Daily Forecast - 24 October 2014

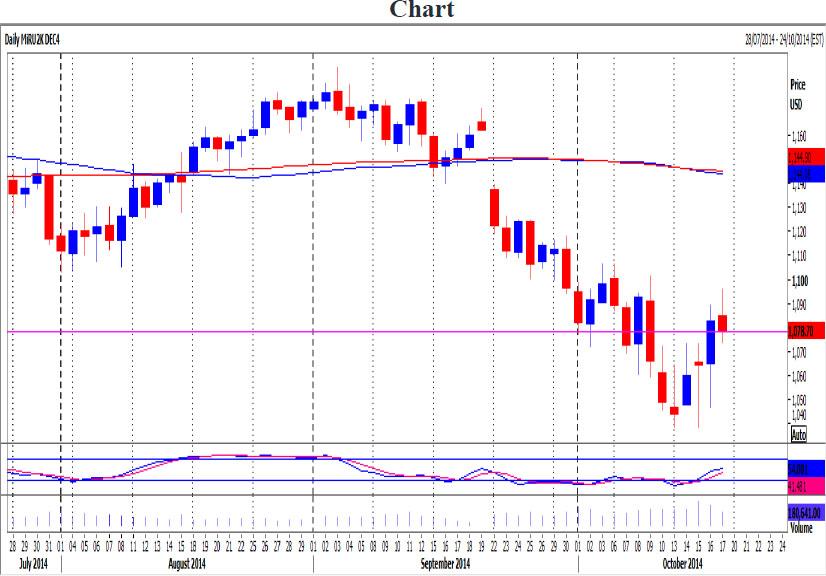

Mini Russell 2000 December contract

Mini Russell unexpectedly beat 1113/15 but shorts from this level were not stopped above 1120. An unexpected break higher today however targets 1124/25 & possibly 1130/31. Exit longs & try shorts expecting a high for the bounce in the bear trend.

Sooner rather than later we expect the bear trend to resume. Downside pressure today targets 1110/09 then good support at 1101/00. Failure here however then targets 1095 & 1089/88. A good chance of a low for the day if we fall this far but be aware a break lower targets 1081/79.

E Mini Nasdaq December contract

E-Mini Nasdaq unexpected break higher beat 4010/12 to reach 4024 but we have backed off sharply. We are overbought now & could hit profit taking. If we hold below 3985/83 this should trigger a move towards 3959/58 & perhaps as far as key support at 3945/43. A good chance of a low for the day but longs need stops below 3939. Be ready to go with a break lower to target 3911/10 then 3905. Any further losses meet good support at 3895/94 & a bounce from here likely at this stage.

Holding above 3985 is more positive & may allow a retest of yesterday's high at 4022/24. A break higher meets strong resistance at 4033. Try shorts with stops above 4040. A break higher again then targets 4047/48.

Emini Dow Jones December contract

Emini Dow Jones held support at 16420/410 & unexpectedly beat 16560/570 to hit our next target of 16690/16700. Prices topped exactly here & being severely overbought now we should turn lower. Already we have hit support at 16515/510 but below here targets 16480. If this does not hold the downside look for a move towards 16380. Good support from here down to 16350 but any longs need stops below 16320. A break lower could then target 16245.

Immediate resistance at 16600 but above here we could retest 16690/16700 for a selling opportunity with stops above 16750. A break higher however could target 16780/85 then 16860.

EURUSD

EURUSD became severely oversold short term & bottomed at 1.2612. A short term bounce halted below resistance at 1.2688/93 however. Immediate resistance at 1.2686/92 again today but be aware a break higher targets 1.2730/40 for a selling opportunity with stops above 1.2760.

Outlook remains negative in the bear trend. A break below immediate support at 1.2620/12 keeps the market under pressure to target 1.2605/00 then 1.2585/80. If this does not hold the downside in the bear market, look for 1.2550/45 then a retest of October lows at 1.2500.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.