The countdown continues

Yesterday, the euro reversed part of Friday’s tentative rebound against the dollar. The EUR/USD down-move in the morning was technical in nature. The US eco data were mixed and couldn’t help the dollar build out initial gains.

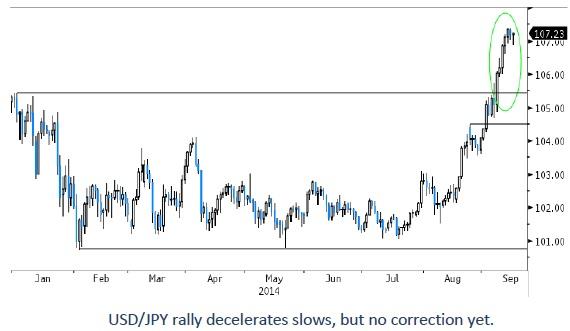

EUR/USD finally settled in the mid 1.29 area, awaiting the key event to come later this week. USD/JPY hovered tightly in the lower half of the 107 big figure.

Overnight, Asian markets remain in wait-and see modus. Most Asian equity indices show limited losses. EUR/USD is little changed in the mid 1.29 area.

USD/JPY tries to move away from the 107 level. BOJ’s Kuroda repeated that the BOJ has still tools available to ease monetary policy, but that it has no plans to ease now. He added that the BOJ is making steady progress in meeting the inflation objective and repeated that the weaker yen is not hurting the economy. So, this is still a ‘Nihil obstat’ for some further yen weakening.

Today, the calendar is only modestly interesting. In Germany, the consensus expects the ZEW investor confidence to decline further, but we see a risk for a better than expected outcome. If so, it might be slightly positive for the euro, but the ZEW is seldom a trend changer. In the US, the PPI is expected little changed and thus unlikely to change the market assessment ahead of the Fed policy decision.

Last week, the market positioned for the Fed taking a small step towards policy normalisation. This caused a rise in core/US bond yields. This move has run its course. So, for now the dollar doesn’t get additional interest rate support. This suggests more erratic-like sideways trading in USD/JPY and EUR/USD in the run-up to the Fed policy announcement. After the Fed decision, attention will shift to the TLTRO liquidity operation and the Scottish referendum. Uncertainty on those issues will probably cap the topside in EUR/USD, unless the Fed is extremely dovish, which we don’t expect. Yesterday’s price action confirmed that the 1.30 barrier won’t be that easily regained.

From a technical point of view, USD/JPY confirmed the clearance of the key 105.44 resistance, opening the door for a new up-leg. The negative impact of the weak US payrolls was limited and short-lived. Better US data and anticipation on the Fed preparing markets for a less expansive policy can still push the pair higher.

At the same time, the yen remains in the defensive as markets see a decent chance of more BOJ easing down the road. We maintain a positive bias on USD/JPY. 110.66 is the next important resistance.

The technical picture of EUR/USD deteriorated substantially after the break below the key 1.3105 level (Sept 2013 low). This level is now the new resistance that will be difficult to regain. The negative deposit rate is a structural negative for the euro. In a longer term perspective, the EUR/USD downtrend is confirmed. 1.2755/1.2662 is the next key support. A more pronounced correction (EUR/USD rebound), is an opportunity to add to EUR/USD short exposure. The euro is currently working off oversold conditions.

Will CPI data break the referendum stalemate?

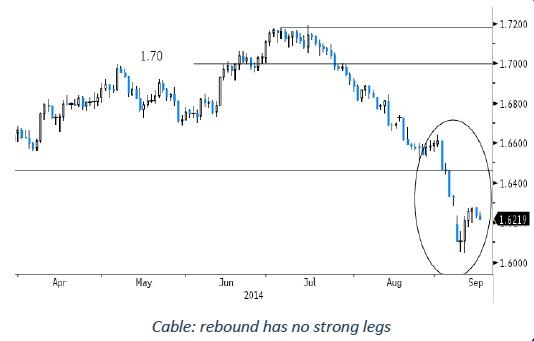

Yesterday, there was again no clear directional move in sterling trading. The UK data have only limited impact on trading these days and there was also little in the way of hard political news on the Scottish referendum. It will be a neck-and-neck race and this uncertainty will only be solved when the final result will be on the screens late on Thursday. EUR/GBP declined temporary to the mid 0.79 area. This was in the first place a euro move, which was undone later in the session. Cable drifted cautiously lower in the 1.62 big figure.

Later today, the UK price data will be published. Normally this is a potential driver for sterling trading as this is key information for the BOE’s policy assessment. The consensus expects a decline from 1.6% to 1.5%, well below the 2% inflation target. We see even downside risks to the consensus. In ‘normal times’ such a scenario should be negative for sterling. However, today the reaction will also be disturbed as investors are focusing on the referendum when managing GBP positions. That said, we still see a chance for sterling to lose ground in case of soft inflation figure.

Uncertainty on the referendum after the recent opinion polls made us change our ST bias on sterling last week. There is a substantial risk that this issue will keep sterling investors side-lined until it is out of the way. We removed our sell-on-upticks bias for EUR/GBP and installed stop loss protection on GBP-longs (both against USD and EUR). We avoid sterling long exposure short.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.