Market Overview

Sentiment has swung more positive to start the final quarter of the year as reports out over the weekend suggested that Deutsche Bank might be able to re-negotiate its fine with the DoJ (US Department for Justice) down from a crippling $14bn to a relatively more manageable size, reported in the German press as being $5.4bn. Although by no means confirmed, the news is helping to improve confidence that one of Europe’s largest banks will manage to avoid the worst case scenarios being banded around last week. This means that risk appetite is more stable on Monday morning. Other news over the weekend could be more wide reaching though as the UK’s Conservative Prime Minister Theresa May announced that steps would be put in motion the UK’s exit from the EU. A Parliamentary Bill to repeal the 1972 European Communities Act by April or May would put the UK on a more solid path towards Brexit. Sterling has slipped back on the news, but the selling pressure has not yet taken it back towards the lows hit in July in the wake of the referendum.

Wall Street closed higher on Friday with the S&P 500 up +0.8% with Asian markets also more confident today (Nikkei +0.9%). European markets are a little more cautious in their optimism early on but are still trading higher. In forex markets sterling is the major underperformer trading around 50 pips off against the dollar, with the dollar performing well across the board. The dollar strength is also a further drag on commodities with precious metals slightly weaker, and oil also down marginally.

The first trading day of the month is PMI day and although China is on holiday all week, the Japanese manufacturing data was mildly better than expected. The final Eurozone Manufacturing PMI is at 0900BST (52.6 exp) with the UK Manufacturing PMI at 0930BST and expected to continue last month’s positive performance (although slightly lower) at 52.1 down from 53.3. The US ISM Manufacturing is at 1500BST and is expected to move back above 50 to 50.4 (49.4 last month).

Lucky 8 – FX Trader of the Year 2016 competition update

Today is the first day of our new competition which we will be running throughout October. I will be giving daily updates on how the 8 instruments of the week are performing.

