Target Trading in the Forex week of May 8th, 2016 EU,UJ,GU,AU

$EURUSD

What ProAct Forex Target Traders See: We are currently sitting @ 1.1404 in a potential reversal. As long as USDX is strengthening we are looking for a continuation move down to the 0.500 Fibo@ 1.1148 after a wave 2 is printed. A failure to break the 0.382 Fibo @ 1.1223 would indicate more ranging. The average daily true range (ATR) for the pair currently is 86 pips.

————————————————————————--

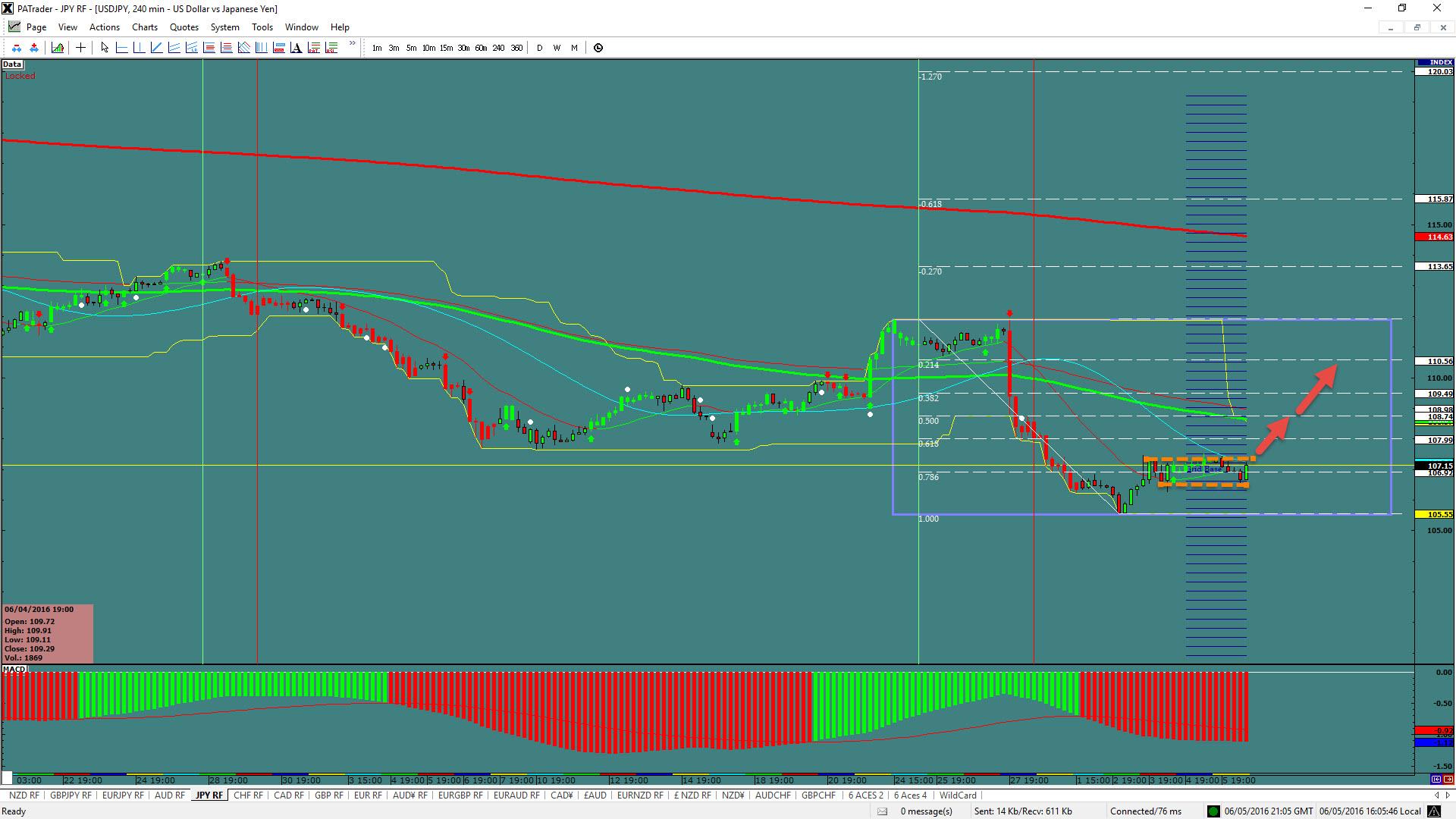

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 107.15 with a bottom in place. We are looking initially to the 0.500 Fibo @ 108.74 with a continuation to the 0.214 Fibo@ 110.56. The average daily true range (ATR) for the pair currently is 126 pips.

