Fundamental Forecast for British Pound:Neutral

Price & Time: GBP/USD Bucking the Trend?

Pound May Overlook UK GDP Upgrade, Aussie Dollar Drops on Capex Data

For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

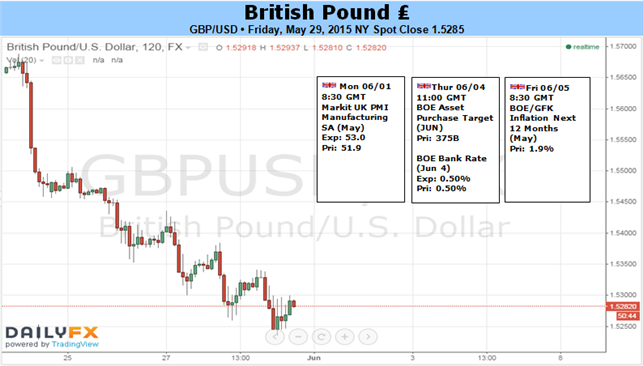

GBP/USD remainsat risk of facing a further decline in the week ahead should the fundamental developments coming out of the U.K. & U.S. heighten bets of seeing the Federal Reserve normalize monetary policy ahead of the Bank of England (BoE).

The BoE’s June 4 meeting may spur a limited market reaction as the central bank is widely expected to retain its current policy, and the lack of fresh central bank rhetoric may put greater emphasis on the U.S. data prints as Fed officials continue to see a rate hike in 2015. As a result, major economic developments coming out ahead of the Federal Open Market Committee’s (FOMC) June 17 interest rate decision may play an increased role in driving market volatility as BoE members show a greater willingness to normalize monetary policy in 2016.

However, the ongoing slack in the U.S. economy may continue to produce a mixed batch of data prints, and the Fed may largely discuss a further delay in liftoff as disinflationary environment undermines the central bank’s scope to achieve the 2% target for price growth. At the same time, positive developments coming out of the U.K. could highlight a tightening race between the Fed & BoE as Governor Mark Carney sees the spare capacity being fully-absorbed over the next 12-months, and we may see a growing dissent within the Monetary Policy Committee (MPC) in the coming months as a growing number of central bank officials prepare households and businesses for higher borrowing-costs.

Nevertheless, the recent string of lower highs & lows in GBP/USD raises the risk for a further decline in the exchange rate, and the pair may continue to give back the rebound from 1.4564 (April low) as it fails to retain the bullish formations carried over from the previous month. In turn, the next downside region of interest comes in around 1.5190, the 50% Fibonacci retracement from the April advance.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.