-

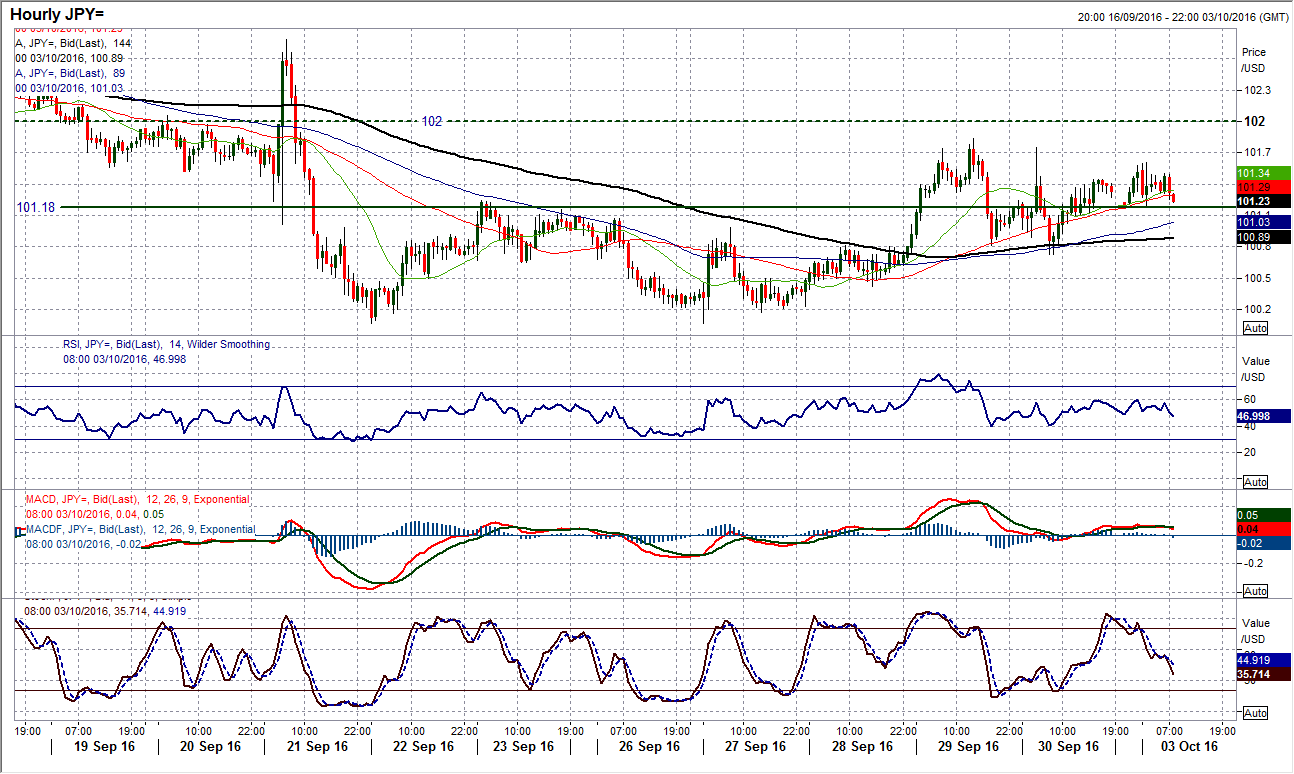

USD/JPY – The bulls are looking to push the market towards a 102 pivot with the resistance at 101.85 important near term for a potential breakout. Support at 100.80 is acting as a floor, a breakdown opens 100.40 but the market continues to range near term (see below for more detail).

-

AUD/USD – Is the Aussie topping out in front of the RBA? The high at $0.7710 has drawn a correction to break the uptrend. Another lower high under $0.7688 could pile the pressure on $0.7590 support again. $0.7670 is resistance today with $0.7635 being initially supportive.

-

AUD/NZD – Support around 1.0470 protects a big head and shoulders top completing. Another lower high under the 1.0555 pivot could pressure for a corrective move. Key resistance at 1.0585.

-

GBP/JPY – The market has started to move sideways but there is a slight bearish drift that could be coming back to test 130.40 support. A breach would re-open 129.60. Resistance comes in at 131.95, with 132.40 now key near term.

-

USD/SEK – The positive momentum continues to post higher lows and upside pressure for a clear break above 8.600 is building. Corrections are being bought into with support at 8.5555 and 8.5375 now key.

-

US30 (Dow Jones Industrial Average) – An extremely choppy range play has formed between 17,992/18,450 with hourly momentum suggesting to play the range. Above 18,370 re-opens 18,450 but expect the range to continue.

-

Silver – The medium term range continues with technical indicators increasingly neutral. $19.20 is a pivot point, with support at $18.89 preventing a move back to $18.50

-

Coffee (KCc1) – The corrective candles are racking up on the daily chart and with momentum slipping away a breach of 149.00 would open 147.00 and then 145.00. Resistance at 154.95 has held back the bulls for the past week.

