After threatening to break through the support level at 0.93 for the last couple of days, the Australian dollar finally slid lower to below this level and moved towards the previous key level at 0.9220. In the last 12 hours or so however, it has rallied well to return to the 0.93 level where it is presently consolidating. Over the last month or so, it has generally been sliding lower from close to 0.95 down to its present trading levels around 0.93. A couple of weeks ago the Australian dollar surged higher to a one week high near 0.9375, before easing back and then falling sharply. It has done well of late to cling onto the 0.93 level after its sharp fall which saw it move from above 0.9400 down to a seven week low below 0.9240. A few weeks ago it was easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance. The Australian dollar reached a three week high just shy of 0.9480 several weeks ago after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week.

Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

RBA governor Glenn Stevens is "quite concerned" that Australia's unemployment rate has reached a 12-year high. Australia's jobless rate jumped to 6.4 per cent in July, official figures showed, surprising market analysts who have been awaiting the governor's thoughts on the shocking rise. In his semi-annual testimony to parliament on Wednesday, Mr Stevens said he was concerned about the rise but reminded people that the current jobless rate would historically be regarded as low. "I'm quite concerned at the thought that unemployment is higher," Mr Stevens said. "I'd still observe that even on the latest reading, it's not that many years ago that six-point-something was regarded as low. "I regard it as not quite low enough actually, but I think we need to keep a bit of historical perspective here on how high it is." Mr Stevens said the RBA's mandate was to achieve full employment as well as price stability. He said the RBA's two-to-three per cent inflation target framework was a good one for keeping both goals in mind.

(Daily chart / 4 hourly chart below)

AUD/USD August 21 at 23:25 GMT 0.9302 H: 0.9310 L: 0.9237

AUD/USD Technical

During the early hours of the Asian trading session on Friday, the AUD/USD is trading in a small range just above 0.93 after surging higher in the last 12 hours or so. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading right around 0.9305.

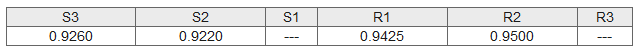

Further levels in both directions:

- Below: 0.9260, and 0.9220.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.