EURUSD

Pullback from yesterday’s 1.1614 peak found footstep at 1.1468, just ahead of good support at 1.1461 (Fibo 38.2% of 1.1213/1.1614 upleg, reinforced by rising 5SMA. Narrow consolidation (1.1468/1.1509 range) is underway, with spike to 1.1527, showing limited upside attempts for now.

Reversal of daily Slow Stochastic from overbought zone, generates bearish signal and shows more room for extended correction.

Loss of 1.1461 handle, could trigger fresh easing towards 1.1400 (round-figure support) and 1.1367 (Fibo 61.8% of 1.1213/1.1614, reinforced by daily 10SMA, where extended dips should be contained, to keep overall bulls intact.

Conversely, fresh strength above 1.1527 high, would ease immediate bearish pressure, while return above 1.1558 (Fibo 61.8% of 1.1414/1.1468 downleg), is needed to neutralize near-term bears and signal higher low formation.

Meantime, the pair may stay in extended near-term consolidation, awaiting US jobs data for stronger signals.

Res: 1.1509; 1.1527; 1.1558; 1.1580

Sup: 1.1461; 1.1414; 1.1396; 1.1367

GBPUSD

Correction from Tuesday’s peak at 1.4768, extended to 1.4459, where temporary support was found. Subsequent bounce shows signals of fading, keeping 1.4575 breakpoint (former consolidation top / Fibo 38.2% of 1.4768/1.4459 downleg) intact for now.

This keeps downside risk in play for further correction of 1.4088/1.4768 rally, which may extend to next strong supports at 1.4386/75 (daily Kijun-sen / 20SMA) and 1.4296 (Fibo 61.8%) in extension.

Sustained break above 1.4575 is needed to sideline downside threats.

Res: 1.4540; 1.4570; 1.4650; 1.4700

Sup: 1.4459; 1.4400; 1.4375; 1.4330

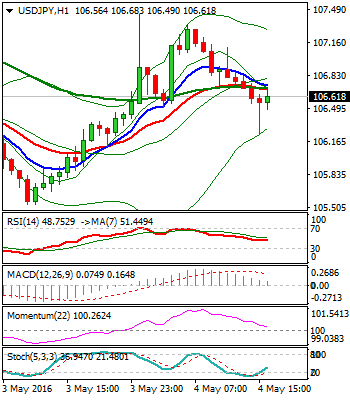

USDJPY

The pair trades in extended consolidation which keeps the price within narrow range, despite spikes to 105.53 and 107.44, which proved to be short-lived.

Overall structure remains bearish and favors fresh bearish resumption after prolonged consolidation, signaled by few long-legged Doji candles.

Bearish action through next support at 105.18 (15 Oct 2014 trough), could extend towards 100.80 (weekly higher base), in the coming sessions.

Alternative scenario needs bounce through session high at 107.44 and close above 108 barrier (near Fibo 38.2% of 111.87/105.53 downleg) to neutralize downside pressure.

Res: 107.44; 107.60; 108.00; 108.70

Sup: 106.23; 105.53; 105.20; 104.10

AUDUSD

The pair remains under pressure and posted marginally lower low today, following yesterday’s sharp fall that generated strong bearish signal on long red daily candle. In addition, fresh weakness probes below daily higher base / daily Ichimoku cloud top at 0.7490/75, with close below here, to signal further bearish extension of short-term pullback from 0.7833 (21 Apr peak).

Next strong support at 0.7448 (Fibo 38.2% of 0.6825/0.7833 rally) is in near-term focus.

However, extended consolidation could be anticipated on hesitation at 0.7475 pivot.

Good resistances lay at 0.7600/33 (Fibo 38.2% of 0.7833/0.7459 / daily 10/30SMA’s bear-cross).

Res: 0.7515; 0.7546; 0.7600; 0.7633

Sup: 0.7459; 0.7448; 0.7400; 0.7327

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

EUR/USD grapples with higher ground as Fed cuts weigh on Greenback

EUR/USD found the high end on Thursday, holding fast to the 1.1150 level, though most of the pair’s bullish momentum comes from a broad-market selloff in the Greenback rather than any particular bullish fix in the Euro.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.