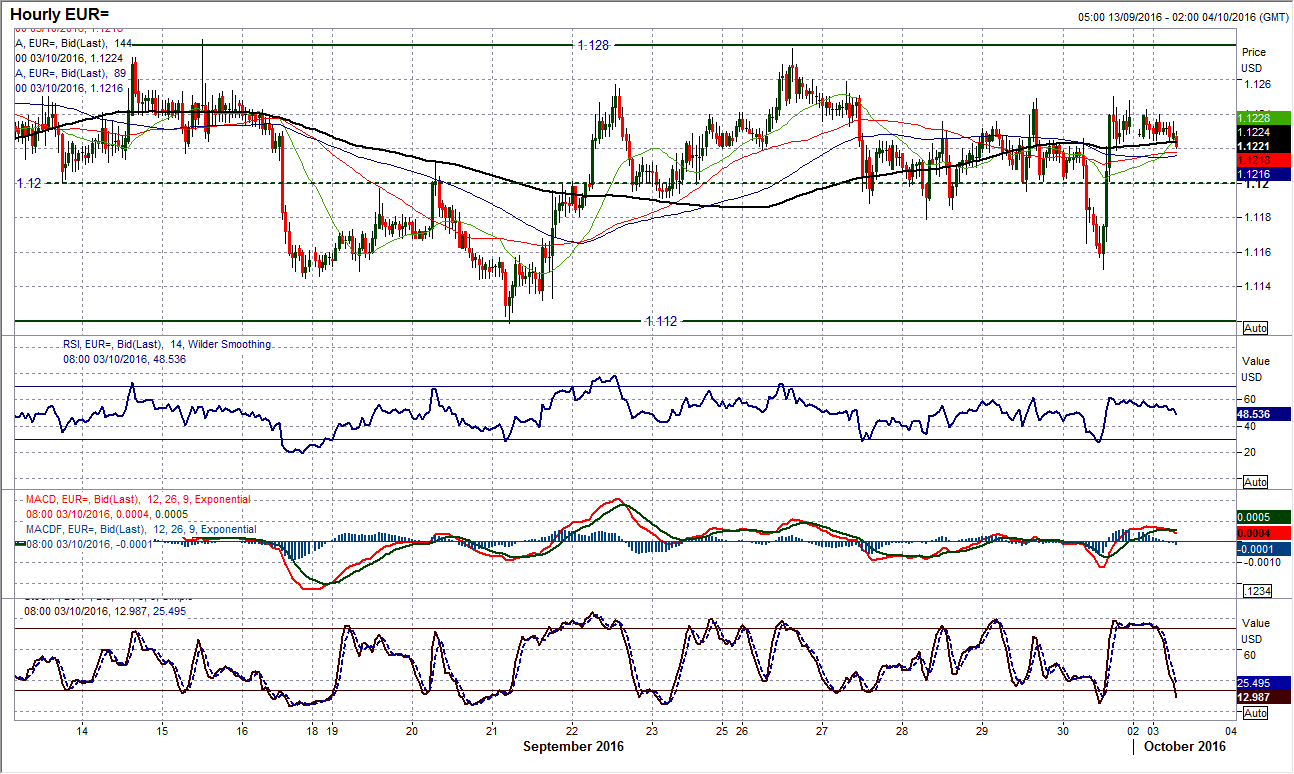

EUR/USD

Despite the fact that volatility on the euro ramped up significantly with the fears surrounding Deutsche Bank that really took hold on Friday, the euro still remains very neutral on the technical outlook. As I have said previously, although the bulls may be feeling a touch more happy, the fact that the significant overhead supply between $1.1285/$1.1325 is close, means that upside potential for the bulls in this phase remains limited. The Stochastics have a slightly positive configurations whilst the RSI and MACD lines do not show the prospect of any imminent breakout. I continue to expect the market to trade within the confines of the recent range between $1.1120/$1.1325, with the downtrend since April today providing resistance at $1.1265. The hourly chart shows that despite Friday’s big swings the outlook remains neutral near term.

