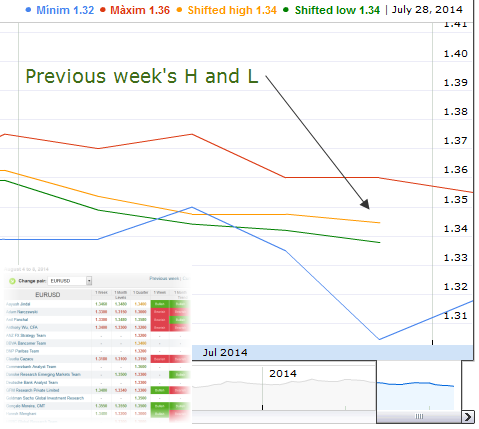

EURUSD opens the week in the 1.3420s, largely unchanged on the previous week resulting in a potentially bullish Doji candle, sitting on the weekly 200-SMA. As a reaction to this indecision pattern, forecast averages also consolidated, and the range between the highest and the lowest contribution to the poll shrinked, mostly because sub- 1.32 numbers almost vanished. On the upper side, not many participants were keen to bet above 1.35. Therefore 1.35 should act as psychological resistance. Sell orders on bounces will tend to put their stops above that level.

The skewness: -0.5 a little bit up, close to 0 means that the tails on both sides of the mean balance out, which is the case both for a symmetric distribution. The slightly negative touch means traders are more inclined towards lower prices. In the 1-quarter forecasts skewness has not been negative in 2014, what can be interpreted as a migration of the whole poll towards lower levels, not just a few participants- a quite negative sentiment for EUR/USD.

Kurtosis in the short-term, which describes the shape, and in particular the "peakedness" of that dataset, dropped from 2 the week before to almost 0, meaning there is less variance or extreme deviations among forecasters.

The bias: Short-term sentiment is negative but not at an extreme. Mid-term sentiment, in turn, was above 50% last week, a situation which is associated with swing lows during the bull market displayed in EUR/USD since the lows of 2012. Long-term bulls until now sidelined probably started buying at 1.34, the level they considered to be fair value few weeks ago. The long-term bearishness is recovering from a 11-week low printing 4 weeks to the upside.

What does this mean for traders? The market looks like it is set up for a small short squeeze, the only situation I would go for selling. The first short-term set-up may look like a bearish divergence if we infer how MACD and RSI oscillators may develop below 1,35. An additional sellable point would be on a break above the downward slopping trend line, coincident at 1.35 by end of the week.

Note: The Weekly Sentiment Report provides a breakdown of the data published in the Currencies Forecast Poll through the use of descriptive statistics. The Currencies Forecast Poll is published every Friday at 17:00 Central European Time by FXStreet and aggregates the forecasted values from individuals and companies that were reported from Wednesday to Friday of the same week.The data represents what direction members feel the market will be in the next week, one month and three months.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.