——————————————————————————–

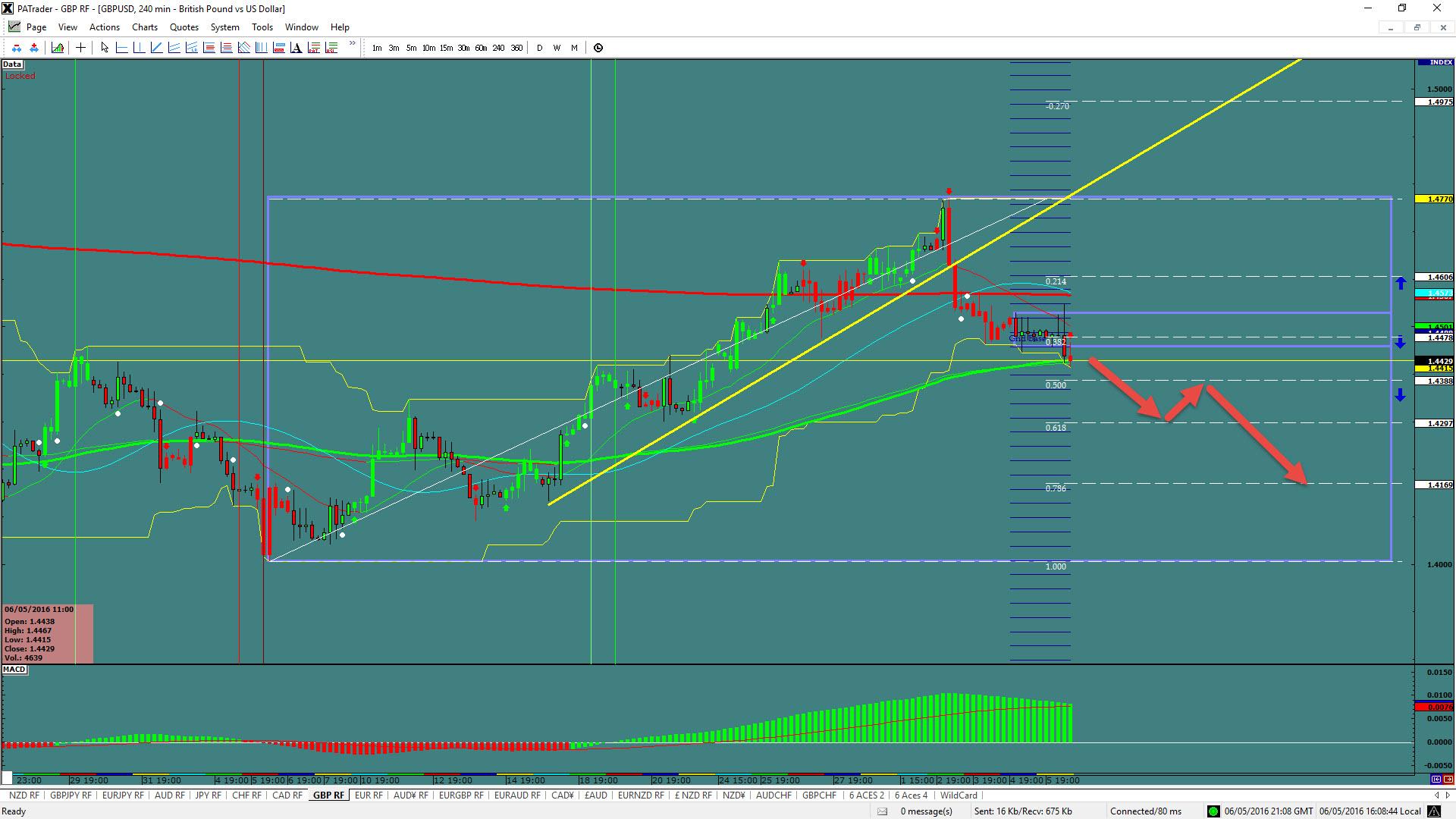

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently @ 1.4429 and in a large range. We are looking initially to the 0.618 Fibo @ 1.4297 and a bounce there before a continuation to the 0.786 Fibo@ 1.4169. The average daily true range (ATR) for the pair currently is 119 pips.