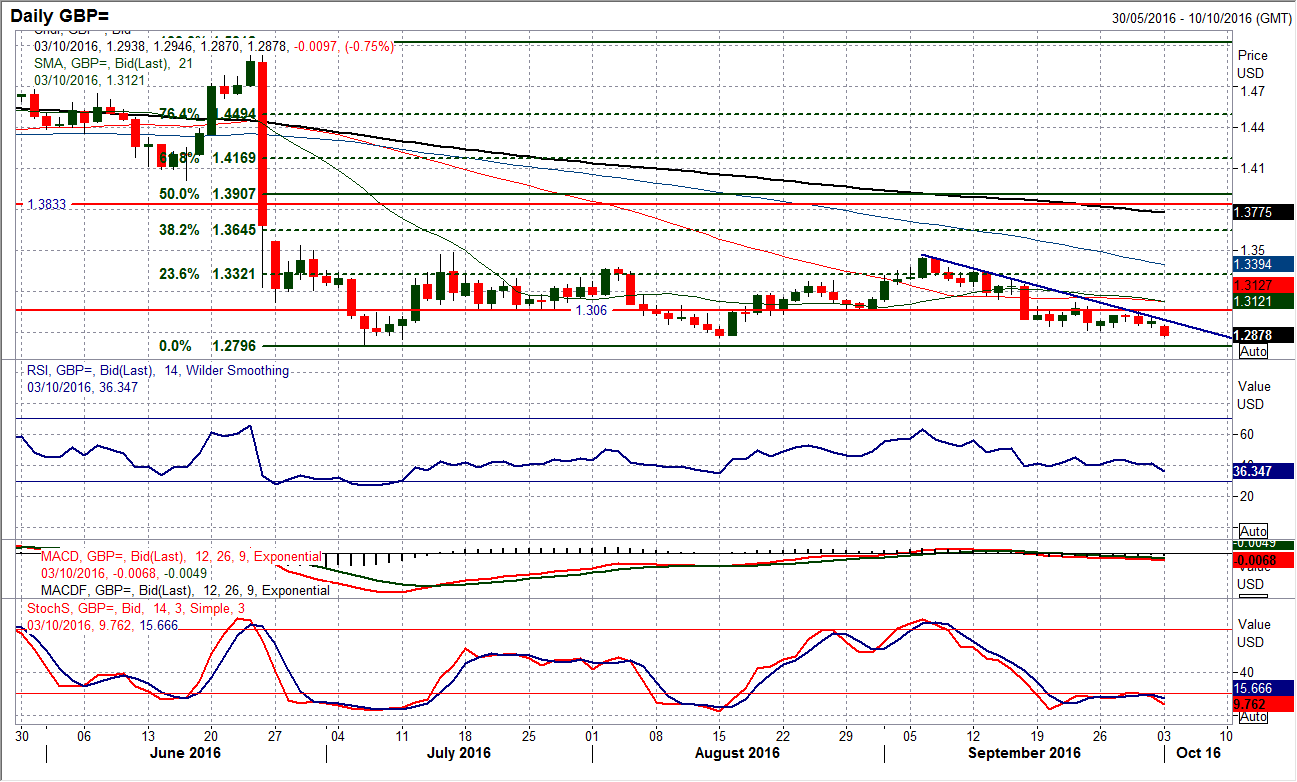

GBP/USD

With talk of a “hard Brexit” and legislation to begin the process of a move to trigger Article 50, sterling has begun the new quarter under pressure. The technical downtrend in place for the past few weeks continues to drag the price lower and the market continues to post lower highs with the $1.3060 pivot band key. The intraday support at $1.2912 was breached in early Asian hours (on thin trading) and as the European traders have come in this morning the price is getting hit again to confirm the move in what is likely to be continued pressure today. The daily technicals are deteriorating again with the Stochastics turning lower and RSI looking to move back below 40. The turn lower below $1.2912 now opens $1.2863 and a likely test of $1.2796 the key post-Brexit support. The hourly chart shows more of a bearish bias with a resistance at $1.3022.

USD/JPY

The strengthening dollar managed to form four consecutive recovery candles in the latest run of sessions and the market is once more looking to test the barrier of the long term downtrend. This recovery is showing with a confirmed buy signal on the Stochastics whilst also posting a closing price back above the near term resistance at 101.20. The downtrend comes in at 101.90 today which will be a target, but the bigger resistance is at 102.80 which was the high on the day of both the BoJ and FOMC meetings in September. The hourly chart shows that the recovery is posting higher lows and 100.75 will now be supportive whilst all the hourly moving averages are rising. Thursday’s reaction high at 101.85 coincided with a test of the downtrend so is clearly an area of interest near term.

