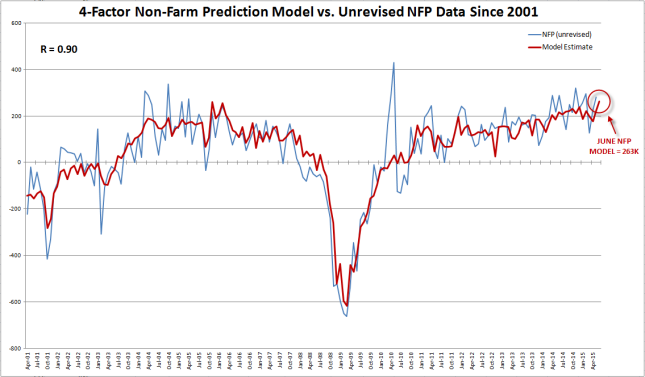

The June Non-Farm Payroll report will be released tomorrow at 8:30 ET (12:30 GMT, 1:30pm BST), with expectations centered on a headline print of 231k after last month’s stellar 280k reading. My model suggests that the report could exceed these expectations, with leading indicators suggesting a June headline NFP reading of 263K.

The model has been historically reliable, showing a correlation coefficient of 0.90 with the unrevised NFP headline figure dating back to 2001 (1.0 would show a perfect 100% correlation). As always, readers should note that past results are not necessarily indicative of future results.

Source: Bureau of Labor Statistics, FOREX.com

As the chart above shows, this month’s projected 263k reading is actually the highest expected monthly NFP figure at any point in the last 14 years, according to the model. While the historically correlated ISM Services PMI employment survey will not be released until next week, all the other labor market indicators improved last month. The ISM Manufacturing PMI employment component recovered back to 55.5 while the ADP Employment report rose to 237k; both of these readings are year-to-date highs. Meanwhile, initial jobless claims continued to march lower, hitting an historically extreme low level of just 268k during the survey week.

Trading Implications

Despite the ongoing drama in Greece, many traders are eyeing September as a likely time for the Federal Reserve to start hiking interest rates. Therefore, the jobs report will be interpreted through the lens of monetary policy. Three possible scenarios for this month’s NFP report, along with the likely market reaction, are shown below:

As always, traders should monitor both the overall quantity of jobs created as well as the quality of those jobs. To that end, the change in average hourly earnings could be just as critical as the headline jobs figure, especially after last month’s strong +0.3% m/m reading. As long as average hourly earnings can meet the +0.2% m/m expectation, it would strengthen the case for a September rate hike by the Federal Reserve. Historically, USD/JPY has one of the most reliable reactions to payrolls data, so traders with a strong bias on the outcome of the report may want to consider trading that pair.

Though this type of model can provide an objective, data-driven forecast for the NFP report, experienced traders know that the U.S. labor market is notoriously difficult to predict and that all forecasts should be taken with a grain of salt. As always, tomorrow’s report may come in far above or below my model’s projection, so it’s absolutely essential to use stop losses and proper risk management in case we see an unexpected move. Finally, readers should note that stop loss orders may not necessarily limit losses in fast-moving markets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.