——————————————————————————–

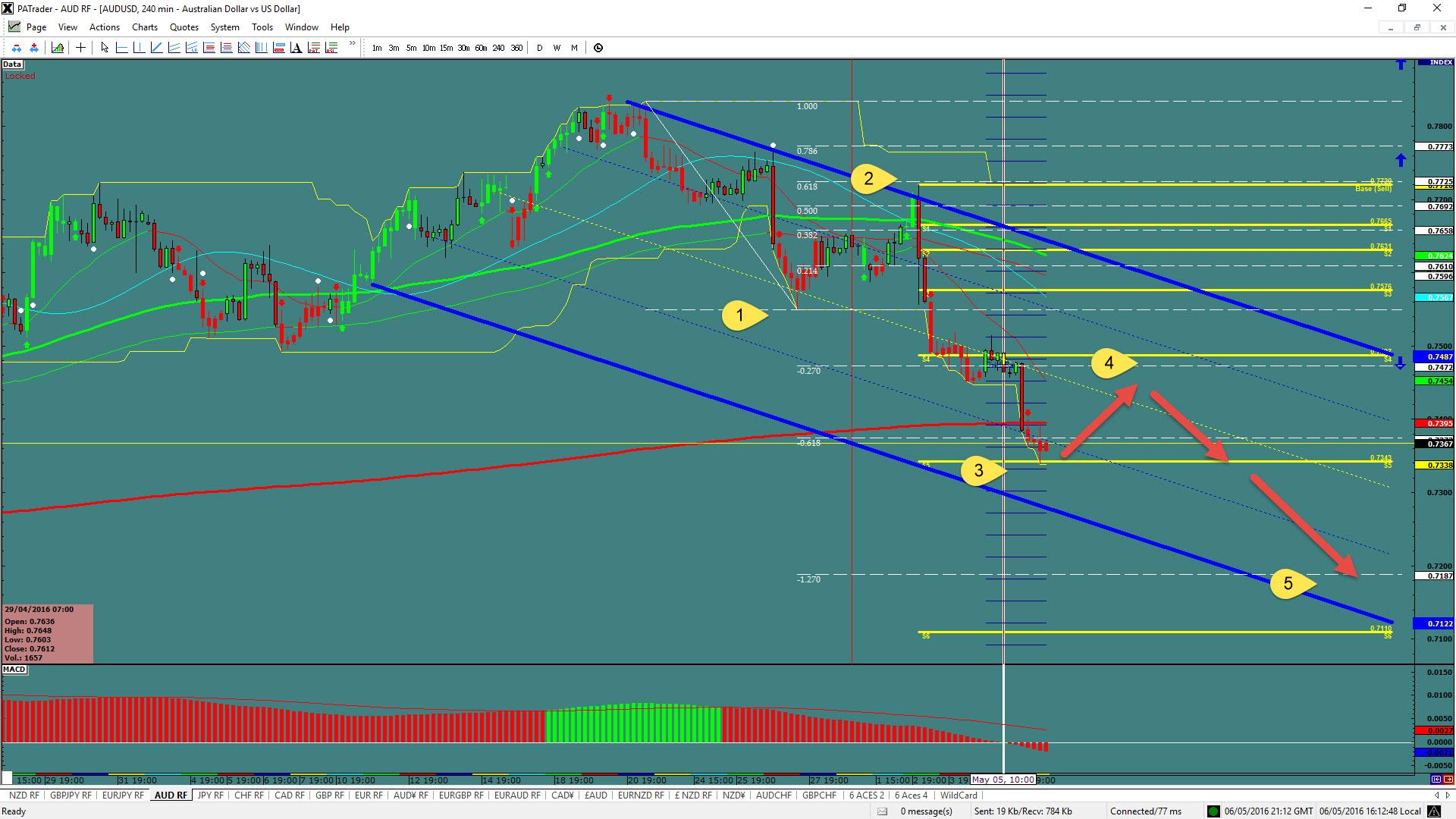

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7367 and in possibly finishing a 3rd wave. We are looking for a bounce to complete the 4th wave and then a continuation move down to the bottom @ 0.7187. The average daily true range (ATR) for the pair currently is 97 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.