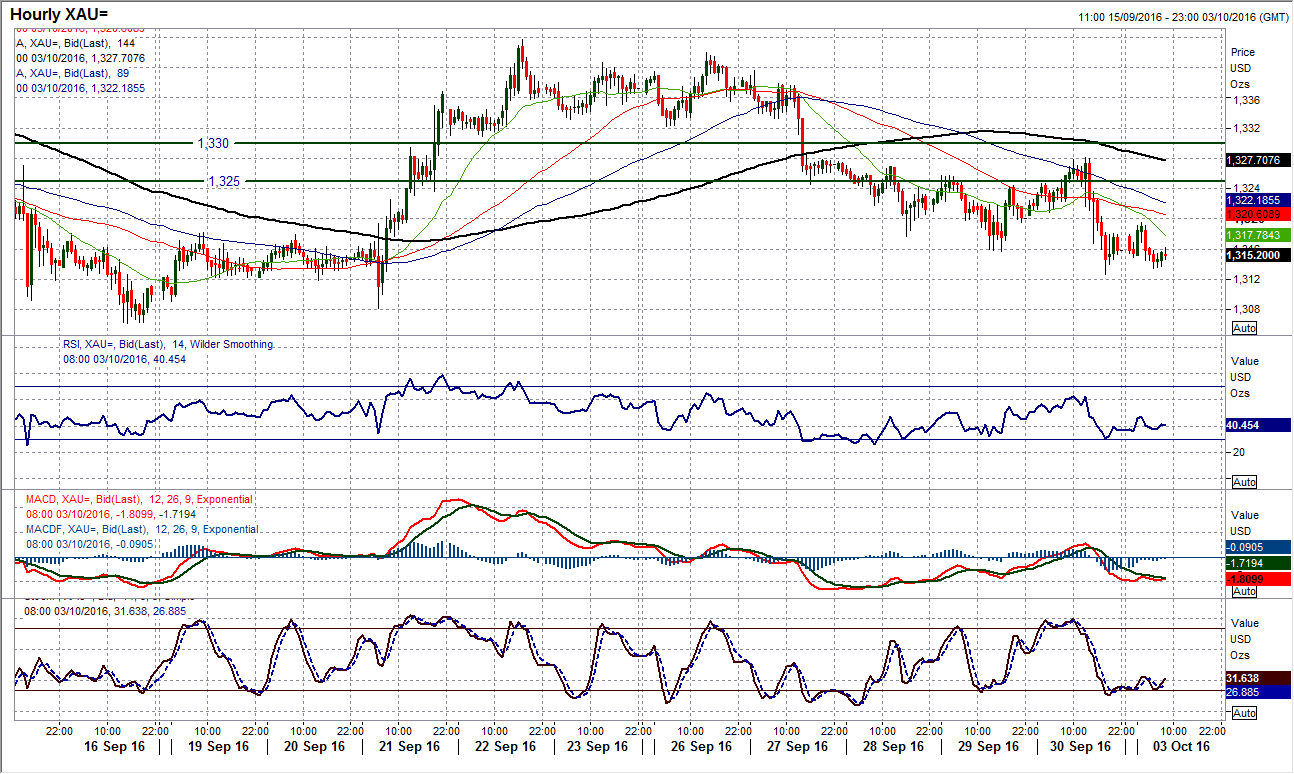

With four consecutive bear candles in a row, the near term correction within the medium term range now seems to be breaking down the longer term bull arguments. The uptrend intact since December has been broken whilst the 89 day moving average which has also been supportive of the past three rallies has also been broken. However, just because the longer term bulls have lost control, it does not mean we need to turn bearish, just that the medium term consolidation has gone on longer than would have been ideal. However it does now put added pressure on the support above $1300 as a breach would be a big top pattern now. The recent correction has continued in the early moves today and the Stochastics and RSI are in decline, however, the selling pressure is not dramatic and does not look on the hourly chart as though there is an appetite to break the medium term range The hourly chart shows the hourly RSI holding above 30 with the hourly Stochastics also not dramatically bearish. A test of the range support that starts with $1308 before $1306 and the key low at $1302. The pivot band $1325/$1330 is again acting as a near term ceiling.

