Briefly: In our opinion, speculative short positions are favored (with stop-loss at 1,970 and a profit target at 1,850, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook remains bearish:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

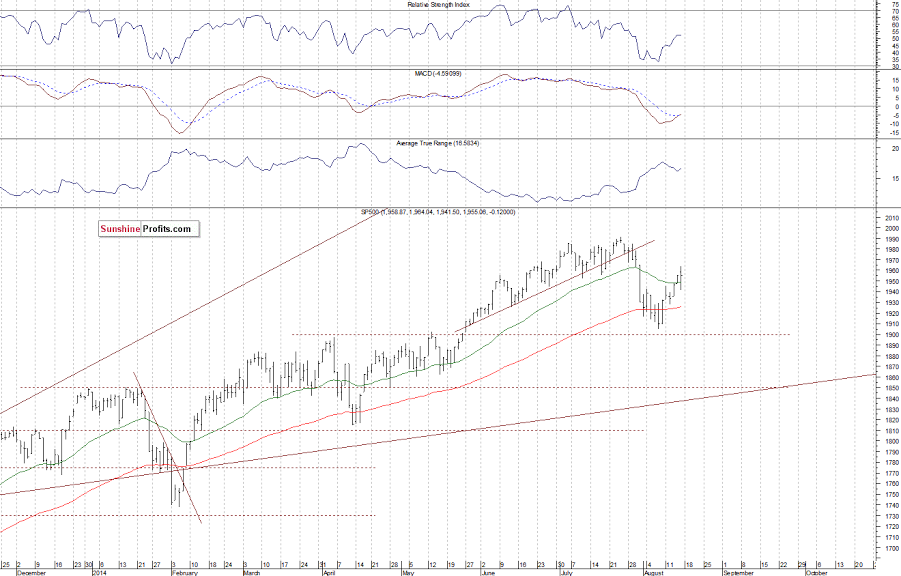

The U.S. stock market indexes were mixed between -0.3% and +0.5% on Friday, following volatile trading session, as investors reacted to some geopolitical news concerning Russia-Ukraine conflict, among others. The S&P 500 index retraced more than half of its late July – early August decline, however, closing slightly below Fibonacci’s 61.8% retracement of 1,958.3 (with the daily high at 1,964.04). The resistance level is at around 1,970-1,980, marked by previous local highs, and the next resistance is at 1,990-2,000, marked by July 24 all-time high of 1,991.39. It still looks like a correction within a short-term uptrend, however, a bullish scenario cannot be excluded here:

Expectations before the opening of today’s session are positive, with index futures currently up 0.5%. The main European stock market indexes have gained 0.6-1.4% so far. The S&P 500 futures contract (CFD) is in a relatively narrow intraday trading range, fluctuating along Friday’s highs. The nearest important resistance level is at around 1,960-1,965, marked by some of the previous local extremes. On the other hand, the level of support remains at 1,940, among others, as we can see on the 15-minute chart:

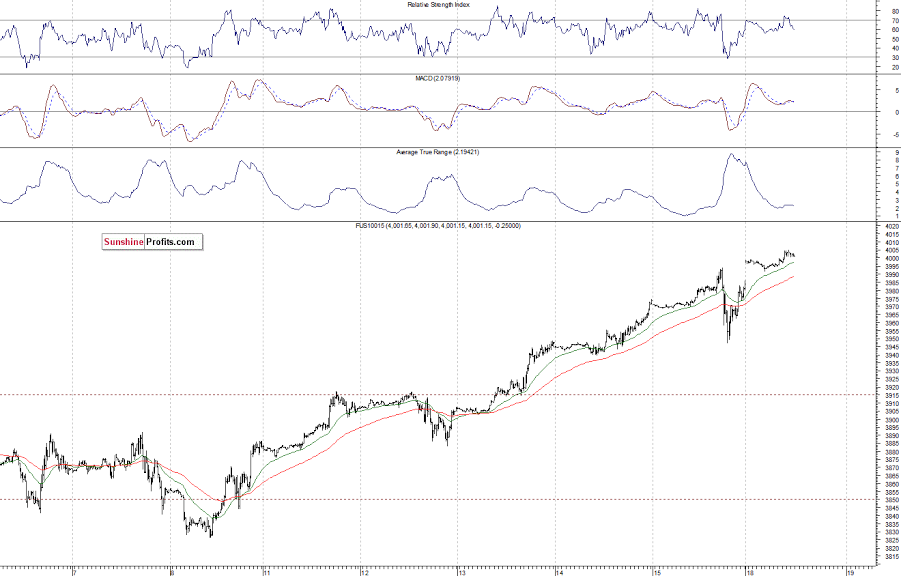

The technology Nasdaq 100 futures contract (CFD) reaches new long-term highs, as it trades close to the level of 4,000. The nearest important support level is at around 3,950-3,970, as the 15-minute chart shows:

Concluding, the broad stock market continues its recent move up, as it retraces more than half of the late July – early August sell-off. Is this a new uptrend or just a strong upward correction? We remain cautiously pessimistic, maintaining our speculative short position, with stop-loss at 1,970 (S&P 500 index). So, the price currently tracks dangerously close to our stop-loss figure. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps to limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.