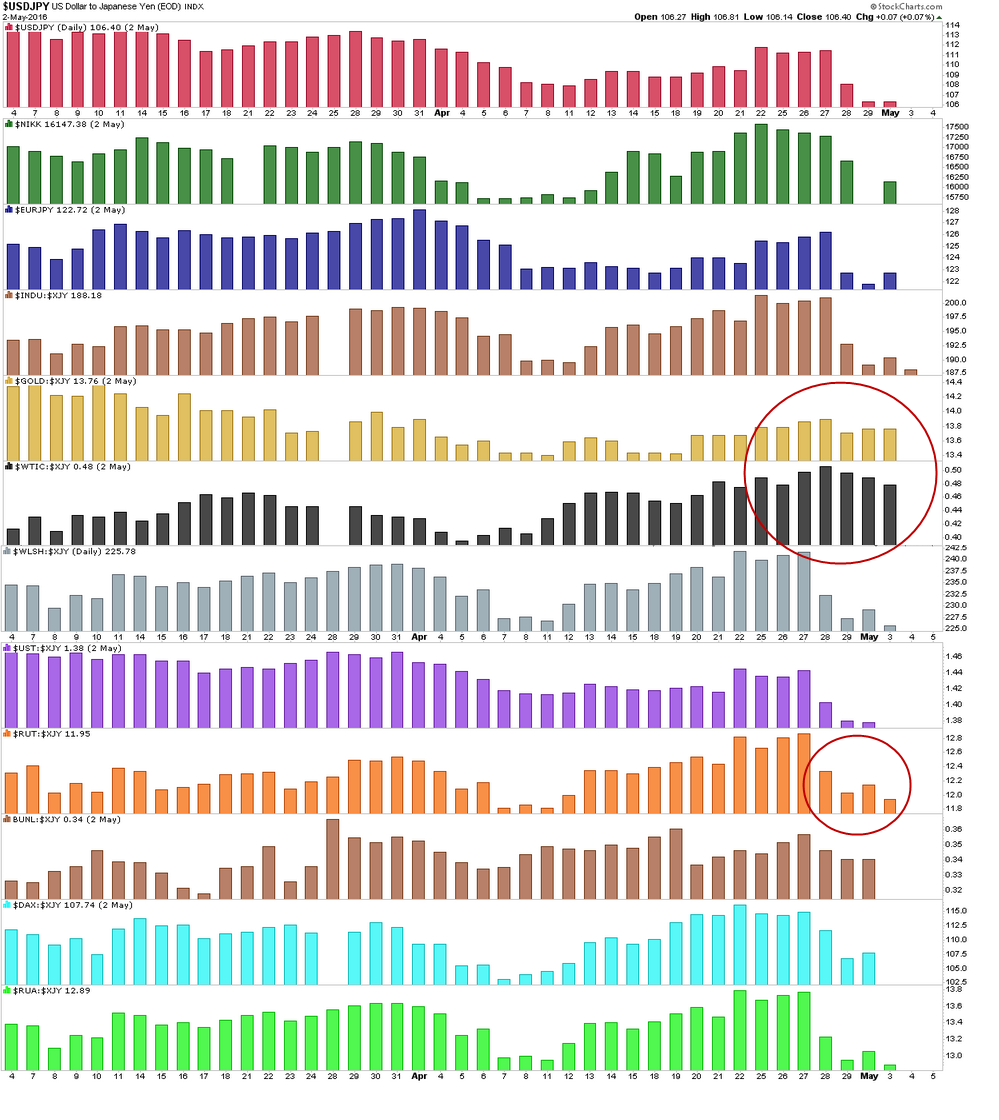

One of the ways we have to monitor current capital flows is looking at development of the yen in recent trading and to track price behavior of some benchmarks priced in the Japanese currency.

On the 22nd, in a knee-jerk reaction to the BOJ headlines on negative interest rates the USDJPY was about to climb back into positive territory for the month, but from the 28th on it has been all downhill after the BOJ disappointed markets by keeping its monetary policy setting unadjusted.

More recently, the Dax and German Bunds found that challenge just a step too far and finished last week with some of the losses recaptured, whereas major currencies such as USD and EUR kept an heavy tone against the yen.

In the equities world, Russel 2000 had similar modest end-of-week recoveries and seemed to contain the damage better of than the and 3000, the broad Wilshire or the Dow Jones Industrials Average.

This hints to what issues are holding the market up, besides from treasuries, notably small-cap stocks considered less risky. Commodities also kept its chin up when priced in yen. In dollar terms, gold flirted with January's highs, and Oil with its highest level since November last year. It is this combination which is casting a shadow on risk sentiment and the one to monitor these days.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.