This Week's Highlights

Happy Halloween

Euro hit by poor data

US data dominates

FX Market Overview

Happy Halloween or All Hallows Eve; an event which is being more widely marked in the UK than it has in decades. It does seem off that what started as a celebration of departed loved ones has turned into a fright night when kids demand goods with menaces. Good luck with the Trick or Treaters.

In the financial markets, it is the last day of the month and that will cause some volatility but there are other reasons for traders to be active.

It has been a really bad week for the Euro. German retail sales slumped, the ECB is being battered by its critics for doing nothing to stimulate growth and this morning's Italian unemployment figure was the worst on record. We will get Eurozone inflation and unemployment data this morning and it could well rock the euro unless the inflation data is at least above 0.3% growth on the year. We will find out at 10:00 am UK time.

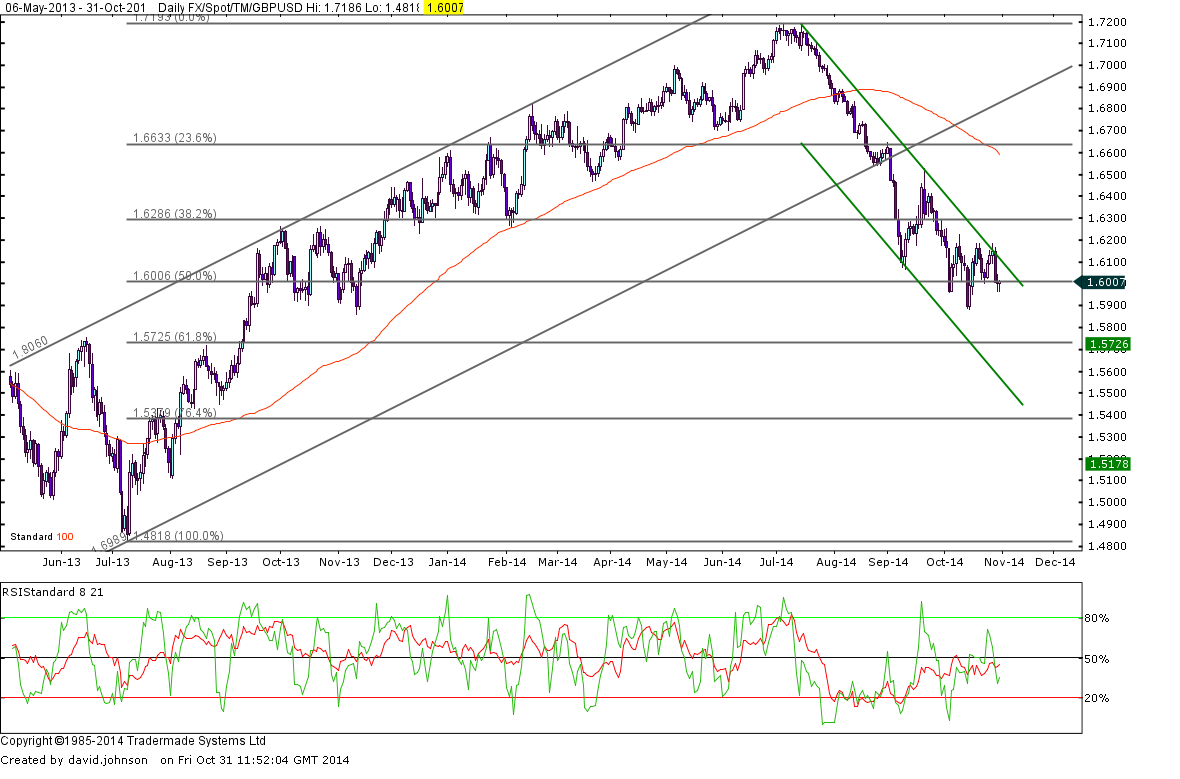

Sterling is still in a holding pattern against most other currencies. Against the Euro it seems to have its braces caught on the €1.26 handle and against the US Dollar, $1.60 is proving a magnet. This has been a week in which UK data has been scant so the path the Pound has taken has been dictated by external events to a large degree.

US data has also been in meagre supply but we will get wages, income and expenditure data this afternoon which may help the Federal Reserve with its interest rate plans. They finalised their bond buying program this week but have yet to determine when they will start really tightening the money supply with interest rate hikes. However, they have shown confidence in the strength of the US recovery. That is slightly ill placed confidence in many analysts' minds but the US Dollar did strengthen on that statement. This afternoon also brings both business and consumer confidence indices so the USD will have a lively afternoon.

The Canadian Dollar, which has benefitted from this week's USD strength, faces the Canadian economic growth data this afternoon. Most forecasters believe the Canadian economic will be confirmed to have stagnated and that isn't good for the loonie. However, this data is for August and things may well have moved on since then.