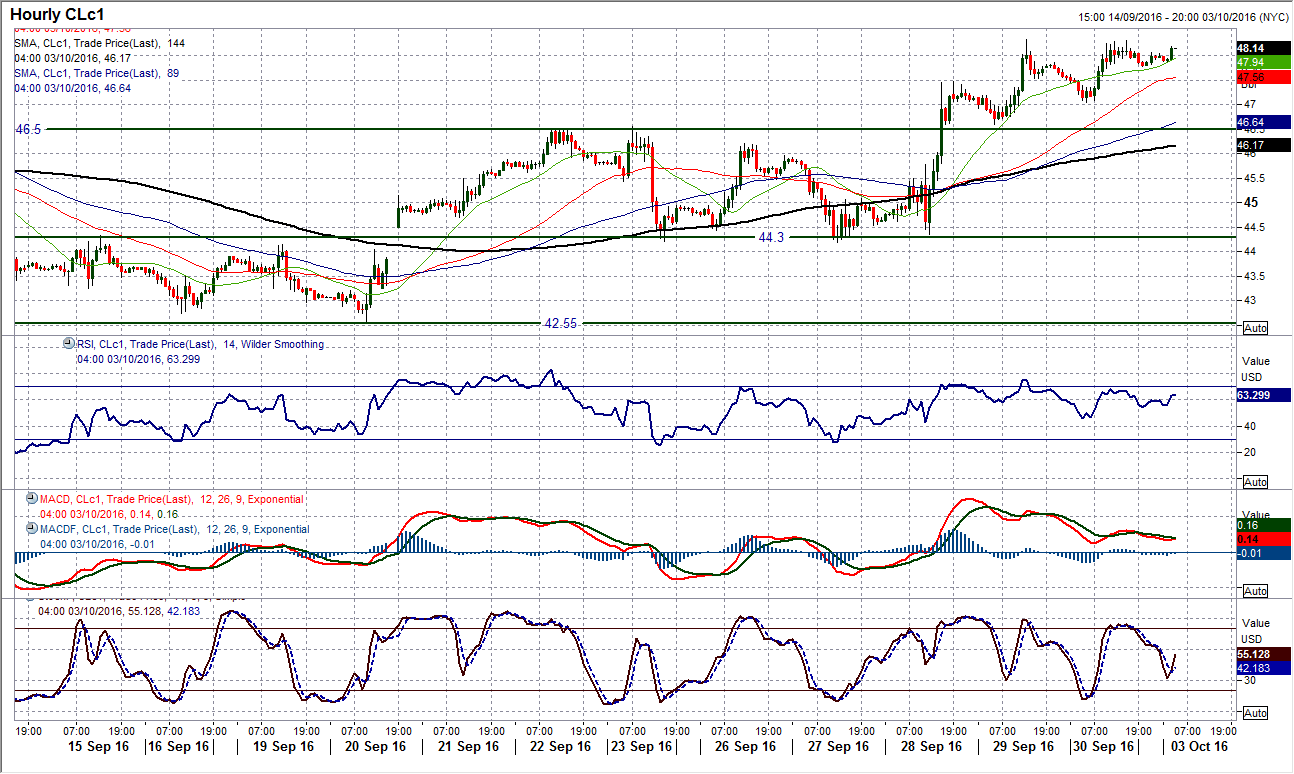

WTI Oil

The bulls fought back well on Friday (helped by the gradual improvement in general risk appetite throughout the session as Deutsche Bank rebounded) and posted another positive bull candle. The run higher in the wake of the OPEC agreement continues although the pace is slowing. Despite this, the Stochastics (which are the most sensitive of the momentum indicators) are in strong advance now and the market is consolidating its breakout above $46.50. This old resistance was a high from a couple of weeks ago and has provided the floor for a pullback in the wake of the OPEC agreement. This now will become an increasingly important support this week. The breakout above the downtrend also became supportive on Friday and is now around $47.00 today, whilst the hourly chart shows $46.50/$47.00 as a support band now as intraday corrections are bought into. The bulls will continue to eye the key August high at $48.75 as a breakout would really open the upside once more.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.