We heard overnight that the Bank of Japan added to its bond holdings. That has the side effect of weakening bond yields and the extra effect of weakening the Japanese Yen. I am sure that was not their intention (he wrote with an ironic smile) but we have seen the Yen drop against the Pound and the US Dollar in early trade.

Next week brings purchasing managers indices from all over the world and central bank activity from the UK, Australia and others. It also beings the employment reports from the US, Canada Australia as well. We will be busy bees won't we.

A quick reminder that US and Canadian clocks go back this weekend (enjoy the extra hour in bed or in the club dependent on your lifestyle) and I'll leave you with news that the town of Vendargues near Montpellier in the South of France has banned people from wearing clown outfits and masks. Personally I would ban them anyway because they give me the creeps but this ban is due to a number of violent assaults by clown-mask-wearing attackers. So the town's Mayor, Pierre Dudieuzere, has made it an offence to be in public in an evil clown outfit. I might go there on holiday.

Currency - GBP/Australian Dollar

Next week brings the Reserve Bank of Australia's interest rate decision and the RBA is expected to keep their base rate on hold, just like the New Zealand central bank did a few days ago. Slowing growth in China (Australia's Number 1 export market) and a drop in oil prices look set to both lower demand for Australian exports and lower inflation within Australia. That takes the pressure off the RBA to raise interest rates and weakens the Australian dollar as well. Estimates vary but the fact that oil is at 2010 levels could knock 0.3% off Australian inflation figures and that is enough breathing space to ensure no interest rate hikes for up to a year. So, whilst the chart above appears to flag a fall in the Sterling – Australian Dollar exchange rate to the bottom of the current range; circa A$1.8050, the medium term direction is still upward. I think we can use a range of A$1.80 to A$1.84 for most purposes.

Currency - GBP/Canadian Dollar

The strength of the US Dollar over the last few days has swept the Canadian Dollar along with it. But the support for Sterling hampered the Canadian Dollar's gains against the Pound. Then, when the Canadian GDP data was published at 12.30GMT, this exchange rate shot up by a cent in no time at all. A small but significant decline of 0.1% was the cause. Economic contraction is never greeted with a positive attitude but to see Canada struggling when the US is gentle recovering is a real concern for the Canadian authorities. As 70% of Canada's exports go to the US, if the US growth isn't creating growth in Canada, the problem is domestic. The Bank of Canada has some work to do and an interest rate cut may well be necessary. In the short term, a C$1.8050 target is obvious but, if that breaks, we could be in for a rally to C$1.82 in the next week.

Currency - GBP/Euro

European data is almost universally poor at the moment. We are even witnessing a drop in the German economic activity alongside a record high in Italian, Spanish and Greek unemployment and a French economy which look set to decline further. That makes sense of the trend channel on the chart above. However, just as the upward trend is obvious, so too is the resistance at €1.28 and €1.29. It would appear inevitable that the Pound will get to test that level in the near future but whether it will have enough vim and vigour to break through is open to debate. Next week brings a wealth or data and plenty of reasons to trade. I suspect the first week of November will be a biggie for volatility so stand by for action.

Currency - GBP/New Zealand Dollar

The Reserve Bank of New Zealand left their base rate on hold when they met this week. That was entirely in line with expectation. Nevertheless, the Sterling – NZ Dollar exchange rate has bounced between NZ$2.02 and NZ$2.06 this week. And it goes without saying that a 2% variation is worth knowing about if you are moving sizable sums between the UK and NZ or vice versa. Not only was it in line with expectations, it keeps this currency pair in the generally upward trend channel it has been in since June 2013 and the narrower part of that channel which started back in August of this year. Barring any unexpected spikes, NZ$2.08 is the upper end of that range and NZ$2.00 marks the bottom end of the same range.

Currency - GBP/US Dollar

The Dow Jones equity market index hit a record high today. Cheap money from the Federal Reserve is still in the system and interest rate hikes look a long way off so investors are inevitably drawn towards the share market as they seek a return on their money. This is true of overseas investors a swell; hence the strength of the US Dollar. But the USD is also a source of cheap money for investment in overseas markets. So the ebb and flow of these funds will cause spikes and troughs in US share prices. Technically speaking, this is a great level at which to be buying Sterling against the US Dollar. As you can see in the chart above, there is plenty of buying interest at $1.59 and anything below there and that is cause a recovery every time the Pound is weakened. However, unless Sterling can make some sort of gain above $1.62, the downward trend is intact and we may yet see lower levels. The risk-averse GBP buyer will cover some of their requirements here but those with more of a gambling nature may hang fire and hope for better.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.